The investing world is abuzz with talk of bull rallies and the skyrocketing NASDAQ. Despite the coronavirus crisis, the tech-heavy index is up more than 15% so far this year, and shows no signs of stopping. It’s a clear message of investor confidence.

Not so fast, however. The Dow Jones, long the go-to metric for stock market followers, has not matched the tech sector’s performance. The Dow, composed of 30 blue-chip stocks in finance, industry, manufacturing, and retail, has indeed recovered from its winter crash – but its recovery has taken a shallower angle than the NASDAQ’s.

However it’s not all doom and gloom. Despite the Dow’s relative underperformance, the stocks composing the index are among the market’s most stable. These are companies with proven record of longevity and success – that’s how they were picked for the index in the first place – and even in today’s rocky investment climate, they feature Buy ratings, healthy upside potentials, and general approval from Wall Street’s analysts.

There are certainly compelling stocks to be found in the index. You just have to know where to look. Here we turned to TipRanks database to pinpoint the best Dow Jones stocks out there right now — at least according to Wall Street’s pros. Let’s take a closer look.

UnitedHealth Group, Inc. (UNH)

We’ll start in the healthcare sector. It’s no surprise, really, that the world’s largest health insurance provider, with last year’s revenues exceeding $242 billion and yielding a net profit near $14 billion, is doing well in the wake of a global pandemic. UNH has deep pockets, and over 130 million insurance customers worldwide.

Where most companies saw earnings fall in 1H20, UNH’s Q1 results, while slightly lower sequentially, were in line with the company’s previous four quarters (higher than one, lower than three). The real earnings story is the forecast for Q2, which is forecast to show a sharp spike, and a sequential gain from $3.72 to $5. Increased sign-ups as the uninsured race to shore up their health coverage are boosting business strength, and UNH has issued guidance for full-year 2020 EPS of $16.25 to $16.55, above the previous estimate of $16.22.

The general quality of UNH stock – its gains, and the company’s solid business position – led Leerink analyst Stephen Tanal to rate the stock a Buy along with a $360 price target. (To watch Tanal’s track record, click here)

Backing his stance, Tanal writes, “UNH possesses the managed care industry’s most powerful combination of national breadth and local depth – factors that beget sheer scale and the industry’s greatest resources (UNH expects to generate $19.25 billion of operating cash flow in 2020), as well as local economies of scale – and provide a platform for significant enterprise earnings growth…”

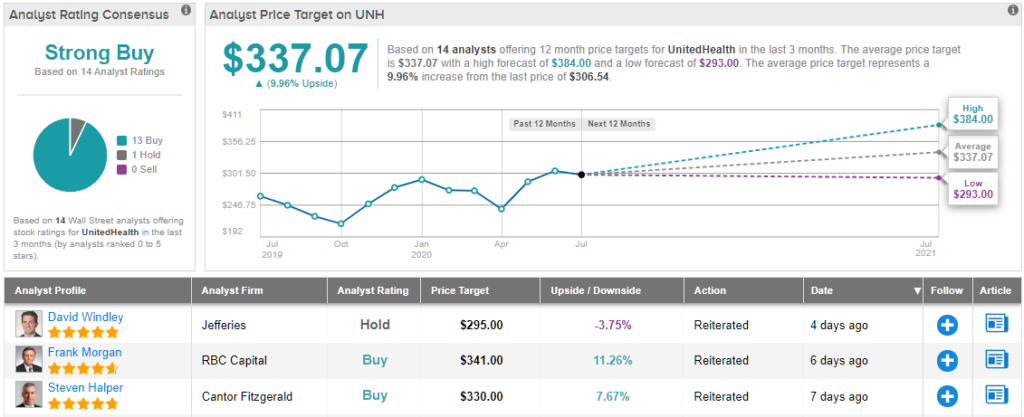

Overall, UnitedHealth has 14 recent analyst reviews, breaking down to 13 Buys and 1 Hold, making the analyst consensus rating on the stock a Strong Buy. Meanwhile, the average price target of $337 implies an upside potential of 10% for the coming year. (See UNH stock analysis on TipRanks)

Nike, Inc. (NKE)

From managed health care we move to retail – where Nike, of course best known for its sneakers, is a major name in athletic wear and leisure/sports apparel. The company’s skill and success in branding are legendary; Nike’s ‘swoosh’ is one of the few corporate logos instantly recognizable without any caption at all.

That strong foundation helped Nike to weather the initial stages of the COVID-19 pandemic, and the company beat forecasts for CYQ1 as North American and digital sales made up for losses in China. Q2, however, brought trouble. Sales in the North American market tumbled during the lockdown policies, and the company saw EPS fall to a 51-cent per share net loss. On an interest note, online sales continued to grow, by 75%, and made up 30% of total revenue. Nike’s website saw increased traffic from customers looking for indoor workout gear – sneakers and sweats.

Susquehanna analyst Sam Poser is blunt in his rating of NKE stock. “Buy Nike,” he says, adding, “We think short-term headwinds are masking NKE’s long-term potential. Investors should look past the challenges that NKE will face over the next two quarters and focus on the unmatched global strength of the Nike brand, digital prowess, best-in-class customer engagement, unrivaled product innovation, and fortress balance sheet.”

In line with that outlook, Poser set a $130 price target, implying a robust 35% upside over the coming 12 months. (To watch Poser’s track record, click here)

Wall Street’s analyst corps agrees with Poser on NKE. The Strong Buy analyst consensus rating on Nike’s stock is based on 22 Buys, 3 Holds, and a single Sell set in recent weeks. The average price target is $110.70, suggesting an upside of nearly 15% for the next this year. (See NKE stock analysis on TipRanks)

The Goldman Sachs Group (GS)

Last on our list of buy-rated Dow stocks is the Goldman Sachs Group, one of Wall Street’s storied names. The international bank holding company specializes in asset management, trading and investments, and securities services. Goldman provides services mainly to institutions: corporations, other banks, and government entities, but also to some high net worth individuals.

The coronavirus hurt Goldman in the first quarter, and the firm saw EPS fall by 39%, to $3.11. At that, however, it did beat the forecast by over 9%. Revenues, at $7.77 billion, were down 14% sequentially; but that result was at the mid-point of the past four quarters’ results. While the first quarter was bad, Goldman had the resources to survive – and the bank is looking at improved EPS for Q2, and is expected to beat the estimate of $3.84 per share.

Goldman is one of the market’s most reliable dividend players. The company maintained its $1.25 common stock dividend through the crisis months, paying out in March and June. The annualized payment of $5 per share gives a yield of 2.43%, somewhat better than the ~2% average found among S&P-listed companies, while the payout ratio of 40% shows that the payment is fundamentally sound.

Analyst Mike Mayo, writing from Wells Fargo, believes that Goldman can meet the challenges of the current environment. He writes of the company, “Our confidence is reinforced since GS has many levers it [can] pull and much of these types of moves are within its control. This includes more aggressive actions which both can increase short-term earnings and free-up capital, such as by harvesting private equity investments.”

Mayo puts a $255 price target on GS, suggesting a strong 21% one-year upside, and backs up his Buy rating. (To watch Mayo’s track record, click here)

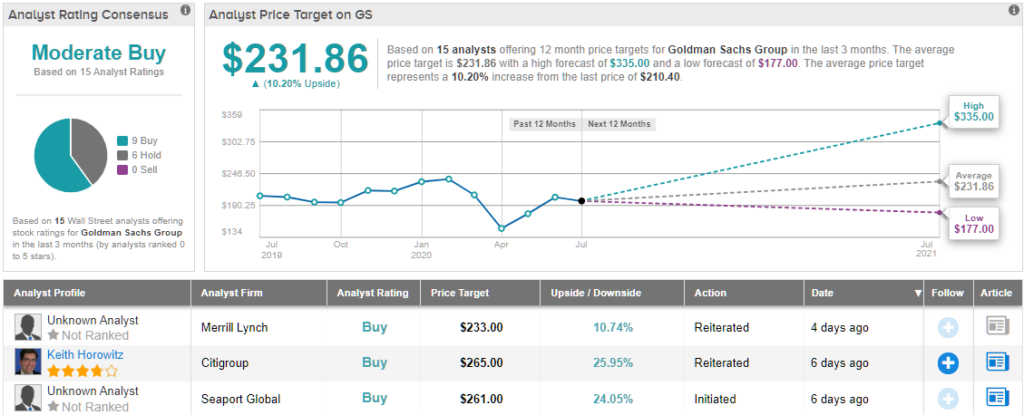

Overall, Goldman gets a Moderate Buy rating from the analyst consensus, based on 9 Buys and 6 Holds. The stock is selling for $210, and the average price target, at $231.86, implies it has room for 10% upside growth this year. (See Goldman Sachs’ stock analysis at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.