Green hydrogen stocks are one of the prime beneficiaries of the Inflation Reduction Act (IRA) passed in 2022. The IRA has allotted $369 billion towards green energy solutions and technology. Green hydrogen producers can avail themselves of up to $3 per kilogram in tax credits for the first ten years of a project.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Energy companies are vying for the lucrative opportunity to avail of tax credits worth billions of dollars. In the race, companies are also facing the question of what truly defines green energy.

Green hydrogen is basically the hydrogen produced by splitting water into hydrogen and oxygen using renewable sources of electricity. It is worth noting that the Internal Revenue Service (IRS) and the Treasury Department are writing down rules to define the eligibility criteria for the proposed hydrogen tax credits. Some of the conflicting issues in defining the criteria include the use of U.S.-based equipment, how much of the hydrogen output is produced using green energy, and the location of the projects.

As per some green companies, one of the drawbacks of the tighter norms might be that companies would have to prove their hydrogen plant’s energy consumption to renewable power generation on an hourly basis as well as confirm the location of their green plant.

Let us look at three green hydrogen companies that are poised to benefit from the IRA.

NextEra Energy Inc. (NYSE:NEE)

Energy company NextEra Energy (NYSE:NEE) is one of the largest electric power generators in the U.S. The company also boasts a clean energy portfolio led by NextEra Energy Resources (NEER), which is the world’s largest generator of renewable energy from wind and sun.

As per a WSJ report, NEE is arguing that proving renewable energy production on an hourly basis would increase its cost. The company plans to be carbon neutral by 2045 by focusing on solar projects and hydrogen-based power plants.

What is the Future of NEE?

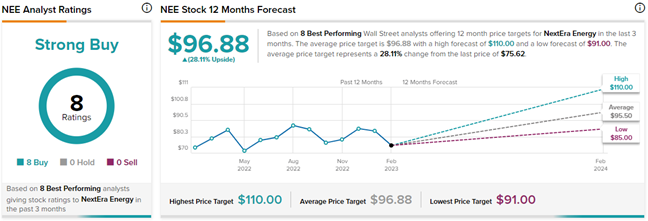

With eight unanimous Buys, NEE stock has won the favor of Wall Street analysts. The stock has a Strong Buy consensus rating on TipRanks. Also, the average NextEra Energy price target of $96.88 implies 28.1% upside potential from current levels. Meanwhile, the stock has lost 9.8% so far this year.

Plug Power (NASDAQ:PLUG)

Plug Power (NASDAQ:PLUG) manufactures hydrogen fuel cell systems that replace conventional batteries in equipment and electric vehicles (EV). Moreover, Plug Power engages in hydrogen fuel cell turnkey solutions, hydrogen and green hydrogen generation, as well as storage solutions.

The hydrogen generated by Plug Power is not fully green, in that it uses power from the electricity grid (a mix of green and fossil fuel energy). The company has a long way to go before it can deploy fully green energy sources, but to avail of the tax credits, Plug Power aims to buy renewable energy certificates (RECs), often sold by green power project companies, to qualify as a green energy company.

Is Plug Stock Expected to Rise?

On TipRanks, the average Plug Power stock prediction of $31.56 implies an impressive 104% upside potential from current levels. Analysts have awarded PLUG a Strong Buy consensus rating based on eight Buys and one Hold rating. at the same time, the stock has gained 27% so far in 2023.

Bloom Energy (NYSE:BE)

Bloom Energy (NYSE:BE) is one of the largest hydrogen companies in the world that manufactures and markets solid oxide fuel cells. Its product, the Bloom Energy Server, converts standard low-pressure natural gas or biogas into electricity through an electrochemical process without combustion. Further, the company has developed a Bloom Electrolyzer that can pair with solar and wind energy to produce green hydrogen, store it, and even convert it back to electricity in the future.

Is Bloom Energy a Buy Right Now?

Currently, BE stock has a Moderate Buy consensus rating based on four Buys and three Hold ratings. The average Bloom Energy price target of $29.57 implies 26.9% upside potential from current levels. Year to date, the stock has gained 21.4%.

Ending Thoughts

The war-led price escalation of oil and gas has also led to a boom in the demand for and generation of clean energy resources. As per research from Rhodium Group, last year in the U.S., renewable sources outpaced the electricity generated by coal for the first time in over 60 years. The changing landscape towards green energy bodes well for all players involved in green energy generation, directly or indirectly. The companies mentioned above are not only well-positioned to benefit from the shift but are also poised to benefit heavily from the IRA.

An investor can refer to TipRanks’ Best Green Hydrogen Stocks list to compare and study more green hydrogen stocks.