Amazon (NASDAQ:AMZN) went public 30 years ago and is among the largest companies in the world. Valued at $2 trillion by market cap, the e-commerce giant has returned more than 160,000% to shareholders since its IPO (initial public offering) in 1997. Despite its outsized gains, I remain bullish on Amazon due to its expanding addressable market, expanding profit margins, and growing advertising business.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

An Overview of Amazon

Today, Amazon is a household name and has a presence in most global markets. It sells consumer products, online ads, and subscription services through online and physical stores. In the last 12 months, Amazon reported revenue of $590.74 billion, up from $280.52 billion in 2019.

Amazon Is Firing on All Cylinders

Amazon has a sizeable presence in several growth markets that include e-commerce, cloud computing, digital advertising, and online streaming. In Q1 of 2024, its Online Store segment increased its revenue by 7% year-over-year to $54.7 billion, accounting for 38% of sales.

According to a report from Research and Markets, the global e-commerce market is forecast to expand from $18.98 trillion in 2022 to $47.73 trillion in 2030, indicating an annual growth rate of over 12%.

Its Amazon Web Services business accounts for 17% of sales, and this segment grew by 17% year-over-year in the March quarter. A Statista report forecasts the public cloud market to expand from $631.8 billion in 2023 to $1.8 trillion in 2029, indicating an annual growth rate of 18.5%.

In recent years, Amazon’s Advertising Services business has gained significant traction. While it accounts for just 8% of total sales, sales from the segment rose by 24% year-over-year in Q1. A Precedence Research report expects global digital ad spending to rise from $550 billion in 2023 to $1.367 trillion in 2033, indicating annual growth rates of 9.6%.

We can see that each of Amazon’s business segments is positioned to grow at a steady pace in the upcoming decade, making the tech giant an enticing investment option right now.

Amazon’s Expanding Margins

Similar to most other companies, Amazon has focused on lowering its cost base to tide over an uncertain and soft macro environment. Since Q4 of 2022, it has eliminated more than 27,000 jobs, allowing it to improve profit margins significantly. In the last 18 months, Amazon has lowered its technology and infrastructure costs as well as sales and marketing expenses, shoring up its bottom line.

In the last 12 months, Amazon reported free cash flow of $50.15 billion compared to a free cash outflow of $3.31 billion in the year-ago period. Further, it expects profit margins to improve in Q2 of 2024, although at a far more measured pace.

Amazon expects operating income to range between $10 billion and $14 billion in Q2 compared to the year-ago figure of $7.7 billion. Comparatively, it expects revenue between $144 billion and $149 billion, indicating year-over-year growth between 7% and 11%.

Historically, Amazon has sacrificed profitability for growth. In fact, it reported several quarters of operating losses before reporting consistent profits in the last decade. Currently, Amazon is experiencing strong growth in sales and earnings due to economies of scale, a competitive moat, and its leadership position.

Ad Sales Will be a Key Driver

Amazon owns and operates the third-largest digital ad business after Alphabet (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META). Due to higher customer purchase intent, Amazon’s ad business should attract a higher share of corporate marketing spend amid sluggish consumer demand.

Amazon attributed its strong digital ad performance to sponsored products, which benefited from improvements in relevancy and measurement capabilities for advertisers. It expects sponsored products to drive demand going forward while growing new verticals such as Prime Video ads.

In the last three years, Amazon’s ad business has grown from $6.4 billion in Q1 of 2021 to $11.8 billion in Q1 of 2024. Its ad business grew at a much higher pace compared to peers Alphabet and Meta. Moreover, this segment is a high-margin one and should be a key driver of revenue and profitability through 2030.

Is Amazon Stock Undervalued?

Wall Street expects Amazon to report an adjusted earnings per share of $4.54 in 2024, up from $2.90 per share in 2023. So, AMZN stock is priced at 44x forward earnings, which is steep, given that the sector median multiple is far lower at 15x. Alternatively, Amazon is growing at a far higher pace, so a premium multiple is justified.

Is Amazon Stock a Buy, According to Analysts?

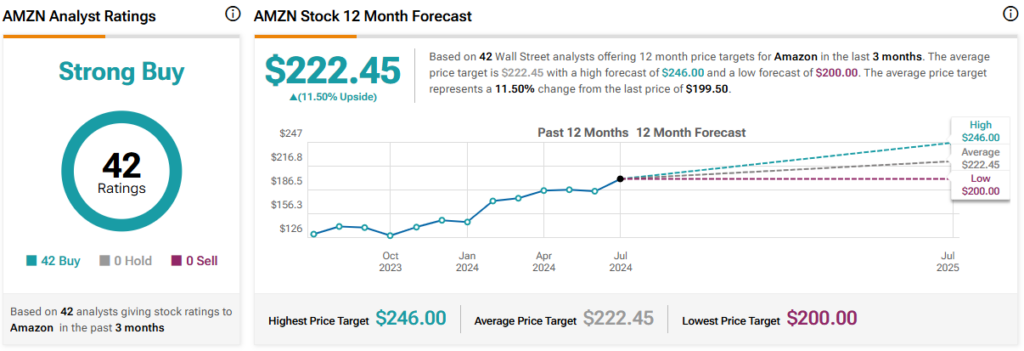

Each of the 42 analysts covering Amazon stock has a Buy rating, indicating a Strong Buy consensus rating. The average AMZN stock price target is $222.45, indicating upside potential of 11.5% from current levels.

The Takeaway

Two years ago, Amazon stock was pummelled due to its slowing growth and unattractive profit margins. Today, it is one of the fastest-growing mega-cap stocks on the planet, driving its share price toward all-time highs. In my view, its expanding addressable market and improving bottom line make it a top investment choice for investors in July 2024.