There’s a gloomy mood, as investors see COVID-19 rates increasing again after moves to reopen the economy. In an atmosphere like this it’s only natural to take defensive moves to protect the portfolio, and moves like that will naturally draw investors toward dividend stocks. These are the classic defensive stocks, and for good reason: a reliable dividend keeps the income flowing, no matter what the markets do. And in today’s environment, with share prices pushed down by the economic reaction to the coronavirus, it’s possible to find sky-high dividend yields.

But not all dividend stocks are created equal. JMP analysts have chimed in – and they are recommending high-yield dividend stocks for investors looking to find protection for their portfolio.

Using TipRanks database, we’ve pulled up the details on some of JMP’s recommendations. These are stocks with a specific set of clear attributes, that frequently indicate a strong defensive profile: a high dividend yield, over 11%; a Moderate Buy consensus view; and a considerable upside potential — over 10%. So let’s take a closer look at three of Oppenheimer’s picks.

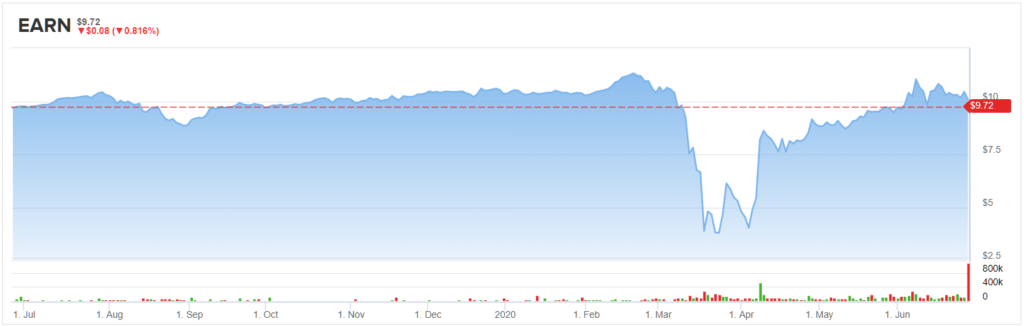

Ellington Residential Mortgage (EARN)

We’ll start with a REIT, a real estate investment trust. Due to a quirk of tax regulation, REITs are perennial dividend champs, and Ellington Residential Mortgage is no exception. The company buys, manages, and invests in real assets and mortgage-related securities, focusing primarily on residential mortgage-backed security packages with backing guaranteed by the US government.

EARN reported a Q1 EPS of 27 cents, a sequential drop from the end of 2019. Company management put the falloff in income to the general chaos of the financial sector during the coronavirus pandemic, but credited an orderly portfolio reduction with preventing a forced sale of assets. On a positive note, EARN ended Q1 with $59.7 million in cash on hand.

A strong liquidity position allowed the company to maintain its dividend payments. EARN has a long history of both keeping up the payments, and adjusting them when needed to keep them in line with earnings. The current dividend, at 28 cents per share quarterly, was declared earlier this month. The annualized rate, of $1.12, gives a yield of 11.4%, far higher than the ~2% found among S&P-listed companies. This will be the fifth quarter in a row that the dividend has been held steady.

Covering this stock for JMP, analyst Mikhail Goberman writes, “[W]e continue to believe this best-in-class micro-cap agency MREIT should be trading much closer to its book value and at a premium to its peers, we reiterate our Market Outperform rating and adjust our price target slightly to $11.00, or 0.92x current estimated book value.” Goberman’s price target implies an upside of 13% from current levels. (To watch Goberman’s track record, click here)

The analyst consensus on EARN is an even split, with 1 Buy rating and 1 Hold rating set recently. The Buy is more recent, and so the stock gets a Moderate Buy overall. Shares are selling for $9.72, and the average price target of $10.50 suggests a one-year upside of 8%. (See EARN stock analysis on TipRanks)

Arbor Realty Trust (ABR)

Next up is another small-cap player in the mortgage industry. Arbor Realty specializes in making loans for multi-family developments – apartment complexes. The company is a major funder of Fannie Mae and Freddie Mac small loans, with over $30 million in such made in June so far. Arbor boasted that it created a $2 million rental assistance program to help families impacted by the COVID-19 epidemic.

Arbor reported 31 cents in Funds from Operations (FFO) in Q1, which was enough to keep up the common share dividend of 30 cents. This dividend has been increased steadily – albeit with a blip at the end of 2018 – for the past three years. The $1.20 annualized payment gives ABR’s dividend a yield of 13.3%, an impressive 6.5x higher than the average dividend yield – and more than 13x higher than the current yields on Treasury bonds. With the history of dividend growth, ABR’s payment is a clear incentive for investors.

On an important financial note, Arbor closed a $40 million senior note offering in April. The notes are due in 2023, and the proceeds were used to pay down secured debt and shore up liquidity.

JMP’s Steven DeLaney noted the liquidity as one factor in Arbor’s solid position when he wrote, “We believe Arbor offers an attractive opportunity in this environment as any concerns over multifamily loan servicing advances have largely been addressed, and the steady performance and outlook for its Agency multifamily business should generate consistent earnings, while the company deals with credit issues in its Structured bridge loan portfolio. Additionally, following the April $40M senior note offering, liquidity stood at ~$350M…”

DeLaney’s $10 price target on ABR comes with an 13% upside potential, and supports his Buy rating for the stock. (To watch DeLaney’s track record, click here)

Arbor Realty shares are currently selling for $8.85. The average price target, at $10.75, implies a healthy upside of 21% from that level, even more bullish than DeLaney suggests. Both of the recent reviews on ABR are Buys, making the consensus view a Moderate Buy. (See ABR stock analysis on TipRanks)

Capstead Mortgage Corporation (CMO)

Last up is a residential mortgage REIT. Texas-based Capstead invests in a portfolio of adjustable rate residential mortgage securities, issued and backed by US government agencies, mainly Fannie Mae and Freddie Mac.

Capstead has been able to keep earnings positive during the ‘corona quarter,’ and even saw a sequential gain in core earnings EPS, from 15 cents in Q4 to 16 cents in Q1. The Q1 result was based on $19.8 million in reported core earnings. In a positive note for investors, Capstead kept operating costs low, just 1.22% of long-term capital.

The quarterly results, despite a fall-off in mortgage repayment rates during the pandemic, supported the company dividend, which was paid out in Q1 at 15 cents per share and declared earlier this month for Q2 at the same rate. This is the third quarter in a row that the dividend has held steady at 15 cents per share, and the payment has been increased steadily since the end of 2018. The annualized payment is 60 cents per common share, and gives the stock a dividend yield of 11.2%.

Writing on CMO for JMP, Steven DeLaney sees a clear path forward for the company: “[We] believe CMO shares are now well-positioned to benefit from a sustained period of low interest rates that should lead to a higher dividend in time and should command an improved valuation as the better-managed agency MREITs move up to the 0.90-1.10x BV valuation range in a more favorable operating environment with less interest rate volatility.”

DeLaney’s Buy rating on Capstead is supported by his $6 price target, which suggests an upside of 10% for the coming year. (To watch DeLaney’s track record, click here)

Overall, Capstead is another Moderate Buy stock, with 2 recent reviews from Wall Street’s analysts both rating the stock a Buy. Shares are priced at $5.35, almost in the penny-stock range, and the average price target matches DeLaney’s at $6. (See Capstead stock analysis on TipRanks)