Not long ago, the key to success in the market was growth – but in today’s environment, with inflation running at a 40+ year high level and the Federal Reserve aggressively hiking interest rates in an effort to push back, growth stocks have taken a beating. According to data from investment bank Goldman Sachs, defining high-growth companies as those forecasting 30% or better expected sales gains, these stocks have contracted by 58% so far this year.

But at least one Goldman analyst still sees a viable path for growth stock investors. Ryan Hammond, VP of US equity strategy, points out that growth stocks, generally, are running cheap right now – but that they’re not showing depressed values yet. He recommends that investors avoid those growth companies that are burning cash, writing, “Reward higher quality growth stocks but continue to avoid unprofitable growth stocks that would be required to tap into financial markets at a time when the cost of capital is rising.”

Some of Goldman’s stock pros are following this line of thought – and tapping the profitable growth stocks which they see in strong positions for the year to come. We’ve used the TipRanks data platform to look up two of these picks – both have Strong Buy ratings from the Street’s analysts, and the Goldman analysts give them each more than 40% upside, even in today’s uncertain market conditions.

Credo Technology Group (CRDO)

The first Goldman pick we’re looking at is Credo Technology, a ‘fabless’ firm in the semiconductor chip world. Credo is a holding company, and its subsidiaries design new semiconductor chips, produce prototypes, and outsource the production runs to larger chip foundries. This model allows Credo to focus its attention and energies on designing the highest quality products, including high-end line cards, optical DSP chips, and active electrical cables, all vital components of wired network systems.

Credo went public early this year, through an IPO that saw the company start trading on the NASDAQ on January 27. The shares opened at the bottom of the predicted range, just $10 each, and the company cut back the offering from 25 million shares to 20 million – but the downscaled IPO raised a full $200 million, and the stock has gained 28% so far this year.

The solid share performance comes after three public quarterly financial releases in a row showing profitability. EPS was reported at 3 cents for fiscal 3Q22, 2 cents for fiscal 4Q22, and 3 cents again for fiscal 1Q23. That last quarter, fiscal 1Q23, for the quarter ending July 30, also showed revenue of $46.5 million, up 24% from the previous quarter, and more than quadruple the year-ago quarter’s top line. The company finished it fiscal first quarter with over $405 million in total assets, of which $243.7 million was in cash and cash equivalents.

Toshiya Hari, one of Goldman’s 5-star analysts, sees this company in a sound position even in the high volatility environment of today’s markets. He writes, “Despite the increasingly uncertain macroeconomic backdrop and a more challenging cloud capex outlook, we continue to believe that Credo’s strategic role in enabling next-generation bandwidth needs in a cost- and power-effective envelope as well as the company’s idiosyncratic design wins will support a robust growth trajectory and, by extension, a healthy degree of operating leverage that is likely to be increasingly appreciated by investors as customer concentration dynamics naturally decline over time.”

Based on the above, Hari gives CRDO shares a Buy rating, and his 12-month price target of $19 suggests an upside of 48%. (To watch Hari’s track record, click here)

While relatively new to the public markets, this stock has picked up 4 analyst reviews – and they are unanimously positive, to support the Strong Buy consensus rating. The shares are selling for $12.82, and their $17.75 average price target implies a one-year gain of ~38%. (See CRDO stock forecast on TipRanks)

Pure Storage (PSTG)

Next up is another chip company – and as its name suggests, it’s focus is on computer memory. Pure Storage boasts a line of products that offer solutions to memory issues at all scales, from simple flash drives to the ‘FlashStack’ computing and networking server. Pure Storage’s solid-state flash drives are used in applications from cloud computing to desktop virtualization to data center servers. The company has over 10,000 customers globally, and boasts a market cap of $8.5 billion.

Pure Storage recently reported its financial results for 2Q of fiscal year 2023, and beat the market expectations. For the quarter, which ended on August 7 of this year, Pure Storage showed a 30% year-over-year gain in revenue, with the top line hitting $646.8 million. The gains were driven by a 35% y/y increase in subscription services, which rose to $232.2 million of the revenue total. Subscription ARR, or annual recurring revenue, a key metric of forward performance, rose to $955.3 million, a 31% y/y gain.

On the bottom-line, adj. EPS came in at 32 cents. That earnings figure was a solid 45% better than the 22-cent expectation, and more than double the year-ago quarter’s 14-cent EPS result.

Sound financial performance generated plenty of cash. Pure Storage reported total cash and liquid asset holdings of $1.4 billion at the end of the quarter, and an operating cash flow in fiscal Q2 of $159.4 million, of which $134.2 million was free cash flow. While this company does not pay out a dividend, it did return $61 million to shareholders during the quarter, through the repurchase of 2.4 million shares.

In his comments on Pure Storage, Goldman Sachs analyst Rod Hall applauds the company’s performance in a “tough environment” and sees the firm’s quality product pipeline as an invaluable asset.

“The company expressed confidence on their pipeline and visibility for FH2. Regarding product trends, Pure noted that their newly recently launched FlashBlade//S product accounted for 20% of all FlashBlade orders in the quarter. We believe this indicates significant traction for the new product right out of the gate with momentum likely to improve in our opinion,” Hall opined.

“We see Pure’s commentary on the demand environment as consistent with our EAI/ESI proprietary indices which predict significant deterioration in enterprise IT spending outlook,” Hall went on to add. “However, with the company’s technology advantage and product differentiation we believe Pure is better positioned to weather a slowdown in spending by gaining market share.”

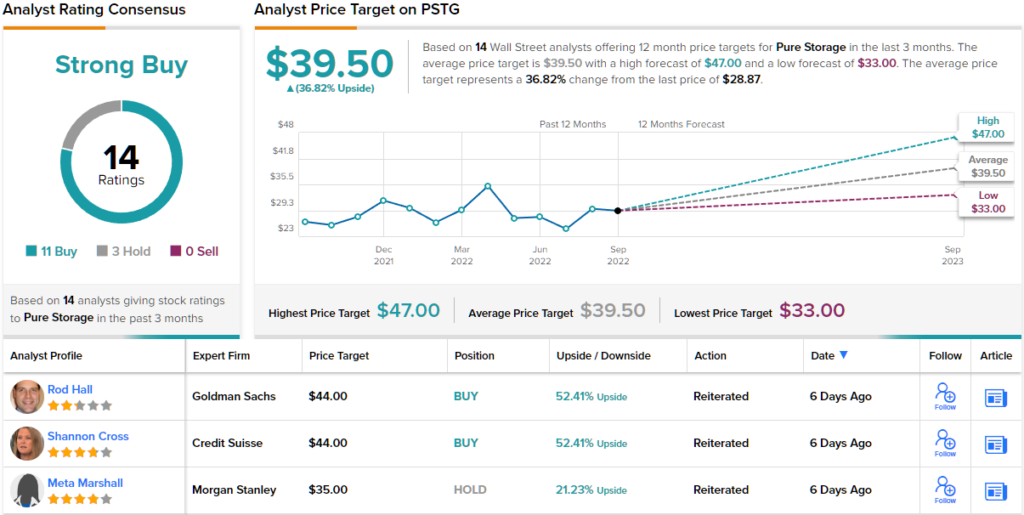

To this end, Hall puts a Buy rating on the stock, along with a $44 price target that indicates potential for ~52% share gain in the year ahead. (To watch Hall’s track record, click here)

This company, like many tech firms, has garnered plenty of attention from the Street’s analysts – in this case, 14 recent analyst reviews. These reviews break down 11 to 3 in favor of Buy over Hold, for a Strong Buy consensus rating, and the average price target of $39.50 implies ~37% gain from the current trading price of $28.84. (See PSTG stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.