The U.S. stock market is currently abuzz with corporate results for the January-March quarter of 2022. Sentiments are positive as companies across multiple sectors have shown healthy recovery from the turmoil created by the pandemic. Cost inflation, supply-chain restrictions, labor issues, and the rippling impacts of the Ukraine-Russia war seem to have weighed on.

Limiting our discussion to the industrial goods sector, we find that many players have shown resiliency to the pandemic while falling prey to the abovementioned headwinds. It is worth noting that the S&P 500 Industrial index lost 2.7% in the January-March quarter of 2022, while it has declined 7.6% since the beginning of the April-June quarter.

Many industrial companies are slated to release their results this week. Investors will be interested to know how the three well-known ‘large cap’ players from the sector are positioned for this reporting period.

Illinois Tool Works Inc. (NYSE: ITW)

The $61.5-billion industrial equipment and products maker is due to release its results for the first quarter of 2022 on May 3, 2022, before the market opens.

The consensus estimate for Illinois Tool’s earnings for the first quarter is pegged at $2.07 per share. The revenue consensus estimate is $3.76 billion.

The Glenview, IL-based company might have benefited from its investments to boost organic growth, marketing innovations, initiatives for deeper penetration into profitable markets, and top-line synergies from the MTS Test & Simulation (MTS) business buyout in the first quarter. Solid operational execution, contributions from enterprise initiatives, and share buybacks are other tailwinds.

Weakness in automotive markets due to supply-chain restrictions, costs inflation, margin dilution from the MTS buyout, and foreign currency-related woes might have hurt the results.

Illinois Tool’s Chairman and CEO E. Scott Santi said, “ITW is a company that has the enduring competitive advantages, agility, and resilience necessary to consistently deliver top-tier performance in any environment.”

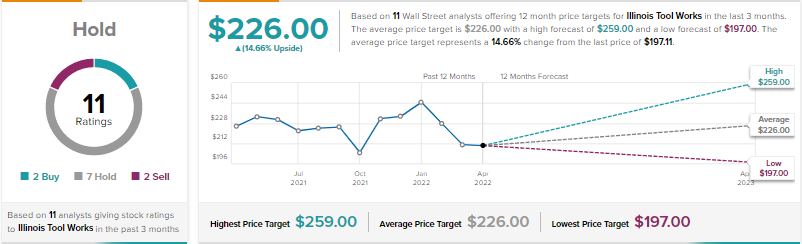

A few days ago, Nicole DeBlase of Deutsche Bank maintained a Hold rating on Illinois Tool while lowering the price target to $226 (14.66% upside potential) from $236.

Overall, the company has a Hold consensus rating based on two Buys, seven Holds, and two Sells. Illinois Tool’s price forecast of $226 suggests 14.66% upside potential from current levels. Shares of Illinois Tool have declined 19% year-to-date.

Eaton Corporation plc (NYSE: ETN)

The Dublin, Ireland-based power management company is slated to release its first-quarter results on May 3, 2022, before the market opens. It presently has a market capitalization of $58 billion.

For the first quarter, the consensus estimate for earnings and revenues stands at $1.60 per share and $4.79 billion, respectively.

Solid product offerings, expansion of business geographically, buyout gains (including Royal Power Solutions), and healthy demand might have aided the first-quarter results. However, cost inflation and labor problems might have played spoilsport.

For the first quarter, Eaton predicts adjusted earnings to be $1.55-$1.65 per share. Organic revenue growth is expected within the 7%-9% range, and the net impact of acquisitions and divestitures is expected to be (6%).

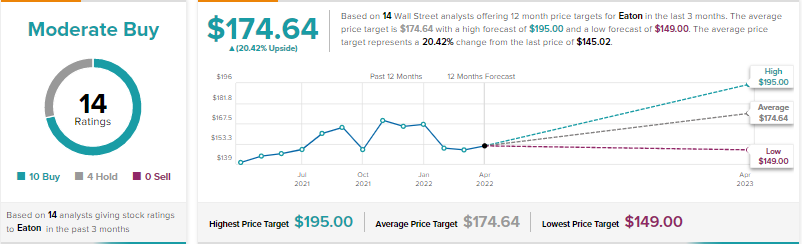

A few days ago, Christopher Glynn of Oppenheimer reiterated a Buy rating on Eaton while decreasing the price target to $170 (17.23% upside potential) from $185.

Currently, the company has a Moderate Buy consensus rating based on 10 Buys and four Holds. Eaton’s average price target of $174.64 mirrors 20.42% upside potential from current levels. Shares of Eaton have declined 14% so far this year.

Emerson Electric Co. (NYSE: EMR)

The industrial products maker that has a market capitalization of $53.6 billion is scheduled to release its results for the second quarter of Fiscal 2022 (ended March 2022) on May 4, before the market opens.

The consensus estimate for Emerson’s earnings for the second quarter stands at $1.18 per share. Analysts expect the company to post revenues of $4.71 billion.

Healthy demand across geographical markets served, effective cost management, and benefits from inorganic actions are likely to have positively impacted Emerson’s results in the second quarter. However, supply-chain and logistics woes are to hurt.

For the second quarter, Emerson anticipates net sales to increase 4% to 6% year-over-year, with underlying sales expected within the 6%-8% range. Adjusted earnings per share are expected to be within the $1.15-$1.20 per share range.

A few days ago, Joseph O’Dea of Wells Fargo reiterated a Neutral rating on EMR while lowering the price target to $100 (10.89% upside potential) from $102.

Currently, St. Louis, MO-based Emerson has a Moderate Buy consensus rating based on five Buys and five Holds. Emerson’s average price target of $110.10 suggests 22.09% upside potential from current levels.

Conclusion

The industrial sector’s fundamentals appear to be strong, as evident from an 8.1% year-over-year increase in industrial production in the United States in the first quarter of 2022. A recovering economy, both domestically and globally, as well as efforts to improve infrastructure by the government, might be advantageous in the years ahead.

Illinois Tool, Eaton, and Emerson are all well-placed to leverage from long-term tailwinds. However, macro and micro headwinds are concerning in the near term. A look at earnings results this week will give investors an idea of how these companies are shaping up for the April-June quarter, and the second half of calendar 2022.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure