Recently reported results of several solar companies, especially those exposed to the residential sector, revealed weakness in near-term demand due to a high interest rate backdrop. Nonetheless, Wall Street is bullish on some solar companies due to their long-term growth potential, as governments worldwide encourage the adoption of renewable energy sources. With the help of TipRanks’ Stock Comparison Tool, we filtered for two solar stocks – First Solar (NASDAQ:FSLR) and Sonnova Energy (NYSE:NOVA), which boast of Wall Street’s Strong Buy consensus rating and solid upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper into these two attractive solar stocks.

First Solar (NASDAQ:FSLR)

U.S.-based First Solar is one of the leading manufacturers of solar panels. Unlike several solar stocks, including leading inverter makers SolarEdge (NASDAQ:SEDG) and Enphase (NASDAQ:ENPH), which have plunged significantly this year, FSLR stock is up about 7% year-to-date.

In a recent CNBC report, Deutsche Bank analyst Corinne Blanchard noted that First Solar has largely been “immune” to the current backdrop, as it does most of its business with large utilities and has less exposure to the residential space.

While several solar companies reported weak Q3 results, First Solar impressed with upbeat Q3 2023 earnings. Q3 2023 revenue grew more than 27% to $801 million. Further, the company swung to earnings per share (EPS) of $2.50 from a loss per share of $0.46 in the prior-year quarter.

Despite a tough macro environment, the company maintained its full-year sales outlook range at $3.4 billion to $3.6 billion and raised the lower end of its EPS guidance to the range of $7.20 to $8.00 from the previous outlook range of $7.00 to $8.00.

Is First Solar a Good Stock to Buy Now?

On Monday, Mizuho analyst Maheep Mandloi initiated coverage of First Solar stock with a price target of $188, citing the stock’s attractive valuation and the company’s pricing power. Mandloi expects FSLR’s earnings through 2026 to likely have a high degree of immunity to near-term spot pricing pressure, due to the company’s take-or-pay contracts. Such contracts limit the company’s downside if solar module prices fall.

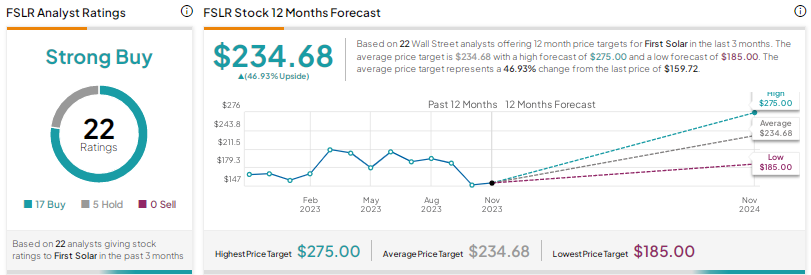

Including Mandloi, 17 analysts have a Buy rating on FSLR stock and five have a Hold recommendation, resulting in a Strong Buy consensus rating. The average price target of $234.68 implies about 47% upside potential.

Sunnova Energy International (NYSE:NOVA)

Sunnova is one of the leading residential solar and energy storage services providers. Despite a 21% rally in the shares over the past one month, NOVA stock is still down 42% year-to-date.

Sunnova’s Q3 2023 revenue jumped 33% year-over-year to $198.4 million in Q3 2023. The company’s loss per share narrowed slightly to $0.53 from $0.56 in the prior-year quarter, but was way more than analysts’ consensus estimate of a loss per share of $0.33. Nevertheless, NOVA stock surged following the results, as the company’s 2024 earnings outlook impressed investors.

What is the Target Price for Sunnova Stock?

On November 20, Mizuho’s Mandloi initiated coverage of Sunnova stock with a price target of $20, noting that the company is among the top residential solar financing companies in the U.S. and has been growing at a faster rate than the market since its initial public offering in 2019.

The analyst expects this trend to continue through 2026 due to strong demand for Sunnova’s lease or power purchase agreements (PPA) offering, as the industry moves from loans to leases amid a high interest rate backdrop. Additionally, IRA tax credit adders are favorable for leasing arrangements.

Mandloi also highlighted Sunnova’s unique dealer strategy that helps the company to rapidly onboard new installers. The analyst expects this strategy to grow new customer additions at a rate of more than 30% in 2024, in contrast to his estimate of an 8% market slowdown.

Overall, Wall Street has a Strong Buy consensus rating on NOVA stock, with a Strong Buy consensus rating based on 15 Buys and five Hold recommendations. At $18.92, the average price target suggests 80.5% upside potential.

Conclusion

Despite a tough demand backdrop, Wall Street remains upbeat about the prospects of First Solar and Sunnova due to their long-term growth potential and positive features, as discussed above.