Microsoft (NASDAQ:MSFT), Meta Platforms (NASDAQ:META), and Walmart (NYSE:WMT) are three stocks that are currently buzzing on the social media platform Reddit. These stocks are unique in a way as they have won the love of Wall Street analysts but are being dumped by their very own corporate insiders.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It’s worth noting that all three stocks command a Strong Buy consensus rating on TipRanks. At the same time, they hold a “Very Negative” insider confidence signal based on TipRanks’ Insider Trading Activity tool.

Corporate insiders are C-level executives, directors, or 10% shareholders of a company. Because of their insider knowledge, insiders are required to report their trades of the company’s shares (Form 4) to the Securities and Exchange Commission (SEC) within two working days. These insiders are in the know about the company’s latest developments and can most accurately foretell if a company is heading for success or failure.

Although uninformative buys and sells can arise from various factors, an informative buy signifies that the insider perceives a positive outlook for the company or anticipates favorable outcomes for their own trading account. Conversely, an informative sell suggests the opposite, indicating a potentially less optimistic perspective on the company’s future.

As an investor, following the trading activities of these insiders can prove to be highly beneficial when searching for new investment ideas. Against this backdrop, let’s delve right into these trending Reddit stocks.

What is the Forecast for MSFT Stock?

On TipRanks, MSFT stock has a Strong Buy consensus rating based on 30 Buys, four Holds, and one Sell rating. The average Microsoft stock price forecast of $347.94 implies 2.9% upside potential from current levels. Also, the highest 12-month price target on MSFT is $420, which implies an impressive 24.3% upside potential. This was given by Credit Suisse analyst Sami Badri on May 31, 2023.

Year-to-date, MSFT stock has gained 42% thanks to the overall bullishness of the tech sector. Analysts remain highly optimistic about Microsoft Cloud’s growth ahead, given its early adoption of artificial intelligence (AI) and large enterprise focus.

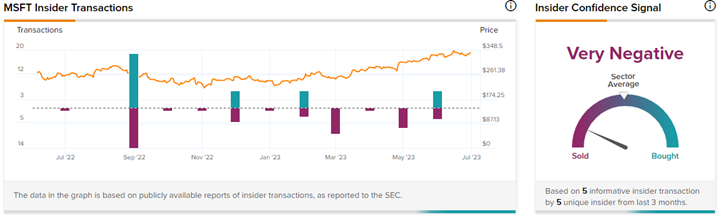

Coming to the Insider Trading Activity tool, Microsoft has a Very Negative insider signal, as corporate insiders have sold $15.6 million worth of MSFT stock in the last three months. It is important to note that TipRanks considers only the Informative Buy/Sell transactions while generating the insider confidence signal.

Is Meta Platforms Stock a Buy or Sell?

With 36 Buys and four Hold ratings, Meta stock has a Strong Buy consensus rating on TipRanks. Nevertheless, the average Meta Platforms price target of $295.53 implies 0.6% downside potential from current levels.

Recently, a few analysts raised their price targets on META, citing the probability of earning greater ad revenues as the online ad market picks up steam and the gaining traction of Meta’s Reels (a video platform on Instagram).

Plus, analysts are bullish about the prospects of Meta integrating generative AI into its products, which could propel further growth for the company.

The highest 12-month price target on META is $365 (23% upside potential), assigned by analyst Rob Sanderson of Loop Capital on July 3. META stock has gained 138% so far this year.

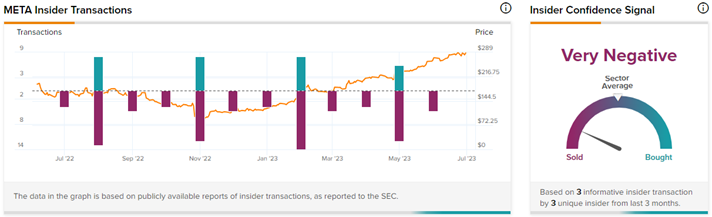

At the same time, the TipRanks Insider Trading Activity tool shows that corporate insiders have sold $8.9 million worth of META shares in the last three months.

Is Walmart a Good Stock to Buy?

Big-box retailer Walmart has earned 25 Buys and four Hold ratings on TipRanks, giving it a Strong Buy consensus rating. The average Walmart stock prediction of $169.33 implies 7% upside potential from current levels. Meanwhile, its highest 12-month price target of $186 (17.6% upside) was given by Exane BNP Paribas analyst Chris Bottiglieri on June 12.

Wall Street is bullish about Walmart’s growing memberships, which, as per private surveys, has touched 21.5 million recently. Yesterday, Evercore ISI analyst Greg Melich picked Walmart as a top pick for its “Best Core Ideas” list, pushing the shares to touch a new 52-week high. Year-to-date, WMT stock is up 11%.

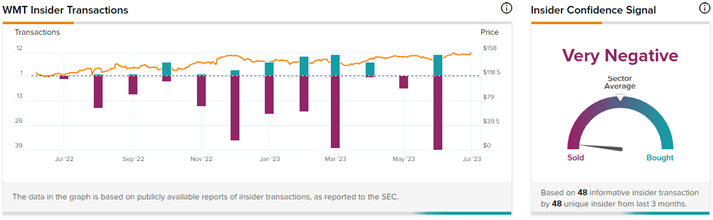

On the contrary, corporate insiders of Walmart are not so positive about the stock’s trajectory. As per TipRanks Insider Trading Activity tool, insiders have sold a whopping $4.2 billion worth of WMT stock in the last three months. Among the stock sellers are a few people from the Walton family (the co-founders of Walmart), namely Jim Walton, Robson Walton, and Alice Walton.

The Takeaway

MSFT, META, and WMT have conflicting signals from Wall Street analysts and corporate insiders. Although insiders of these companies are selling their shares, it could be perceived that they are leveraging the overall bullish stock market environment to profit from their investments.

Analysts, on the other hand, mostly have a long-term focus in view while analyzing a stock, and their recommendations could be considered when investing in a stock for a longer horizon.