Watching the markets for investment bank BTIG, analyst Michael Gorman sees three high-yielding dividend stocks that investors should note. These stocks are offering dividend returns ranging from 4% to 6%, or 2x to 3x higher than the average dividend yield found among S&P-listed companies. And with Treasury notes yielding less than 1% after the Federal Reserve’s moves to slash interest rates, investors are hard-pressed to find high returns. Dividend stocks offer the best chance for growing one’s investments.

Using TipRanks database, we’ve looked up Gorman’s stock picks to find out what else makes them compelling buys. Here are the results.

Alpine Income Property Trust (PINE)

First on our list is a real estate investment trust in the commercial niche. Alpine owns a portfolio of single-tenant retail properties, earning income from the annual leases. The company’s tenants include big box retailers, gas stations, hotels, and fast food franchises – in all, 23 tenants in 13 states, on properties totaling 1.09 million square feet.

In its most recent reported quarter, PINE showed 22 cents EPS, against a forecast of 25 cents. While missing expectations, this was clearly sufficient to maintain the regular quarterly dividend of 20 cents. PINE has paid out dividends twice, in December and March, and its third disbursement is due on June 12. The company’s dividend started at 6 cents in December, before it was raised to 20 cents in Q1. At current values, the annualized dividend offers a strong yield of 5.3%.

BTIG’s Gorman is sanguine of PINE’s ability to remain solvent and profitable, even in current market conditions. He writes of the company, “…we think meaningful external growth is a key component of the investment thesis… We believe the company’s improving balance sheet, liquidity, solid management team, and strong acquisition pipeline should help drive strong growth. This is especially true relative to PINE’s small initial portfolio.”

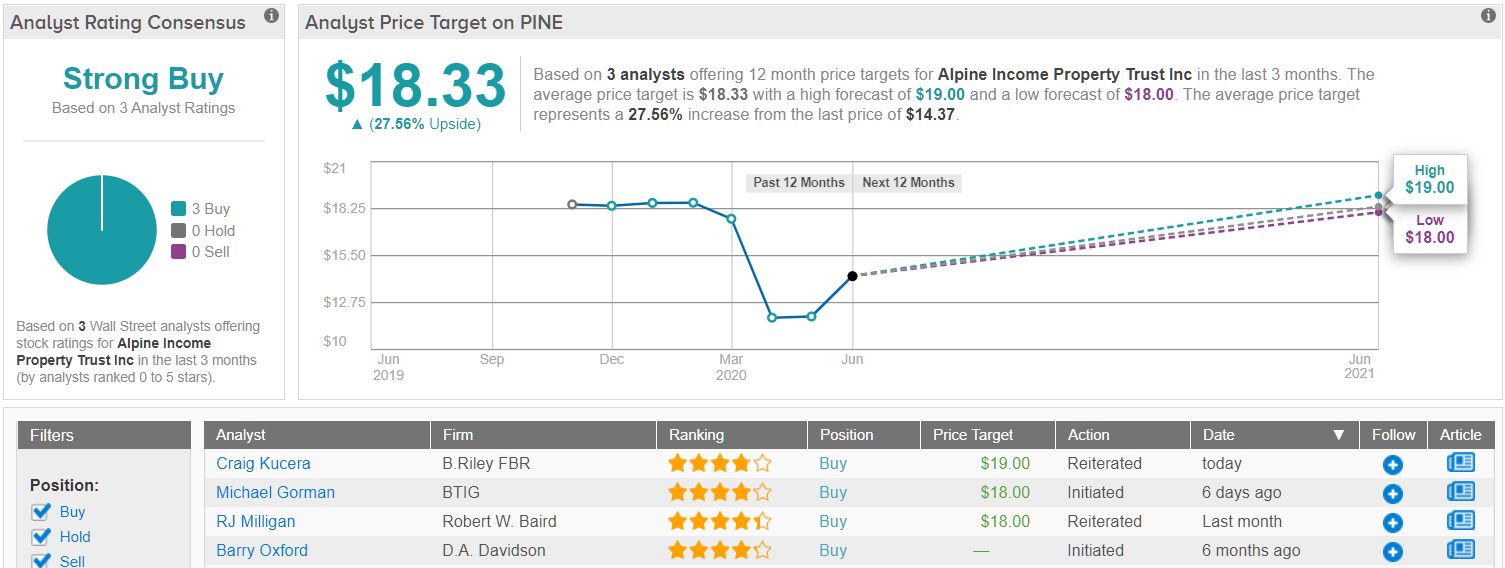

In line with his upbeat outlook, Gorman rates PINE a Buy rating. His $18 price target implies a healthy 25% one-year upside potential. (To watch Gorman’s track record, click here)

Alpine holds a Strong Buy rating from the Wall Street analyst corps, with the consensus based on a unanimous 3 Buys set in the past month. Shares are selling for $14.37, and the $18.33 average price target suggests it has room for 28% growth in the year ahead. (See Alpine stock analysis at TipRanks)

New Senior Investment Group (SNR)

Staying in the REIT sector, we move on to New Senior Investment Group. The ‘Senior’ in the company’s name refers to its properties – this company invests in senior citizen housing properties. The current portfolio, of 103 properties, mainly retirement homes, is primarily private pay. In February of this year, SNR divested itself of the nursing home and memory care facilities in its portfolio, netting $385 million on the sale.

The remaining properties in the company’s portfolio include 102 independent living communities, and one 1 continuing care facility. The properties are located in 36 states and have more than 12,000 beds. With a market cap of $300 million, SNR is one of the country’s largest property owners in the senior housing segment.

First quarter earnings for SNR slipped from 18 cents to 16 cents per share – but that EPS figure was higher than the 14-cent expectation. Revenues, at $86.6 million, beat the forecast by a half percent, although it was down year-over-year.

Earnings were enough to maintain the dividend, helped by the fact that management reduced the payment to 6.5 cents per share. The payout ratio, at 40%, indicates that the dividend is safe and affordable at this level. The 26-cent per share annualized payment puts the yield at 6%, far higher than the 2.16% found among peer companies in the financial sector.

BTIG’s Gorman reviewed this stock, and was pleased with the company’s debt management and forward prospects, saying “SNR maintains sufficient liquidity to navigate the COVID-19 crisis. In March, the company drew $100M on its revolving credit facility and had $135.1M of cash on hand, totaling $235.1M in liquidity. SNR expects to repay a portion of the revolver in 2Q or 3Q. During the quarter, SNR completed $400M of refinancing, resulting in lower debt costs and an extension of debt maturities by 2 years.”

“We think that SNR’s high-quality, heavily demanded IL portfolio and capital position deserve a premium valuation,” the analyst concluded.

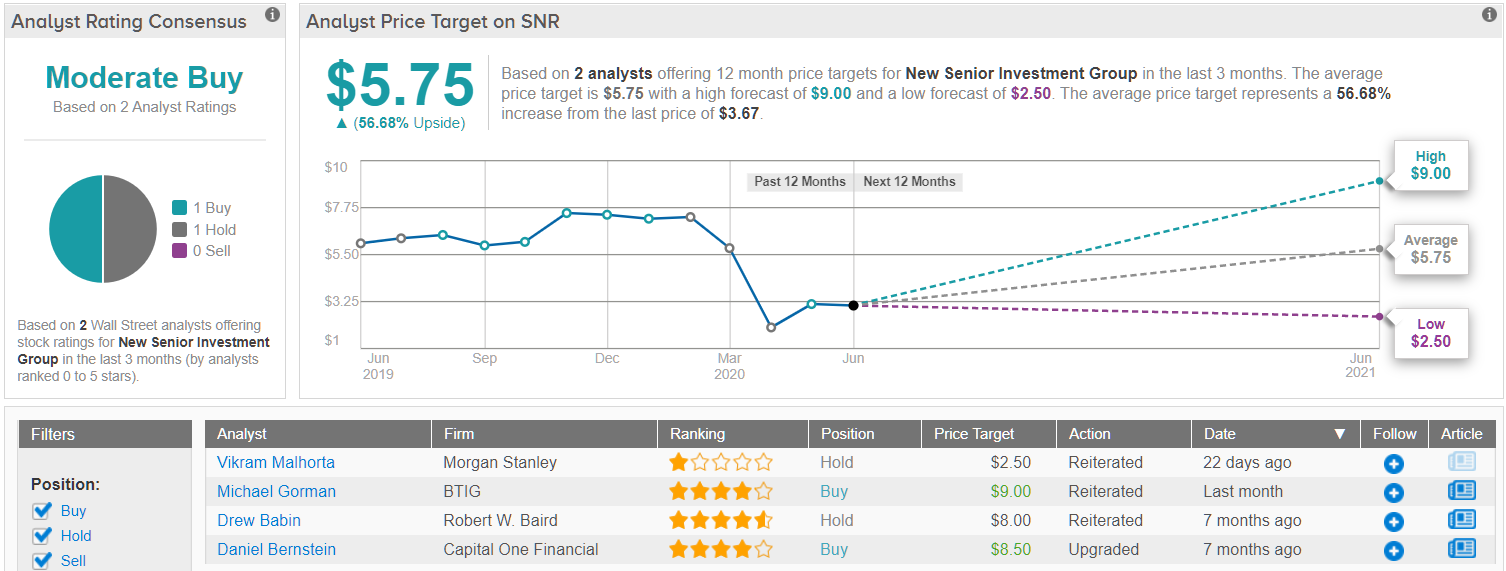

To this end, Gorman put a $9 price target on the stock, suggesting it has impressive potential for growth – up to 120%. This strongly supports his Buy rating.

The two most recent reviews of SNR are a Buy and a Hold, making the analyst consensus view a Moderate Buy. The stock is priced at just $4.07, and its $5.75 price target implies a robust 41% growth potential in the next 12 months. (See New Senior stock analysis at TipRanks)

Postal Realty Trust (PSTL)

Last on the list today is a unique member of the REIT world. Postal Realty, as its name suggests, owns properties leased exclusively by the US Postal Service. PSTL’s portfolio includes 564 owned properties and 403 managed properties in 49 states. Postal Realty boasts a 100% occupancy rate and over 3.5 million leasable square feet. The company has found a boost in the nature of its niche – its sole customer, the USPS, has a Constitutionally mandated existence, and cannot go out of business.

In the first quarter, PSTL saw sequential rental income growth of 37%, and reported FFO – funds from operations – of 12 cents per share. This supported a 20-cent quarterly dividend, paid out in May. PSTL’s dividend started out in July 2019 at 6 cents, and has been raised in each quarter since. The current payment annualizes to 80 cents per share and gives an excellent yield of 4.9%.

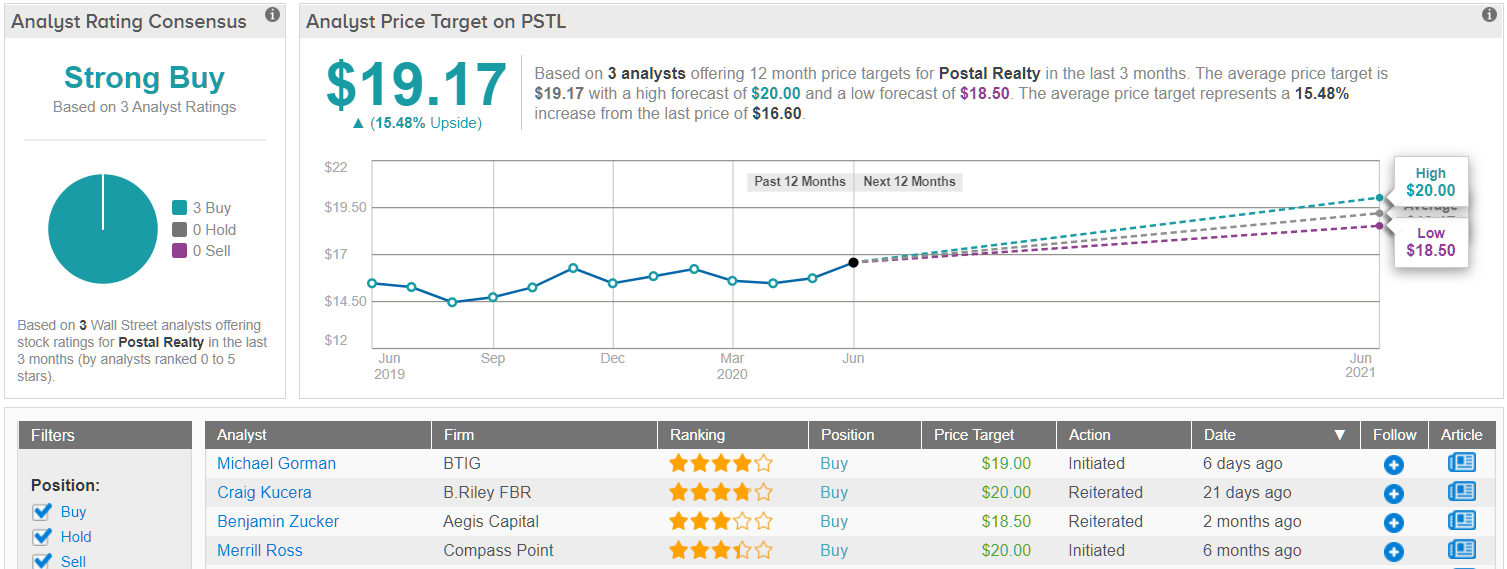

This is another new stock that attracted Gorman’s attention enough for him to initiate coverage. In his initiation report, Gorman rated the stock a Buy and set a $19 price target – that target implies an upside potential of 15%.

In his comments on PSTL, Gorman writes, “Although the portfolio consists entirely of ‘flat’ leases, there should be plenty of opportunity for growth through acquisitions and releasing… Moreover, with the current economic and market uncertainty, we think the portfolio should provide needed cashflow stability to REIT investors.”

All in all, with three recent analyst reviews, all Buys, the consensus view on PSTL shares is a unanimous Strong Buy. The stock’s $19.17 average price target is in line with Gorman’s, and suggests a 15.5% premium from the current share price of $16.60. (See Postal Realty analyst ratings on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.