Gold has always had a special place for investors. It’s one of the world’s oldest forms of money, and while most currencies today no longer circulate precious metals, gold is still used as both a reliable store of value and a ‘safe haven’ investment. And in recent months, with economies reeling from the COVID-19 pandemic and markets generally going haywire, gold has seen a strong rally. The metal is up more than 16% year-to-date, and is now trading for more than $1,700 per ounce.

“The breakout occurring now that is ending Q2 completes an eight week trading range that has resumed higher […] These patterns say gold can make a new all-time high with Q3 on our mind,” said Bank of America strategist Paul Ciana.

The potential is clear in gold; it’s an investment that can both insulate a portfolio during hard time and bring a positive return. Now combine that with penny stocks, and the combination features fantastic upsides.

Penny stocks, defined as selling for less than $5 per share, typically feature high growth potential; even a small absolute gain of just a few cents per share can translate to a hefty percentage gain in share value.

We’ve looked up three penny stocks in gold mining companies in the TipRanks database, with upsides starting at nearly 60%. Let’s see what makes them as good as gold.

Avino Silver & Gold (ASM)

Based in Canada, Avino owns and operates two mining operations outside of Durango, Mexico. The Avino mine produces gold, and copper. The San Gonzalo mine, which reached the end of its active lifetime in 2019, is still maintained for exploration purposes. Last year, ASM produced, primarily from the Avino mine, over 6,900 ounces of gold and more than 958,000 ounces of silver.

A ramp-up in the Avino helped the company report both production and revenue gains in Q1, despite the coronavirus epidemic. The company showed a strong balance sheet, with $7.1 million in top line revenues, $6.7 million in cash available, and a $1.2 million reduction in term and equipment debt.

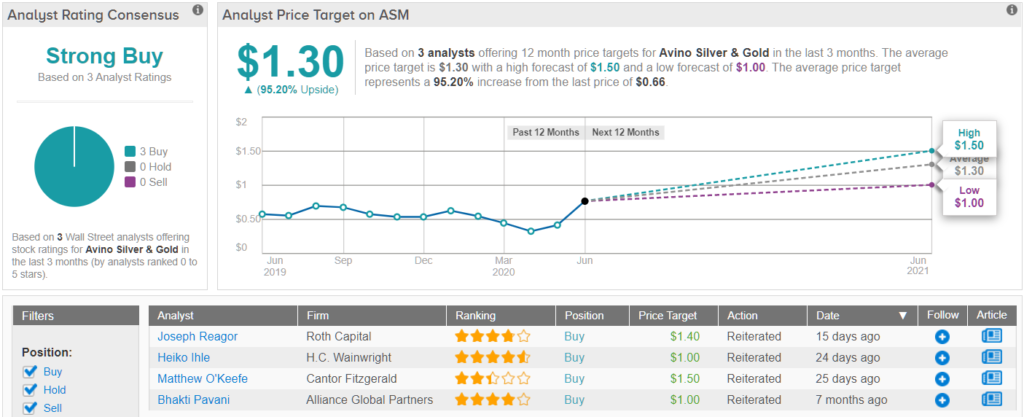

Given its $0.66 share price, some analysts believe that now is the ideal time to get on board.

Roth Capital analyst Joe Reagor likes ASM’s prospects, noting, ““As gold and silver prices rise, ASM should see improved operating cash flow and thus, be able to fund its internal projects and repay its term loan without further dilution […] Looking at the valuation metric, Reagor believes “ASM remains significantly undervalued by the market.”

Reagor’s new price target, $1.40, suggests an impressive upside potential of 110% and backs up his Buy rating on the stock. (To watch Reagor’s track record, click here)

The Strong Buy analyst consensus on ASM is unanimous, based on three reviews, and they all say: this is a stock to Buy. Adding to the good news, the average price target of $1.30 suggests a robust 95% upside potential for the coming year. (See ASM stock analysis on TipRanks)

Galiano Gold (GAU)

Next up, Galiano, is the new name of Asanko Gold. The company made the name change effective in early May, along with the new GAU ticker symbol. The company remains based in Vancouver, Canada and continues to operate the Asanko gold mine, located in the West Africa nation of Ghana. The mine is profitable, and in 2019 it exceeded the full-year production guidance and achieved a record output of 251,044 ounces of gold. Full-year guidance for 2020 stands at 225,000 to 245,000 ounces.

Strong production performance continued in Q1. The company reported quarterly production of 66,333 ounces and sales of 67,820 ounces. With an all-in sustaining cost of $805 per ounce, and an average realized price of $1,542 per ounce, GAU generated record-high quarterly sales of $104.6 million. EPS, reported at 10 cents, was double the 5-cent estimate. The stock’s share performance has reflected the production and sales performance; GAU shares are up 31% in the four months since markets fell in February.

Currently going for $1.22 apiece, some Wall Street pros warn investors not to miss out on an exciting opportunity.

Heiko Ihle, 5-star analyst with H. C. Wainwright, notes the success of GAU’s Asanko mine: “We highlight that the Asanko Gold Mine (AGM) has continued to operate during the current turmoil in the wake of the ongoing COVID-19 pandemic… the AGM remains well on its way to exceed management’s current FY20 gold production guidance…”

In line with that upbeat outlook, Ihle rates this stock a Buy, with a $2.50 price target suggesting a 104% upside potential for the year. (To watch Ihle’s track record, click here)

GAU shares have two recent reviews, and both are Buys. The average price target of $1.95 implies a one-year upside potential of 59% from the current share price of $1.22. (See Galiano stock analysis on TipRanks)

Paramount Gold Nevada (PZG)

Last on our list is Paramount, the Nevada-based gold mining company with two main projects. Sleeper, near the California-Nevada line, is a fully-owned project aimed at exploring and extracting the remaining recoverable reserves of an inactive open-pit mine. Grassy Mountain, near Vale, Oregon, is series of claims spread across 9,300 acres of land. Paramount is the full owner of all mining claims in the Grassy Mountain area.

Paramount is currently engaged in the permitting process for its Oregon projects, which will become the state’s first active mines since the 1990s. Currently, the company is not producing any gold output – but the prospects are excellent for future production. This makes the stock a speculative option for investors willing to take the risk on a gold company that has not yet started active mining operations.

Canaccord analyst Tom Gallo agrees that Paramount has strong prospects. He writes, “There has been no mining activity in Oregon since the 1990s, and although there is a clear permitting process established, no company has applied for, or received mining permits. The receipt of a full mining permit should be a major catalyst for Paramount and a rerating opportunity.”

To this end, Gallo rates PZG shares a Speculative Buy along with a $1.70 price target, which implies nearly 60% upside potential from the current share price of $1.09. (To watch Gallo’s track record, click here)

All in all, Paramount’s shares have a Moderate Buy analyst consensus rating, based on 2 recent reviews. Both of those are Buy, and their average price target is $3.35, suggesting an eye-popping upside potential of 207%. (See Paramount stock analysis on TipRanks)

To find good ideas for penny gold stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.