As the COVID-19 epidemic drags on, and unemployment rises, online equity trading platforms are seeing a surge in use and new sign-ups. The Robinhood app saw Q1 deposits increase by 300% year-over-year, while the popular social trading app eToro saw a 220% growth in trading use. The demographic breakdown of the new online traders makes a more interesting story, however. Data from the Wealthsimple Trade platform shows that 55% of new users are under age 35.

The migration of Millennials to online trading should not come as a surprise. Jeff Bishop, founder of Raging Bull Trading, notes, “A lot of people are at home and have got more time on their hands. And many, unfortunately, have lost their jobs and are looking for new opportunities.” Bishop goes on to add that, “Younger investors are looking for ways to recoup their money. They’re really interested in low, beat-up stocks.”

With this in mind, we’ve delved into three top choices of Millennial traders, according to Robinhood, and found a profile that makes sense young investors seeking to build a lifetime portfolio: blue chip stalwarts, facing tough times now, but holding strong niches. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to get the lowdown on what the near-term holds for these beat-up stocks.

Boeing Company (BA)

The coronavirus epidemic, with the lockdowns, shutdowns, and travel restrictions governments have put in place to combat the spread, could not have come at a worse time for Boeing. The aircraft manufacturer was already facing serious difficulty, due to the 13-month long grounding of the 737-MAX 8, the most popular model of its most popular commercial airliner. Continuing production lines on other commercial jets and strong sales of the F/A-18E/F Super Hornet fighter were only partially compensating for the losses in the MAX 8 program.

The travel restriction put in place against COVID-19 pandemic are a bigger blow. Air travel is deeply depressed, and airlines are cutting routes, mothballing aircraft, and furloughing workers – and that has now trickled back to Boeing. The company saw Q4 losses of $2.33 per share when the MAX 8 did not reenter production, and in Q1, with coronavirus in full swing, saw additional losses of $1.70 per share. Despite recording $16.9 billion in Q1 revenue, Boeing was in the red by $641 million. The company is now considering cutting the work rolls by 10%.

But Millennial investors are moving into BA shares. At first glance, it is hard to see why. While the overall markets have rallied since hitting the March 23 low point, BA shares have failed to gain traction. The stock is down 60% year-to-date, and has been trending downwards since early April.

This, however, also shows why Millennials are buying in. Boeing is at a 3.5-year low price, and the company remains fundamentally sound. While the MAX 8 lines are shut down, Boeing still produces the 777 and 787 airliner families, along with a variety of military and aerospace airframes. With almost half of all the world’s operational airlines being Boeing products, commercial maintenance work alone will keep the company viable long term.

5-star analyst Josh Sullivan, of Benchmark, sees a strong case to buy into Boeing, and gives the stock a Buy rating. His $180 price target suggests an upside of 48% over the next 12 months. (To watch Sullivan’s track record, click here)

Defending his bullish stance, Sullivan also explains why Millennials – or anyone seeking a long-term holding – should look at Boeing. In particular, he points out that the company’s airliners will remain in demand, as they are essential to air travel networks: “The 737-MAX program is anticipated to begin production at low rates this year and climb to 31/month next … Overall, the 737-MAX program carries the most weight and the adjustments in wide-body production provide a base-line.”

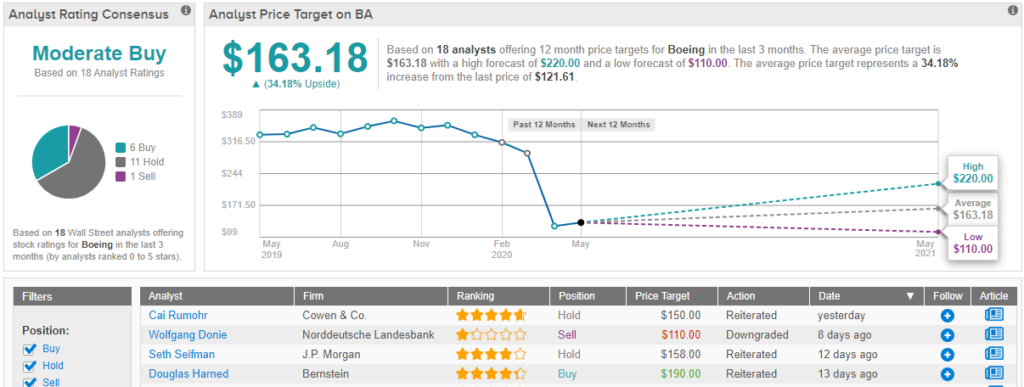

All in all, Wall Street is cautious on BA. The stock has received 18 analyst reviews recently, with a breakdown of 6 Buy, 11 Hold, and 1 Sell, making the consensus rating a Moderate Buy. The 12-month average price target of $163.18, indicates confidence in a healthy 34% upside potential. (See Boeing stock analysis on TipRanks)

American Airlines (AAL)

Measured by fleet size, scheduled passengers carried, and revenue per passenger mile, American Airlines is the world’s largest. Before the coronavirus grounded most air traffic, American was operating 6,800 daily flights to 350 destinations in 50 countries around the world.

American was showing quarterly profits up until the coronavirus struck. In Q4, the company reported earnings of $1.15 per share – but that has turned sharply negative in Q1. AAL showed a net loss of $2.65 in the first quarter, 22% worse than expected, and the losses are expected to worsen in Q2, to as much as $7.35. American had not posted a quarterly loss since 2013. The company is also burning $70 million in cash per day in the current quarter, but expects that figure to fall by nearly 30% by the end of June.

After absorbing the $2.24 billion net loss in Q1, AAL, like Boeing, suspended its dividend and buyback plans. Prior to this, the company has paid out 10 cents per share quarterly, reliably, for 6 years. Company management has put a priority on maintaining the balance sheet, with renewal of the dividend to come after air travel returns to more normal patterns.

Cowen’s 5-star analyst Helane Becker is sanguine that American can weather the current storm. She writes of the company, “[AAL] is receiving a total of $10.6 Bn in aid through the CARES Act. We expect another capital raise in 3Q20, likely against their unencumbered asset base. In the near-term the company is taking action on the fleet by removing 100 aircraft to eliminate fleet complexity. American needs to continue to aggressively manage costs until revenues show signs of improving.”

Her cautiously optimistic line on the stock supports a Buy rating and a $15 price target. Becker’s target implies a robust upside potential of 48% in the coming year, reflecting the necessity of air travel in the modern world. (To watch Becker’s track record, click here)

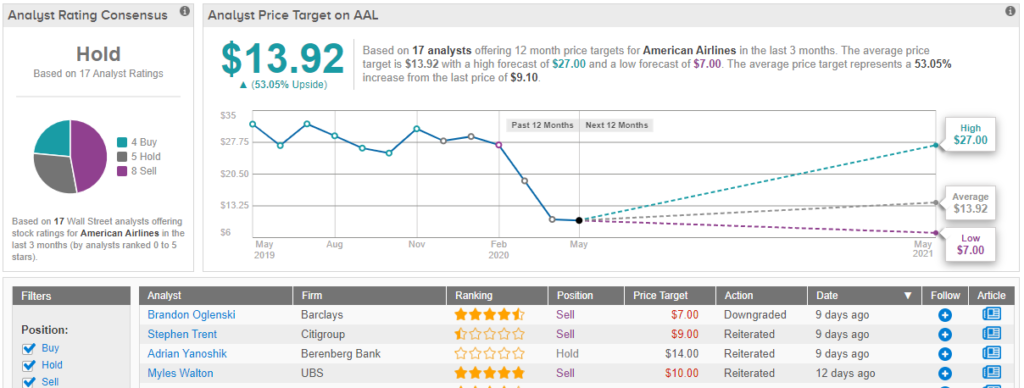

Overall, Wall Street isn’t quite ready to go all in on AAL. The stock has 17 reviews, including 4 Buys, 5 Holds, and 8 Sells. The share price, however, is an affordable $9.09, and the lost cost of entry does help mitigate risk. The average price target of $13.92 suggests an upside potential of 53%. (See American Airlines stock analysis on TipRanks)

Walt Disney (DIS)

Of the three stocks in this list, only Walt Disney turned a profit in Q1. Even so, the 60 cents per share recorded for the first quarter missed the forecast by 27%. Quarterly earnings were also down 60% sequentially and 62% year-over-year. As a cost-saving move, Disney, like the companies above, has suspended its dividend. The next semi-annual payment was due to go out in July; by cutting it, Disney haves $1.6 billion.

There were some positive notes, and they show why Disney remains a solid long-term stock play. Quarterly revenues were up some 20%, to $18 billion. Theme park attendance was shut down during the lockdowns, but media network sales were up. Disney+, the company’s new streaming service, reached 54 million subscribers in the quarter. It was an impressive gain – more than 4.5 million in less than one month – that beat company forecasts and also bodes well for future media profits.

Looking further forward, Disney management has announced that it is starting to phase open the theme parks, starting with Disney Shanghai this week. The cut to theme parks accounted for nearly $1 billion of the quarterly loss; reopening them will go along way toward restoring Disney’s financial performance. Disney facilities in Orlando are scheduled to start reopening on May 20.

JPMorgan analyst Alexia Quadrani sees hope for Disney in the reactivation of the theme parks. She writes, “…we continue to model domestic parks reopening on July 1. We also note that Disney World is still taking reservations starting June 1, while Disneyland in California pushed back reservations to July 1 from June 1 prior, but nevertheless this still suggests the park could reopen by July 1. We view any reopening of the parks as financially beneficial for Disney as even low capacity can help offset the fixed cost base…”

Assuming that the parks will reopen as announced, Quadrani rates DIS shares a Buy, with a $135 price target suggesting a healthy upside of 31%. (To watch Quadrani’s track record, click here)

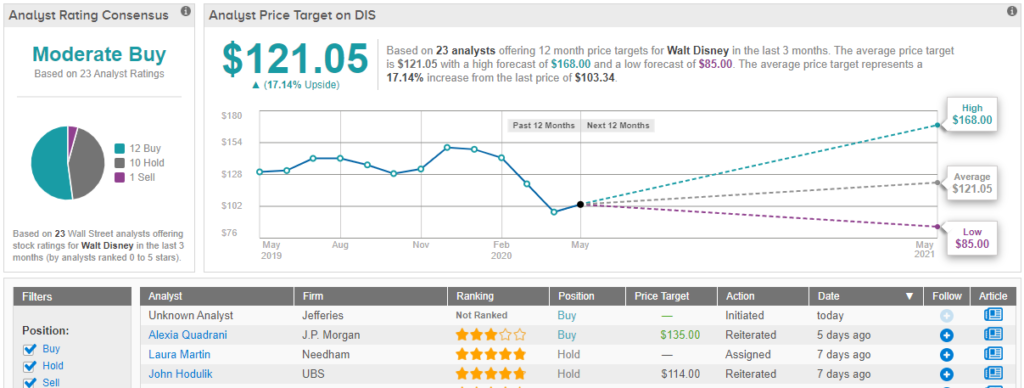

Disney’s overall rating almost evenly split. The stock’s 23 analyst ratings include 12 Buys, along with 10 Holds and 1 Sell, making the consensus view a Moderate Buy. DIS shares have an average price target of $121.05, indicating a 17% premium from the current trading price of $103.24. (See Disney stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.