The current economic scenario has paralyzed investors’ minds in terms of making investment decisions. Supply-chain challenges, inflationary pressures, rising interest rates, and geopolitical tensions have threatened economic growth.

Moreover, supply threats and bleak outlook provided by some firms, along with the Russia-Ukraine conflict impact, have jeopardized investors for future investments.

These macroeconomic issues have caused huge volatility in the market, with the S&P 500 (SPX) down 18.7% on a year-to-date basis. Particularly, the tech-heavy Nasdaq 100 (NDX) plunged more than 28%.

In such an uncertain environment, the TipRanks Smart Portfolio tool assists investors in making smart investment decisions. This tool takes into account numerous factors, including age, income level, and risk profile, to assist investors in picking winners in the turbulent market.

Moreover, the tool helps investors to benchmark their portfolios against the best-performing portfolios on TipRanks and gain valuable information.

Tech is the topmost sector in the best-performing portfolios on TipRanks, which has an allocation of 41.82%.

After considering the TipRanks Smart Portfolio tool, let’s take a look at two tech stocks that are included in the best-performing portfolios.

NVIDIA Corporation (NVDA)

California-based tech giant NVIDIA Corp. is specialized in the manufacture of graphics processing units (GPUs), chipsets, and related multimedia software. Interestingly, 4.43% of the Best Performing Portfolio on TipRanks holds NVDA.

With a market capitalization of $428.8 billion, NVIDIA is gaining traction in the gaming industry. Despite a massive recent sell-off in the tech sector, NVDA stock rallied 17.3% over the past year.

Also, the company has posted upbeat earnings results in all the last seven quarters, reflecting significant growth in its revenue and free cash flow.

Therefore, investors could consider this as an attractive buying opportunity, given the company’s long-term growth prospects and the increase in revenue from gaming, data centers, and professional visualization space.

Encouragingly, in the last earnings press release, Jensen Huang, the CEO of NVIDIA, commented, “We are entering the new year with strong momentum across our businesses and excellent traction with our new software business models with NVIDIA AI, NVIDIA Omniverse, and NVIDIA DRIVE. GTC is coming. We will announce many new products, applications, and partners for NVIDIA computing.”

The company is expected to report its first-quarter earnings results on May 25. Wall Street expects NVIDIA to report earnings of $1.30 per share on revenues of $8.12 billion. Meanwhile, the company expects to report revenues of $8.10 billion (+/-2%)

Ahead of the first-quarter earnings release, Bank of America Securities analyst Vivek Arya maintained a Buy rating and a price target of $320 on NVIDIA. Arya’s price target implies 86.87% upside potential over the next 12 months.

The five-star analyst expects NVIDIA to post upbeat results and provide a strong outlook for the July quarter. Arya’s expectations are driven by the company’s “data center strength, richer gaming mix (per our recent Steam/pricing survey), and potential channel fill with new RTX 40xx (Ada Lovelace) gamecards” despite soft consumer demand.

“However, the post-earnings stock reaction will likely be gated by how much of the F2Q guidance upside is driven by gaming (vs. data center) mix. Many investors appear to be waiting for a large reset in the gaming segment to re-engage with the stock, per our discussions,” the analyst added.

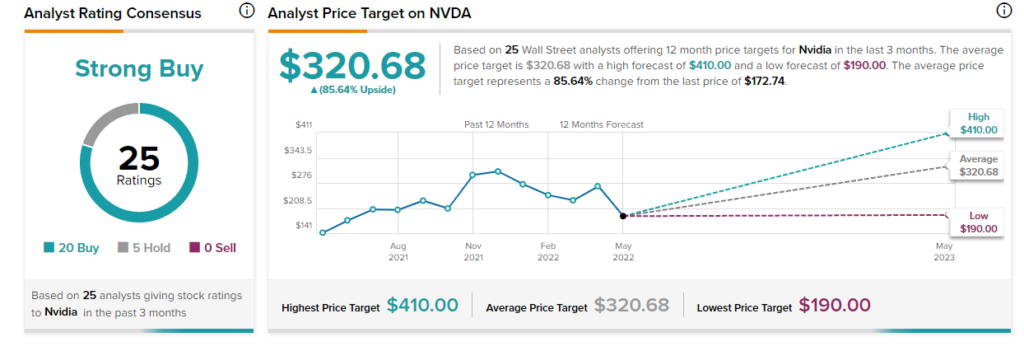

Overall, consensus among analysts is a Strong Buy based on 20 Buys versus five Holds. The average NVIDIA price target of $320.68 implies 85.64% upside potential from current levels.

Additionally, NVIDIA scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Microsoft Corporation (MSFT)

Microsoft Corp. is a tech mammoth that offers a variety of software, services, and solutions, along with devices such as personal computers, tablets, and gaming consoles. It forms 5.41% of the best-performing portfolios on TipRanks.

With a market capitalization of $1.89 trillion and recording gains of around 3.54% over the past year, MSFT stock seems to be an attractive buy, supported by its strong fundamentals and well-diversified business model.

In the current era of digitization, the transition towards the cloud platform in terms of legacy workloads and applications is very active. Therefore, Microsoft, a pioneer in this space with considerable exposure in cybersecurity, CRM, data analytics, and gaming, might be a solid pick.

Moreover, strong customer commitments and the strength of its Azure IaaS are other tailwinds.

Recently, Microsoft reported upbeat March quarter 2022 results on cloud strength. Additionally, the company provided strong guidance for the June quarter.

Positively, Microsoft CEO Satya Nadella commented, “Going forward, digital technology will be the key input that powers the world’s economic output. Across the tech stack, we are expanding our opportunity and taking share as we help customers differentiate, build resilience, and do more with less.”

Following the earnings release, Wedbush’s analyst Daniel Ives said that Microsoft “gave a robust cloud guidance ‘for the ages’ that will calm Street nerves …and was a bullish data point for MSFT and importantly the whole tech sector moving forward.”

Consequently, the five-star analyst maintained a bullish stance on the stock but lowered the price target to $340 (34.31% upside potential) from $375, “reflecting a lower multiple.”

In line with Ives’ stance, consensus among analysts currently results in a Strong Buy rating, based on 23 unanimous Buys. The average Microsoft price forecast of $363.09 implies 43.43% upside potential from current levels.

Also, TipRanks’ Stock Investors tool shows that investors currently have a Positive stance on Microsoft, with 1.5% of investors maintaining portfolios on TipRanks and increasing their exposure to MSFT stock over the past 30 days.

Bottom Line

Despite the recent sell-off in the tech sector, these two tech giants are part of TipRanks’ Best Performing Portfolio and, therefore, might be considered prudent investments.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure