Every investor has a trick up his sleeve, some surefire plan or strategy for finding the right stocks to buy. But a wise investor always remembers: the best strategies are data-based, grounded in real-world information.

And who has better information on the potential direction of a stock, than the company officers who oversee it? The advantage of following these insiders isn’t just that they are privy to data which the rest of us don’t necessarily know – it’s also that they are held responsible for their decisions. Company officers can’t just make trading choices based on personal preference or profit. They must account for their choices to board members and shareholders – and that audience wants to make money, too. So, when corporate insiders start buying up stock in their own company, it’s a strong signal for investors.

Bearing this in mind, we used the Insiders’ Hot Stocks tool from TipRanks to point us in the direction of “Strong Buy” stocks the insiders are snapping up. We found two names flashing signs of strong insider buying that warrant a closer look.

AquaBounty Technologies (AQB)

Massachusetts-based AquaBounty is a company you probably haven’t heard of, but there’s a good chance that you’ve benefited from its tech and products. The company is biotech in the aquaculture niche, developing genetically modified salmon for the fish farming industry. AquaBounty is working to develop new strains of salmon that mature faster – allowing fish farmers to get more fish to market, faster, resulting in lower prices and greater variety for the consumer. AQB’s salmon strains are already approved in the US and Canada, and the company is working on trout and tilapia.

Like many biotech firms, AQB typically operates with a net loss – but that net loss has been growing smaller in recent quarters. The first half of this year, despite the corona crisis, saw AquaBounty meet or beat the quarterly EPS forecast. In addition, the company has moved to raise capital this year, with two offerings of common stock. The first was back in February, when the company put 9 million shares on the market; the second was last week, when an additional 11 million shares of AQB were offered.

That second stock offering has our attention, because two insiders made multi-million dollar purchases. Alana Czypinski, member of the Board, and Randal Kirk, Executive Chair, each put down 10 million dollars for 4 million shares. These were major purchases that swung the insider sentiment on this stock strongly positive.

Covering AquaBounty for National Research, analyst Ben Klieve writes, “We believe AQB has the most disruptive proprietary product of any emerging company across the food chain today, and view the Atlantic Salmon market as uniquely suited for disruption… we believe the enhanced growth characteristics of AAS via advanced genetics will enable AQB to balance the logistical, environmental, and economic considerations more effectively than any peer in the market today.”

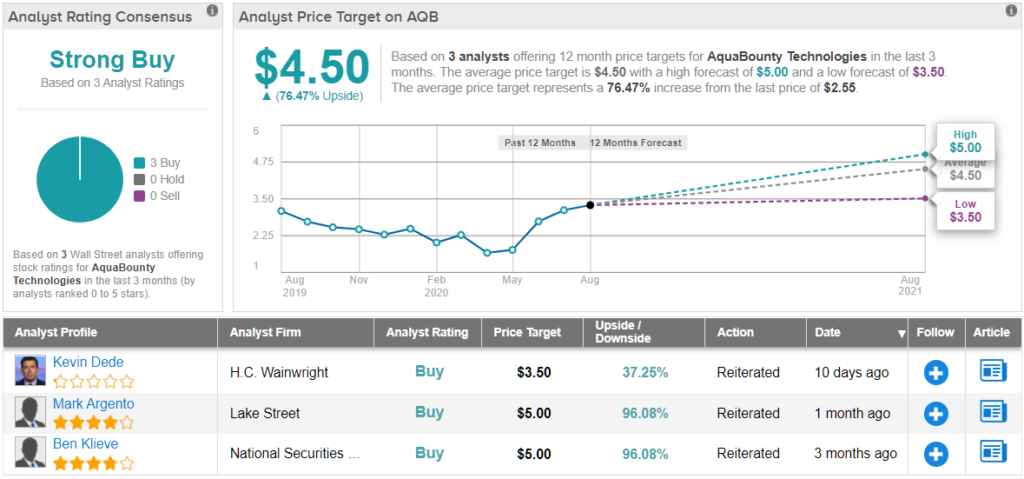

Klieve sets a Buy rating on AQB shares and backs it with a $5 price target, suggesting a 96% upside for the stock. (To watch Klieve’s track record, click here)

Overall, AQB has 3 recent Buy ratings, making the analyst consensus a Strong Buy. The stock is selling for $2.55 and carries a $4.50 average price target, implying an impressive upside of 76%. (See AquaBounty stock analysis on TipRanks)

IAC/InterActiveCorp (IAC)

The next stock for today is a tech company, InterActiveCorp. This is a holding company, with a market cap of $10.5 billion and portfolio built on an array of popular, high-trafficked websites, including Vimeo, Daily Beast, Investopedia, and The Spruce. IAC sees more than $3 billion in annual revenues, and recently reported $726.4 million in Q2 revenues. Since going public in June, IAC shares have gained 15%.

On the insider front, board of directors member Michael Eisner has pushed the sentiment positive with a $4.98 million purchase. He picked up a block of 40,555 shares on August 14. His purchase comes less than a month after IAC separated from its data site brands, splitting Match Group from the parent company.

IAC has also made a major investment in MGM resorts recently, putting over $1 billion into the effort. This move has caught the attention of Wedbush analyst Ygal Arounian, who writes, “This is clearly a long-term bet, but as gaming trends move online, there is a significant market opportunity here as well. The global gaming market is ~$450B with only about 10% online penetration and should see strong tailwinds (particularly in sports betting in our view) as states start to deregulate gaming more.”

Arounian raised his price target on the stock to $170, indicating confidence in a robust 37% upside, and backing his Buy rating. (To watch Arounian’s track record, click here)

The analyst consensus rating on InterActiveCorp is a Strong Buy, based on a 14 to 1 split between Buy and Hold ratings. The shares are selling for $123.41 and the average price target of $153.87 suggests room for a 24% upside potential. (See IAC stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.