Wall Street is sending mixed signals. While the S&P 500 is up 45% from its March lows, the market was choppy throughout most of June and July. On top of this, new COVID-19 cases are being reported at an alarming rate and trade tensions between the U.S. and China are flaring. What does all of this mean? The investing game has changed, so new strategies are needed to keep up with the new rules.

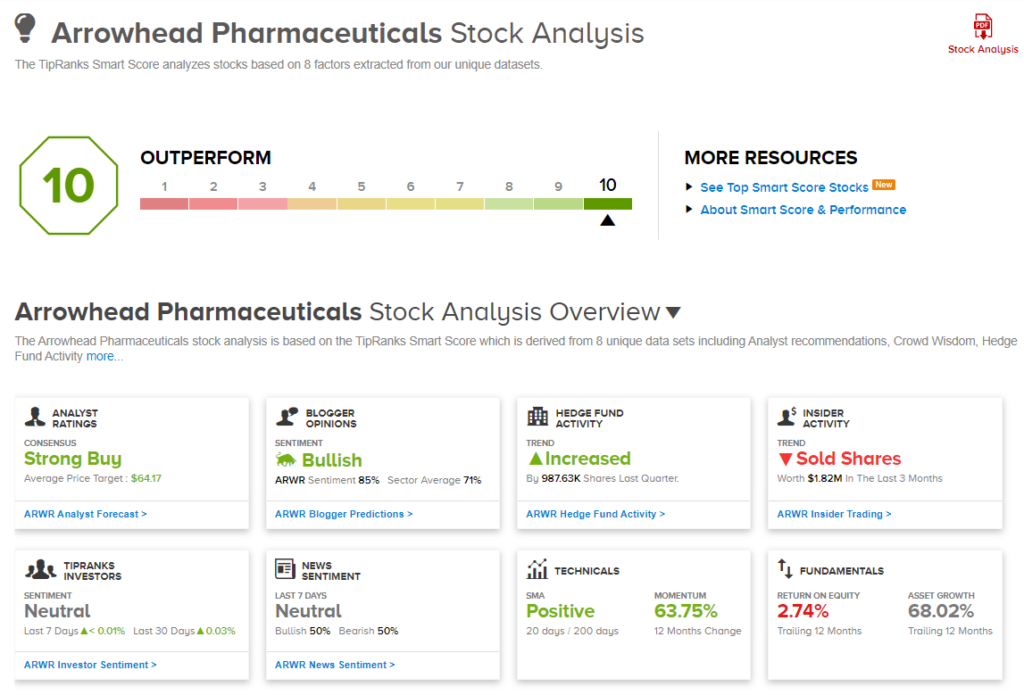

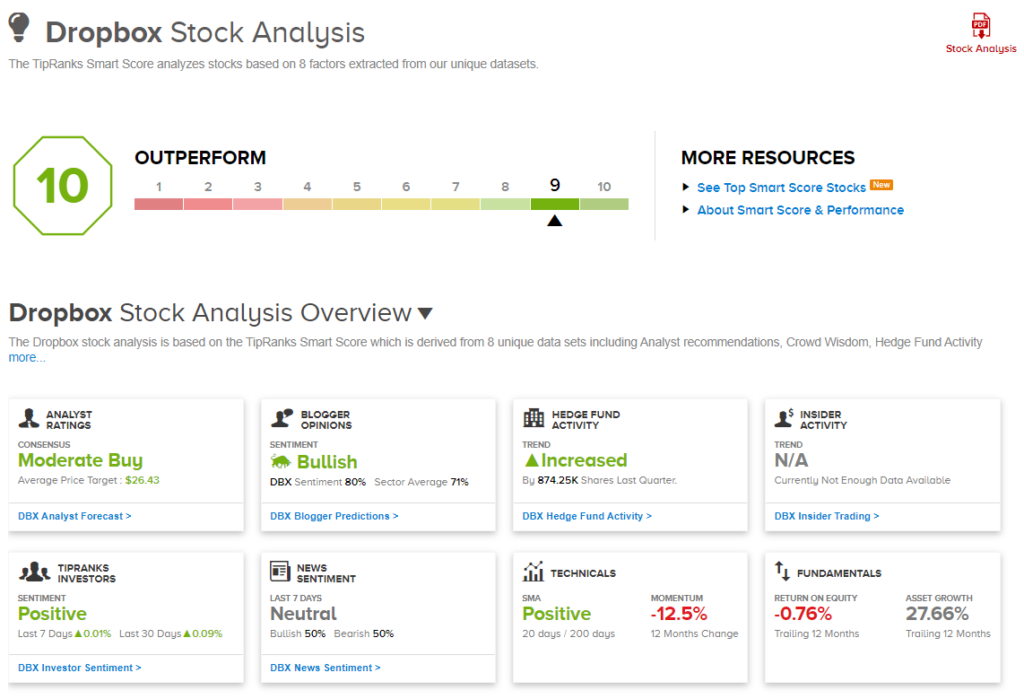

TipRanks has a tool that offers more than just an evaluation on a fundamental and technical basis. Providing a more comprehensive stock analysis, the Smart Score pulls together 8 commonly used predictive metrics, and collates all of the data into a single numerical score. This score ranges from 1 to 10, with 10 being assigned to the names most likely to outperform.

Using TipRanks’ database, we pinpointed three stocks that have earned the enviable “Perfect 10” Smart Score. Let’s dig a bit deeper into the details.

Arrowhead Pharmaceuticals (ARWR)

Through its versatile drug discovery and development platform designed using its patented technologies, Arrowhead Pharmaceuticals develops therapies that target intractable diseases by silencing the genes that cause them. Given its impressive development pipeline, some members of the Street believe that it’s time to take another look at this Perfect 10.

Currently, Phase 1 studies of ARO-APOC3 and ARO-ANG3 are fully enrolled, with updates potentially being provided at the European Society of Cardiology in late August, American Heart Association in November and the National Lipid Association meeting in December. Writing for Piper Sandler, five-star analyst Edward Tenthoff has been impressed by ARWR thus far.

Looking at interim Phase 1 multi-dose data on ARO-APOC3, the therapy was able to generate a 95% reduction in TG. Additionally, ARO-ANG3 demonstrated an LDLc reduction of 39-42% in hypercholesterolemia patients on top of background therapy and a TG reduction of 79% in hypertriglyceridemia patients. Not to mention, the safety and tolerability profile was robust.

Weighing in on the implications, Tenthoff stated, “Clean safety and lipid lowering will enable initiation of pivotal trial starts of ARO-APOC3 in Multifactorial Chylomicronemia (MCM) syndrome and a Phase IIb study of ARO-ANG3 in mixed dyslipedemia by 1H:21. Amgen could report Phase I AMG-890 data and start a Phase II study triggering a milestone.”

Even though COVID-19 forced the company to halt the Phase 2/3 SEQUOIA and open-label Phase 2 AROAAT2002 studies of ARO-AAT, both have now been restarted. The AROAAT2002 study is assessing pre- and post- ARO-AAT treatment biopsies to measure histological liver disease activity over two years, with ARWR potentially releasing six-month biopsy data from the first cohort at AASLD. “While histological changes are not expected at this point, observation of reduction in production of pathological misfolded AAT protein would indicate drug activity,” Tenthoff added.

The company also has other ongoing clinical activity including Phase 1 studies for ARO-HSD to treat NASH, ARO-HIF1 in kidney cancer and ARO-ENaC for cystic fibrosis, and thus, the deal is sealed for Tenthoff. In addition to reiterating an Overweight rating, he kept his $80 price target as is. A twelve-month gain of 65% could be in store, should the analyst’s thesis play out in the year ahead. (To watch Tenthoff’s track record, click here)

Judging by the consensus breakdown, other analysts also like what they’re seeing. 5 Buys and a single Hold add up to a Strong Buy consensus rating. Based on the $64.17 average price target, the upside potential comes in at 33%. (See ARWR stock analysis on TipRanks)

Dropbox Inc. (DBX)

Meeting the needs of a very large market, Dropbox offers cloud storage, team collaboration and work productivity solutions. After hosting a conference call with its SVP of Engineer, Product and Design Timothy Young, one analyst is even more optimistic about DBX’s long-term growth prospects.

Five-star analyst Alex Zukin, of RBC Capital, tells clients he sees “solid potential for the company’s new product strategy, which essentially aims to be a knowledge worker’s central engagement hub.” The platform allows employees to communicate and collaborate using DBX’s own products, integrated applications and other content including URLs and various types of files.

According to Young, technology across various consumer goods is transitioning from an “ownership model” to an “access model”, with the cloud enabling this shift to happen in the workplace as well. As a result, this prompted DBX to revamp its product and strategy. Going beyond managing files, the company is now “in the business of managing asynchronous communications across mediums and even other applications.”

Zukin explained, “We note that Dropbox is not the only vendor trying to serve this need, but Dropbox does view its role here as unique, nothing that while companies like Zoom and Slack are greater for short conversations and exchanges, Dropbox is trying to provide institutional long-term memory.”

As part of this updated strategy, DBX has placed a significant focus on shifting it from an OS/utility layer to a foreground application. “The company highlighted not only its new desktop app, but also tray and menu bars that bring contextual awareness to the knowledge workers and an ability to bring in new aggregation points around access,” Zukin commented. Adding to the good news, management stated its user base is incredibly loyal and has reacted positively to the product changes.

Everything that DBX has going for it keeps Zukin with the bulls. To this end, he maintained an Outperform rating and $30 price target. The implication? Upside potential of 39%. (To watch Zukin’s track record, click here)

Looking at the consensus breakdown, 5 Buys, 1 Hold and 2 Sells have been assigned in the last three months. So, DBX gets a Moderate Buy consensus rating. At $26.43, the average price target indicates 23% upside potential. (See Dropbox stock analysis on TipRanks)

LKQ Corporation (LKQ)

As one of the top providers and distributors of auto repair parts in the U.S. and Europe, LKQ offers lower-cost alternative parts that are considered of “like kind and quality” when compared to OEM manufactured parts. While COVID-19 has had a serious impact on LKQ, the tides could be turning for this Perfect 10.

Covering the stock for SunTrust Robinson, four-star analyst Stephanie Benjamin believes that better days are ahead. To support this conclusion, she pointed out miles driven activity has been recovering across LKQ’s major markets since April, with driving activity now above January 2020 levels.

According to Apple mobility data (driving only), driving activity is up 124% in the U.S., 183% in Germany, 199% in the UK and 829% in Italy since March 31. It should, however, be noted that typically, the highest driving levels are seen in the summer, with work-from-home and virtual education also potentially hampering driving activity in the back half of the year.

That being said, Benjamin argues that “an increase in accident frequency will at least partially offset the reduction in miles driven and ultimately drive demand for LKQ’s alternative parts.” Expounding on this, she stated, “Risky and distracted driving has increased the last several months with speeding up 27% and phone usage up 38% among drivers. As a result, there has been a 20% increase in crash frequency per mile driven during COVID despite an overall decline in the number of crashes.”

Additionally, increased vehicle complexity and higher repair costs could lead to more collision repairs and the need for alternative parts, in Benjamin’s opinion. If that wasn’t enough, margins could get a boost. “In our view, LKQ is well positioned to see the margin progression in 2021 due to its (1) ~$250 million in quarterly cost savings implemented in response to COVID-19, (2) restructuring program which enables the closure of underperforming branches, and (3) ongoing European integration efforts,” the analyst said.

It’s also important to mention that the effects of COVID-19 through May were not as bad as previously anticipated. To this end, Benjamin expects to see similar organic growth in June, with her estimate potentially being “conservative as economies continued to reopen and miles driven improved throughout the month.” Therefore, her 2020 EPS estimate gets a lift, from $1.43 to $1.54.

In line with her optimistic take, Benjamin continues to rate LKQ a Buy. In addition, she bumped up the price target from $30 to $35, suggesting 26% upside potential. (To watch Benjamin’s track record, click here)

The bulls represent the majority on this one. Out of 6 total reviews published in the last three months, 5 analysts rated the stock a Buy, while 1 said Hold. So, the word on the Street is that LKQ is a Strong Buy. The $34.75 average price target implies shares could rise 25% in the next twelve months. (See LKQ stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.