Coffee retailer Starbucks (SBUX) had a mixed quarter, but Quo Vadis President John Zolidis sees three reasons for long-term investors to stay with the coffee shop chain. The reasons are the company’s high ROIC (return on invested capital) unit format, its ability to take share, and growth opportunities, notably in China.

ROIC measures the returns that investors earn from the capital that they have invested in a company.

“ROICs are improving despite Covid and cost pressures due to revenue growth at the store level and capital return at the corporate level,” said Zolidis.

I’m neutral on SBUX shares.

Starbucks Faces Several Headwinds

Zolidis’s comment follows the release of the company’s Q1, 2022 financial report this week, which missed analysts’ expectations, as inflation and COVID woes caught up with the company.

Starbucks owns 4704 stores in China, where the company faces a challenging environment, due to the resurgence of COVID-19 in several provinces where it operates, as well as harsh criticism of private businesses by the government. Same stores sales in the world’s second-largest economy dropped 14 percent.

In addition to overseas headwinds, Starbucks is encountering several headwinds at home, like a tight labor market and the unionization of its labor force. That has forced the company to “double-down” on what it pays its baristas and other store associates, and to pass the higher cost to its customers with price hikes.

Nonetheless, its leadership remains upbeat about the future of the company. “This holiday quarter delivered strong revenue growth highlighted by incredible customer demand for Starbucks. As we enter the third year of this pandemic, our stores continue to play an important role as a community gathering place that offers safe, familiar and convenient experiences for our customers…We remain focused on actions that drive both top and bottom line growth, including industry-leading investments to attract, train and retain the best talent for our stores as customer occasions increase,” said Kevin Johnson, president and CEO.

Still, the rise of unionization in the ranks of Starbucks threaten to turn the company into a welfare agency, undermining the dynamism and the profitability of the brand.

TipRanks’ Smart Score

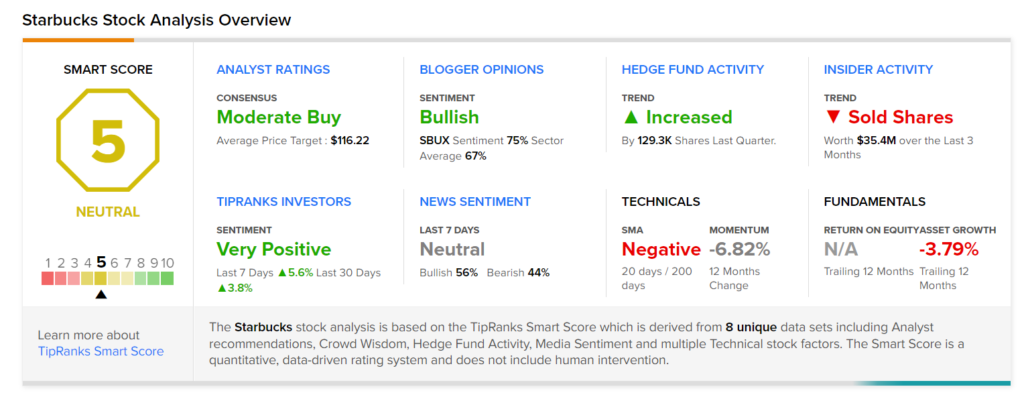

According to TipRanks’ Smart Score rating system, SBUX scores a 5 out of 10, down from 9 out of 10 three months ago, due to the deterioration of the company’s technicals and fundamentals, and growth of insider selling.

Over the last twelve months, SBUX shares have lost 6.6%, trailing the 15.6% gains of the S&P 500 (SPX) in the same period. That’s a divergence from the long-term trend, wherein Starbucks outperformed the S&P500 by a big margin.

Wall Street’s Take

Turning to Wall Street, SBUX has a Moderate Buy consensus rating, based on 13 Buys and 11 Holds assigned in the past three months. At $116.22, the average Starbucks price target implies a 22.4% upside potential.

That isn’t a bad return in a low-interest-rate environment, provided that the unionization of the company associates doesn’t turn the company into a welfare agency, undermining the dynamism and the profitability of the brand.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure