Investment firm B. Riley FBR has been looking at dividend yields, and is telling investors that now is the time to buy in. The reason is simple: even after the market rally that began on March 23, many equities remain affordable.

It may also be something of an artificial situation. The coronavirus crisis pushed economies into a freefall, and markets followed suit. The result was depressed stock prices and inflated dividend yields. We’re well past the market bottom, but how far from the top remains uncertain. And this is where B. Riley FBR is finding both high dividend yields and buying propositions.

We’ve used the TipRanks database to pull up the data on three of the firm’s recent recommendations. They are low-cost dividend plays that are yielding 9% or better.

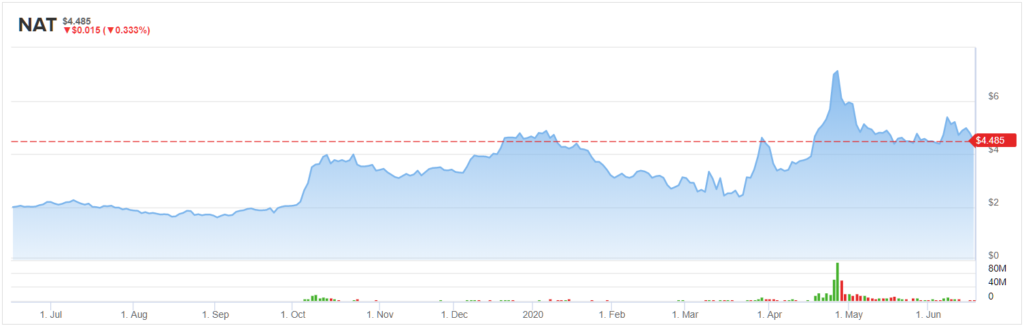

Nordic American Tanker (NAT)

We start in the oil business, specifically, oil tankers. Petroleum and its by-products provide the motive power of the modern economy, and remain essential even during recessionary times. Nordic American, based out of the island of Bermuda, is major operator in the tanker business, with 23 Suezmax vessels. The class name comes from the ships’ size – they are the largest tankers that can traverse the Suez Canal, shortening the travel time from Asia and the Middle East to Europe and the Atlantic.

In Q1, Nordic saw a 60% increase in net voyage revenue, to $86.2 million. And where many companies saw earnings drop sharply in the quarter due to the coronavirus pandemic, Nordic’s Q1 EPS beat the estimates by 8% and grew 200% sequentially.

The strong revenues explain the company’s dividend performance. Nordic paid out 7 cents per share in Q1, 14 cents in Q2, and has recently declared at 20 cent payment for Q3, due in August. At 80 cents annualized, the Q3 dividend gives an eye-popping yield of 16.39%.

Liam Burke covers this stock for B. Riley FBR, and in his last note he pointed out the advantages that the company’s homogenous Suezmax fleet gives in scheduling routes and vessel utilization. In his most recent review of the stock, he notes the dramatic increase in tanker fees charged: “Time charter equivalent (TCE) per day for 1Q20 was $44,100 compared to $26,025 in 1Q19 and $31,700 during 4Q19… The full benefit of Suezmax rate increases, during 1Q20 has been driven by the demand for crude storage that has more than offset the steep decline of global oil consumption.”

Burke’s $7.50 price target suggests a one-year upside to Nordic of 67%, and fully supports his Buy rating. (To watch Burke’s track record, click here)

However, given current economic conditions, and consequent low demand for oil, Wall Street is still cautious on Nordic – and that is reflected in the ‘Hold’ analyst consensus rating. This is based on 1 Buy, 1 Hold, and 2 Sell ratings given in recent months. Shares are selling for $4.47, and the average price target, at $4.70 suggests a modest upside of 5%. (See Nordic stock analysis on TipRanks)

Eagle Point Credit Company (ECC)

Next up is Eagle Point Credit. Eagle, a capital investment company focused on current income generation, invests mainly in equity and junior debt tranches of CLOs. The niche kept Eagle in positive territory for Q1 earnings, netting the company 23 cents per share.

A profitable quarter is always good, but there was bad news, too. EPS came in below the forecast, missing by 37%. Economic conditions in Q1 forced management to slash the dividend payment by 60%, reducing it from 20 cents monthly to just 8 cents. It was a deep cut, but it keeps the dividend payment sustainable for the company.

From investors, the dividend cut is noticeable – but the yield remains impressive. At an annualized rate of $1.96, the yield on ECC’s dividend payment is 13.43%. When compared to the 1.9% average among peer companies in the finance sector, or the ~2% average found on the S&P 500, or the >1% found in Treasury bonds, ECC’s return is simply unbeatable. By cutting the payment, management has shown a commitment to keeping it sustainable.

That sustainability is a key point for 5-star analyst Randy Binner. He writes, “The company’s reported quarterly recurring CLO cash flows averaged $1.01/share over the last 12 months. Similar levels of recurring cash flows would leave a large cushion to service the $0.24 quarterly dividend going forward.”

Binner puts a Buy rating on ECC, with an $8 price target to indicate room for 14% upside growth in the next year. (To watch Binner’s track record, click here)

Overall, there are two recent reviews on Eagle Point Credit, and they are split – one says Buy and one says Hold, giving the stock an analyst consensus rating of Moderate Buy. Shares are priced at $7.02; as the buy rating belongs to Binner, his $8 target stands in place of an average. (See Eagle Point stock analysis on TipRanks)

Ladder Capital Corporation (LADR)

Last up is Ladder Capital, a specialist in commercial mortgages, with customers in 475 cities across 48 states. Ladder provides loads from $5 million to $100 million, and boasts over $6 billion in assets. Most of Ladder’s activities are east of the Mississippi.

In Q1, net income fell by more than half, from 37 cents EPS to 15 cents. At the same time, the Q1 dividend remained high, and was paid out at 34 cents per share.

Since then, management has cut the dividend payment by 41%. As with Eagle above, this was a move to keep the dividend sustainable going forward. The new payment, 20 cents per share, gives a yield of 9.72%, attractive to investors, especially coming from a company with a strong liquidity position.

Ladder’s solid balance sheet caught the eye of B. Riley’s Timothy Hayes, who wrote, “Looking forward, we view LADR to be defensively positioned with over $860M of unrestricted cash, a ~ $1.7B securities portfolio that largely consists of liquid AAA-rated CMBS, and ~$1.8B of other encumbered assets, largely consisting of senior first mortgage loans.”

Hayes gave LADR shares a Buy with an $11 price target. His predicted upside is substantial, at 40% for the coming 12 months. (To watch Hayes’ track record, click here)

Ladder Capital is unique on this list, with a Strong Buy rating from the analyst consensus. Based on 4 Buys and 1 Hold, this rating suggests that Wall Street is impressed by Ladder’s ability to weather the pandemic and chart a path forward in 2H20. LADR shares are selling for $7.98, and the $10.70 average price target indicates room for 35% upside growth. (See Ladder stock-price forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.