What’s better than getting a quarterly dividend from your favorite stock? How about getting dividends on a monthly basis from ETFs? That’s exactly what investors can do with these three ETFs, including two popular newer ETFs. Not only do these ETFs pay a dividend every month, but they also feature double-digit dividend yields.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI)

The JPMorgan Equity Premium Income ETF pays out a dividend every month and yields an extraordinary 11.5% on a trailing basis. This is a large fund that has garnered a substantial sum of assets in a short amount of time. JEPI has grown to over $21 billion in assets under management (AUM) since its inception in 2020.

Part of JEPI’s goal is to mitigate volatility and limit downside. JEPI “generates income through a combination of selling options and investing in U.S. large cap stocks, seeking to deliver a monthly income stream from associated option premiums and stock dividends.”

JEPI achieves this by investing up to 20% of its assets into ELNs (equity-linked notes) and selling call options with exposure to the S&P 500. While this approach held up well last year and preserved investor capital in a challenging market, it warrants mentioning that this approach may also limit some of JEPI’s upside in a bull market. However, this is why an ETF like JEPI is best suited as part of a balanced portfolio.

JEPI is a diversified fund with 116 holdings, and its top holdings make up just 16.7% of assets. The holdings are heavily comprised of large, U.S.-based dividend payers from relatively defensive sectors. The consumer staples sector is one of the steadiest ones out there, and JEPI’s top 10 holdings include consumer staples mainstays like Coca-Cola, Pepsi, and Hershey.

Financials are also well-represented in the top 10 through the likes of Progressive, Visa, Mastercard, and US Bancorp. Healthcare is another traditionally defensive sector, and it is represented in the top 10 through Abbvie and Bristol Myers.

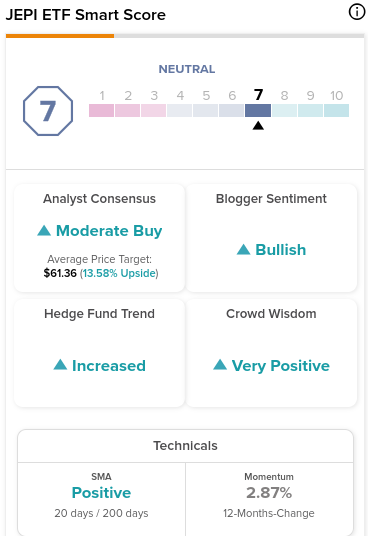

JEPI features an expense ratio of 0.35% and screens positively on a number of metrics. It has a “neutral” ETF smart score of 7 out of 10, while blogger sentiment is bullish and crowd wisdom is very positive.

Additionally, JEPI comes in as a Moderate Buy, according to analysts. The average JEPI stock price target of $61.36 represents upside potential of 13.6%. Of the 2,000 analyst ratings, 63.2% are Buy ratings, 32.6% are Holds, and only 4.2% are Sells.

Based on its great yield, monthly payout, and defensive group of blue chip holdings, JEPI looks like a great choice for income investors.

JPMorgan Nasdaq Equity Premium Income ETF (NYSEARCA:JEPQ)

The JPMorgan Nasdaq Equity Premium Income ETF is similar in approach to JEPI but focuses on Nasdaq 100 stocks. This is a fairly new ETF that launched in 2022 following the success of JEPI. Just as JEPI aims to deliver a significant portion of the results of the S&P 500 with less volatility, JEPQ seeks to do the same with the Nasdaq 100. JEPQ “generates income through a combination of selling options and investing in U.S. large cap growth stocks, seeking to deliver a monthly income stream associated option premiums and stock dividends.” The same note above about JEPI using options and ELNs to generate income applies to JEPQ.

JEPQ is less diversified than JEPI. While it is certainly not a concentrated fund, with 78 holdings, JEPQ’s top 10 holdings make up over 53% of assets. The top holdings are mega-cap tech stocks like Microsoft, Apple, Alphabet, Amazon, and Tesla. Unlike JEPI, in which no single holding makes up more than a 2% position in the fund, top holdings like Microsoft and Apple account for 12.1% and 11.1% of JEPQ, respectively.

Like JEPI, JEPQ has an expense ratio of 0.35%. With a dividend yield of 10.2%, JEPQ has a lower yield than JEPI, but this is still an attractive payout.

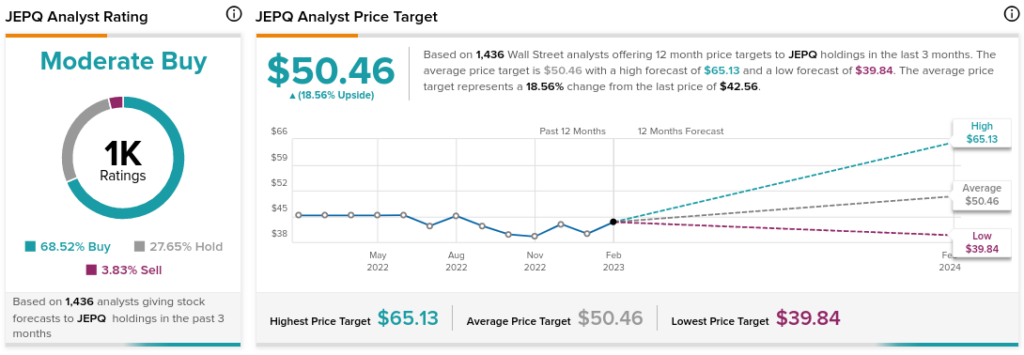

JEPQ has a favorable ETF smart score of 8 out of 10, indicating an “outperform” rating. Additionally, blogger sentiment is bullish, and crowd wisdom is very positive.

Turning to Wall Street, JEPQ has a Moderate Buy consensus rating. The average JEPQ stock price target of $50.46 indicates upside potential of 18.6% from current prices. Out of 1,000 analyst ratings, 68.52% are Buys, 27.65% are Holds, and just 3.83% are Sell ratings.

Like JEPI, JEPQ is a solid choice for conservative investors and income investors thanks to its high yield, monthly payout, and approach to limiting volatility. It’s a bit of a higher-risk, higher-reward ETF than JEPI due to its more concentrated approach and its heavier exposure to growth and big tech.

Global X SuperDividend US ETF (NYSEARCA:SDIV)

Like JEPI and JEPQ, the GlobalX Super Dividend ETF is another monthly dividend payer. SDIV’s dividend yield is even higher than these two at 13.8%.

GlobalX Super Dividend is a smaller ETF than JEPI or JEPQ, with $790 million in AUM. SDIV also features an expense ratio of 0.58%, which is higher than the two aforementioned ETFs.

SDIV invests in 100 of the highest-yielding stocks globally, which gives it more of an international flavor than JEPI or JEPQ. Only about 30% of SDIV’s stocks are U.S.-based, with the rest of the holdings coming from a wide variety of countries, including Brazil, Hong Kong, China, Great Britain, Australia, South Africa, and beyond. SDIV holds 106 positions, and its top 10 holdings make up just 15.4% of assets.

While JEPI and JEPQ are largely comprised of blue chip stocks, the holdings for SDIV include everything from REITs to midstream energy companies to shipping companies, making this a somewhat more volatile basket of holdings.

One thing that SDIV deserves credit for is its longstanding track record when it comes to dividends. The fund has paid out a dividend every month for 11 years and counting.

SDIV isn’t selling options or investing in ELNs like JEPI or JEPQ, which some investors may find preferable. On the other hand, its basket of equities that it holds is likely more volatile. SDIV fell 26.4% last year, while JEPI only fell 3.5%. JEPQ launched in 2022, so it does not have full-year results, although it is down 11.9% since its launch last May.

Final Thoughts

For income investors, it’s hard to argue with double-digit yields and monthly payments. All three of these ETFs fit into that playbook. They may not offer much growth over the long term, but it’s hard to beat them in terms of dividend payouts. Of the group, my personal favorite is JEPI (which I own) due to its impressive yield, low expense ratio, and blue chip, defensive group of holdings. JEPQ harbors appeal as a high-yield vehicle that also offers some of the upside potential of growth stocks in the Nasdaq 100.

One advantage of JEPI over JEPQ is that JEPQ’s portfolio is more expensive from a valuation perspective. JEPQ’s holdings have an average price-to-earnings multiple of 22.3 versus an average P/E multiple of 19 for JEPI.

SDIV is interesting for its sky-high yield and deserves credit for its long-term track record of payments. However, JEPI and JEPQ feature more blue-chip holdings, likely making SDIV more of a choice for risk-tolerant investors.