Three major bank stocks, Morgan Stanley (MS), Goldman Sachs Group (GS), and Wells Fargo & Co. (WFC), have risen since June-end on improving U.S. economic conditions. These stocks have comfortably outperformed the broader S&P 500 (SPX) index’s rise in the same period.

Other large U.S. banks like Citigroup (C) and Bank of America (BAC) have also been able to match the trend. Furthermore, the popular SPDR S&P Bank ETF (KBE) also rallied more than the S&P 500 since the end of June.

Of late, the major economic data releases have pointed out that the tough economic conditions witnessed earlier might have been left behind. Strength in the U.S. jobs market and calming red-hot inflation levels are instilling optimism among investors. On slight relief from some fall in energy and gasoline prices, the consumer price index (CPI) climbed 8.5% over the prior year in July, slowing from June’s 9.1% year-over-year rise.

Moreover, the improving consumer sentiment is being highlighted by the University of Michigan’s preliminary consumer sentiment reading of 55.1 in August compared to 51.5 in July and June’s all-time low reading of 50. It seems that the U.S. economy may receive support from decent consumer spending levels in the second half of 2022.

According to a Wall Street Journal article, major credit-card issuers like American Express Co. (AXP) and Capital One Financial (COF) have increased their marketing and advertising budgets to attract new customers, highlighting the expectations of strong consumer spending. They are also making efforts to raise total credit-card balances.

Furthermore, analysts are speculating that the recession-related fears have already been priced in.

Let’s discuss three major bank stocks that have outperformed the broader market’s rally since July.

1. Morgan Stanley

Financial services major Morgan Stanley posted weaker-than-expected results for the second quarter of 2022, as revenue and earnings missed consensus estimates. However, the company’s capital deployment activities remain strong, as it announced a new multi-year buyback program worth $20 billion.

Turning to Wall Street, analysts seem to be cautiously optimistic about MS, which has a Moderate Buy rating based on 12 Buys and six Holds. However, the average MS stock forecast of $90.53 implies ~1% downside potential. Shares of the stock have lost about 6.9% year to date.

Still, financial bloggers are 86% Bullish on MS compared to the sector average of 67%.

2. Goldman Sachs

The investment banking firm impressed investors with better-than-expected Q2-2022 financial results. Furthermore, the bank informed in July that it dominated in announced and completed M&A worldwide, global equity/equity-related offerings, and common stock offerings in the year-to-date period. It also raised its common dividend by 25%.

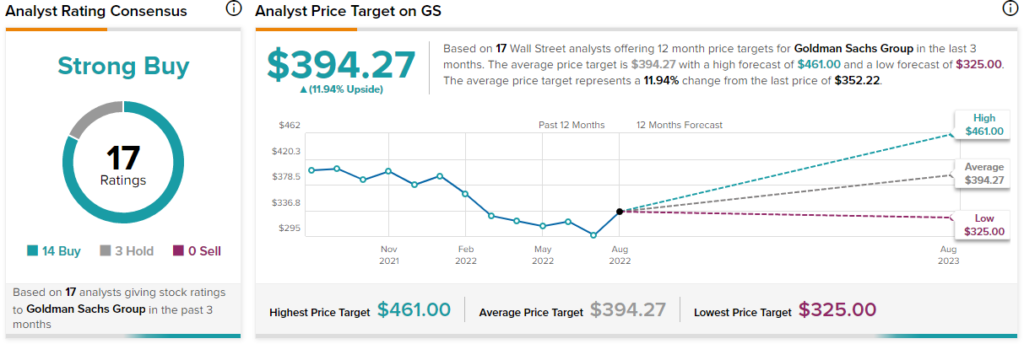

Moving on to Wall Street analysts, they are optimistic about the stock, as it has a Strong Buy rating based on 14 Buys and three Holds. The average GS stock price target of $394.27 implies around 12% upside potential. However, shares of the stock have slipped about 7.9% year to date.

Similar to analysts, financial bloggers are 95% Bullish on GS compared to the sector average of 67%.

3. Wells Fargo & Co.

The American multinational financial services company posted dismal Q2-2022 results, as it missed both revenue and earnings expectations. However, on the dual forces of rising interest rates supporting net interest income growth and falling expenses, management is expecting to see improved performance. Also, Wells Fargo is taking initiatives to boost its loan and deposit balances and consumer card portfolios.

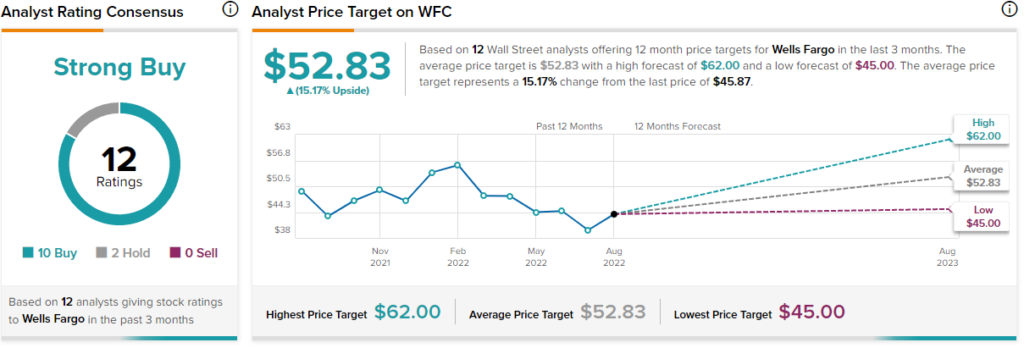

Wells Fargo stock is receiving support from Wall Street, as analysts are optimistic about the stock. WFC has a Strong Buy rating based on 10 Buys and two Holds. The average WFC price target of $52.83 implies 15.2% upside potential. Shares of the stock have fallen about 4.4% so far in 2022.

Lastly, financial bloggers are 79% Bullish on WFC compared to the sector average of 67%.

Conclusion: Will U.S. Bank Stocks Continue Rallying?

There is no denying that if the U.S. economy, which has already contracted for two straight quarters, enters a recession, there can be a decrease in bank stocks’ upside potential. Also, despite the slowing pace, persistently high inflation levels may weigh on the bank stocks’ rally. Other hurdles like the sluggish investment banking environment and slowing U.S. housing market can do the same.

However, all is not dull for the banking sector. The Fed stress test results signal that the major U.S. banks will have the lending capacity even during recessionary periods, per The Wall Street Journal.