Well, the quadrennial silly season is upon us. Corona may have delayed the start of campaigning, but it couldn’t derail our Constitutionally ordained ritual of holding a Presidential election every fourth year. Stock traders are deeply interested in every year’s election results, watching party platforms and candidate statements closely for clues to economic policy.

Some of Wall Street’s top research firms are already starting election year analysis. Writing from Piper Sandler, head of FSG research Mark Fitzgibbon looked into the historical performance data of bank stocks compared to the S&P 500 for the first six months after each election from 1976 to 2016. The results are illuminating.

First off, Fitzgibbon found that bank stocks tend to outperform. After seven of eleven elections analyzed, NASDAQ’s BANK index outperformed the S&P 500 for the next six months. Whether the winner was a Republican or Democrat made less difference than the common wisdom would assume; both the best (28% gains in bank stocks) and worst (29% losses in bank stocks) followed Democrat victories. On average, however, bank stocks gained 12% after Republican wins, compared to 7% after the Democrat won.

“Bank stocks performed significantly better under Republican administrations […] This analysis would seem to suggest that bank stock investors would fare better with a Trump reelection than a Biden win,” Fitzgibbon concluded.

So much for the macro view. Credit Suisse has narrowed the focus for us, homing in on three major financial stocks, all banks, that reported Q2 earnings earlier this month. The results are of clear interest to investors, more so considered alongside Piper Sandler’s historical analysis. Credit Suisse sees these bank stocks outperforming in the coming year.

Turning to the TipRanks database, we’ve pulled the details on Credit Suisse’s picks. These calls were made by 5-star analyst Susan Roth Katzke. She sees each of them gaining more than 20% in the coming months; let’s find out why.

Citigroup, Inc. (C)

First up is Citigroup, the third largest bank in the US and one of the Big Four institutions that dominate the US banking industry. Citi has a market cap of $107 billion and last year saw $74.3 billion in revenues and $19.5 billion in net income.

Citi reported Q2 numbers on July 14. While down 72% from Q2 last year, the 50 cents EPS reported did beat the forecasts. Trading revenues were up, and offset the steep decline in consumer banking. Total quarterly revenues were $19.77 billion, which were above the forecast as well.

Citi passed its June stress test with the Federal Reserve, and announced that it will be maintaining its quarterly dividend. The last payment, of 51 cents per share, went out in May. With an annualized payment of $2.04, the divined yields 3.9%. That’s almost double the average yield found among S&P 500 companies, and an excellent return during the current near-zero rate regime.

Looking at possible scenarios for Citi, Credit Suisse’s Katzke lays out an interesting ‘Blue Sky’ option. She writes, “We contemplate a more optimistic earnings scenario underpinned by more robust economic growth, quantifiable benefits of regulatory reform and incremental operating margin improvement…” Regulatory reform has been a major policy priority for the Trump Administration; citing it as a reason for optimism on the stock is a subtle indicator of confidence that the President will see re-election.

To this end, Katzke rates C a Buy, along with a $75 price target, which indicates a possible 44% growth potential for the next 12 months. (To watch Katzke’s track record, click here)

Overall, Citigroup’s Strong Buy analyst consensus rating is based on 15 recent reviews, which break down to 12 Buys and 3 Holds. The stock is selling for $51.84, and the average price target of $70.08 suggests it has room for 35% upside growth. (See Citigroup stock analysis on TipRanks)

Bank of America (BAC)

Next up, Bank of America, is another of the Big Four US banks. BofA is the second largest player in the US banking sector, and ninth largest globally. The bank generates well over $90 billion in annual revenues, and boasts a $211 billion market cap. Like Citi above, BofA’s consumer banking business was badly depressed in 1H20, and the bank saw serious losses in the consumer loan department. Also like Citi, BofA’s quarterly revenues were ‘rescued’ by the online trading division. It should come as no surprise that online financial activity has increased tremendously during a period of social lockdown policies.

Earnings and revenue both followed the same pattern: down year-over-year, but above current estimates. At the top line, revenues came in at $22.5 billion, just over the expected $22 billion, while EPS beat by a wider margin, 37 cents reported against 28 expected.

In addition to better-than-expected earnings, the bank performed well on the Fed’s stress test, showing capital reserved well above that required by the regulatory authority. After the results were made public, BAC announced that it will maintain its 18-cent quarterly dividend on common stock ‘until further notice.’ The dividend yields almost 3%, has a payout ratio of only 8.7%, making it affordable for the bank and attractive to investors.

In her review of BAC, Katzke wrote, “Our estimates and target price are unchanged, with the quarter’s upside banked against a more conservative forecast for the second half of 2020 (liquidity retention, fee waivers and the path of loss rate realization)… Macro uncertainty may dominate the conversation today, but we expect equal opportunity to observe and value the strength of this balance sheet and the strength of this franchise over time.”

Katzke sees BAC outperforming the markets, and rates it a Buy. Her $31 price target suggests an upside potential of 28% this year. (To watch Katzke’s track record, click here)

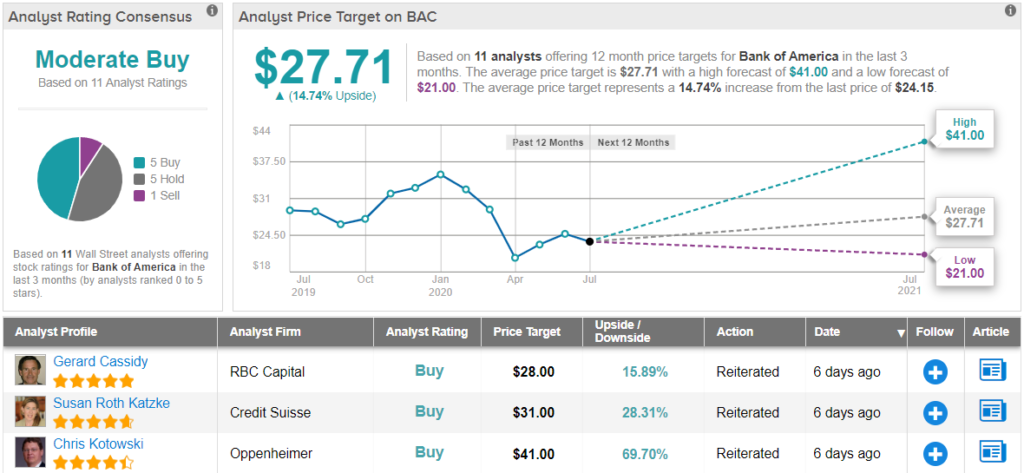

Overall, BAC shares have a Moderate Buy from the analyst consensus rating, with 5 Buy ratings, 5 Holds, and 1 Sell set in recent weeks. The bank’s shares are selling for $24.12, and the $27.71 average price target implies a nearly 15% upside. (See BAC stock analysis on TipRanks)

JPMorgan Chase & Company (JPM)

With a shade under $303 billion in total market cap, JPMorgan is the world’s largest banking institution, and the biggest of the ‘Big Four’ in the US. The bank total revenue in 2019 was $115.6 billion, and the net income that year came in at $36.4 billion.

Once again, we see a pattern in the bank’s business during 1H20, and in the earnings reports. Online trading surged, bringing in record profits, while consumer banking languished. This was attributable to the unique aspect of the corona crisis, with the economic downturn combined with social lockdowns. Online transactions benefited at the expense of brick-and-mortar.

Looking at the numbers, JPM reported $1.38 per share in earnings, slightly better than the $1.34 forecast. More importantly, it was a 76% gain sequentially. Revenues were reported at $33 billion, almost 10% better than the estimates. These earnings were stronger than JPM’s peers above, and like them, JPM chose to maintain its common stock dividend. The payment, at 90 cents quarterly, annualizes to $3.60, and gives a yield of 3.7%.

Katzke notes all of this in her recent review of the stock. Looking at JPM’s prospects, she says, “[F]actoring in a portion of the quarter’s upside, we’re raising our full year 2020 estimate to $4.95 from $4.75; our 2021 and 2022 estimates are unchanged… We remain of the view that JPMorgan is among those banks best positioned to generate above average returns through the cycle.”

This adds up to a Buy rating from the Credit Suisse analyst. She backs that with a $122 price target, indicating her confidence in a 22% one-year upside. (To watch Katzke’s track record, click here)

JPMorgan is another Moderate Buy, according to the analyst consensus. The stock has received 15 recent reviews, breaking down to 10 Buys, 5 Holds, and a single Sell. Shares are trading for $99.20 and have an average price target of $107.60, which suggests the stock has an 8% upside. (See JPMorgan’s stock-price forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.