An experience that few want to relive is the COVID-19 crisis. Though the disruptions it imposed may reverberate for years to come, it also sparked a major silver lining: the development and distribution of messenger-RNA-based vaccines. Indeed, advanced biotechnology firms may be able to leverage this innovation to spark additional therapeutics. In particular, patient forward-looking investors may want to consider the following biotech stocks:

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

- BioNTech (NASDAQ:BNTX)

- CureVac (NASDAQ:CVAC)

- Arcturus Therapeutics (NASDAQ:ARCT)

During the initial development phase of mRNA vaccines for the SARS-CoV-2 virus, public hesitancy arose due to the “newness” factor of the innovative approach. However, as Johns Hopkins Bloomberg School of Public Health noted, mRNA vaccines actually feature a long history, being first discovered in the early 1960s. By the 1970s, research materialized regarding the process of how mRNA could be delivered into cells.

In this research phase, scientists developed the ability for mRNA – a nucleic acid playing essential roles in coding, decoding, regulation, and expression of genes – to be taken up by the body. However, the issue was that the polymeric molecule would degrade quickly. The innovation that eventually facilitated the distribution of COVID-19 vaccines centered on nanotechnology advances.

As Johns Hopkins explains, scientists discovered a mechanism to use fatty droplets called lipid nanoparticles to wrap around the target mRNA like a bubble, allowing entry into cells. “Once inside the cell, the mRNA message could be translated into proteins, like the spike protein of SARS-CoV-2, and the immune system would then be primed to recognize the foreign protein.”

So profound is the “limitless future” of RNA therapeutics that bioengineers published a report on Frontiers that the concept of “undruggable” conditions may be rendered obsolete.

Per the publication, “We are in the midst of a therapeutic revolution, the likes of which have not been seen since the advent of recombinant protein technology almost 50 years ago in Silicon Valley. Accordingly, we will review recent developments in RNA Therapeutics, and their promise to alter the landscape of the pharmaceutical industry.”

BioNTech

A German biotech firm, BioNTech garnered a massive spotlight when it partnered with pharmaceutical giant Pfizer (NYSE:PFE) to develop Comirnaty, a mRNA-based vaccine for COVID-19. However, with President Joe Biden recently declaring that the pandemic is over, the narrative at first doesn’t seem to favor BioNTech. What’s more, on a year-to-date basis, BNTX hemorrhaged nearly 42%.

Nevertheless, for investors that can withstand volatility, BNTX could be one of the discounted biotech stocks to buy. Crossing the development and distribution finish line as one of the top mRNA pioneers, BioNTech commands an enviable scientific lead. Should another disease outbreak occur, the company has a blueprint to work from. In addition, it can pivot to address long-term conditions, thereby expanding the scope of RNA therapeutics.

To be fair, BioNTech only posted revenue of $3.38 billion for the second quarter of 2022, down 47% from the year-ago period. However, the retained earnings line item blossomed because of the company’s success in helping launch the COVID-19 vaccine, jumping from a moribund loss of $498 million in 2020 to $15.6 billion on a trailing-12-month basis.

Is BNTX Stock a Buy?

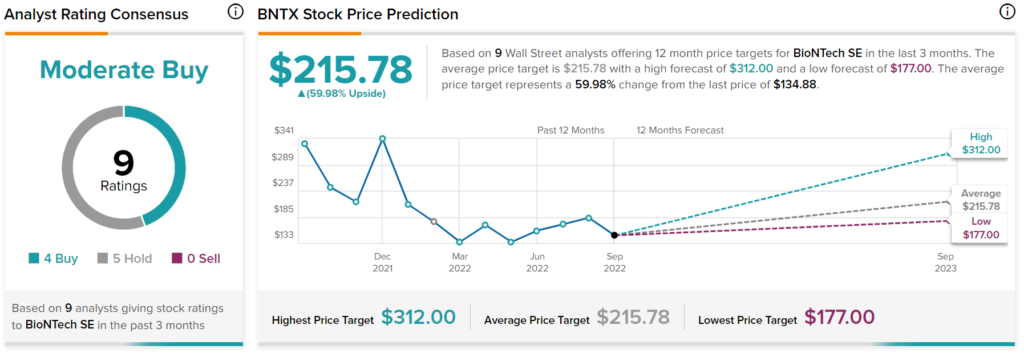

Turning to Wall Street, BNTX stock has a Moderate Buy consensus rating based on four Buys, five Holds, and zero Sell ratings. The average BNTX price target is $215.78, implying 60% upside potential.

CureVac (CVAC)

Another German biopharmaceutical company, CureVac specializes in therapies based on mRNA. Specifically, CureVac features a proprietary RNA platform that may “enable the body to make its own prophylactic and therapeutic drugs,” per its website. While an intriguing market idea based on the forward implications of mRNA-based technologies, CVAC presents significant risks, even compared to other clinical-stage biotech stocks.

Since the start of this year, CVAC suffered a catastrophic loss of almost 77%. Even worse, nearer-term momentum implies the pain has yet to abate, with CVAC incurring a 21% loss in the trailing month.

On the financial spectrum as well, CureVac could use some help. In Q2 2022, the company posted revenue of $21.3 million, down 21% from the year-ago quarter. Additionally, CureVac posted a net loss of $60.9 million in the most recent quarter.

However, the development and distribution of mRNA COVID vaccines should theoretically bolster underlying biotech stocks in the long run due to proven viability. Therefore, risk-tolerant investors may want to consider CVAC.

Will CureVac Stock Go Up?

Turning to Wall Street, CVAC stock has a Moderate Buy consensus rating based on two Buys assigned in the past three months. The average CVAC price target is $37, implying 369.50% upside potential.

Arcturus Therapeutics (ARCT)

A global late-stage clinical mRNA medicines and vaccines company, Arcturus Therapeutics represents a bold bet on the future of advanced medical technologies. As with CureVac, Arcturus features proprietary technologies along with key partnerships with the broader aim to deliver innovative therapeutic solutions.

Currently, Arcturus is developing a COVID-19 vaccine specifically geared toward the omicron variant. As well, the biotech firm seeks solutions for long-term diseases and conditions. For example, Arcturus is collaborating with the Cystic Fibrosis Foundation to develop mRNA-based medicine to treat cystic fibrosis.

Nevertheless, prospective buyers of ARCT must be prepared for a potentially choppy ride, even stacked against higher-risk biotech stocks to buy. Shares are down roughly 58% year-to-date, reflecting tremendous volatility. However, Arcturus posted revenue of $27 million in Q2 2022, significantly outpacing the $2 million posted in the year-ago quarter.

Should investors have the patience and long-term outlook, ARCT could be intriguing as RNA-related biotech stocks rise on the success of the COVID-19 vaccine.

Is ARCT a Good Stock to Buy?

Turning to Wall Street, ARCT stock has a Hold consensus rating based on three Buys, three Holds, and two Sells assigned in the past three months. The average ARCT price target is $40.86, implying 175.71% upside potential.

BNTX, CVAC, ARCT: Higher-Risk Stocks with Potentially Bright Futures

To be 100% clear, the above biotech stocks involve substantial risks. While not completely aspirational, these underlying companies feature an ambition that may not pan out. At the same time, the development and ultimate approval of mRNA vaccines bode very well for the future of therapeutics. Therefore, investors who have some funds earmarked for speculation may want to consider the above market ideas.