Risk and reward are the yin and yang of stock trading, the two opposite but essential ingredients in every market success. And there are no stocks that better embody both sides – the risk factors and the reward potentials – than penny stocks.

These equities, priced below $5 per share, typically offer high upside potentials. Even a small gain in share price – just a few cents – quickly translates into a high yield return. Of course, the risk is real, too; not every penny stock is going to show these sort of gains, some of them are cheap for a reason, and not every reason is a good one.

So, how are investors supposed to lock in on compelling plays? That’s what the pros on Wall Street are here for.

Using TipRanks’ database, we pulled two penny stocks that have amassed enough analyst support to earn a “Strong Buy” consensus rating. If that wasn’t enough, plenty of upside potential is at play here. Let’s take a closer look.

CymaBay Therapeutics (CBAY)

We’ll start by looking at CymaBay Therapeutics, a biopharmaceutical firm focused on clinical-stage research in the treatment of chronic liver disease. The company has a lead drug candidate, seladelpar, that is the subject of three separate clinical trials as a therapy for three different liver conditions. The drug candidate, a PPARdelta agonist, is being tested against primary biliary cholangitis (PBC), non-alcoholic steatohepatitis, and primary sclerosing cholangitis. Of these, the PBC track is the farthest advanced.

That clinical path has just completed patient enrollment for the Phase 3 RESPONSE study. That study will evaluate the safety and efficacy of seladelpar as a treatment for PCB patients who have not responded to or tolerated the current UDCA treatment. The study involves 180 patients in more than 20 countries, and results should be released some time next year.

In addition to the RESPONSE trial, seladelpar is also undergoing the ASSURE trial, an open-label, long-term study designed to collect additional long-term safety data on the drug. The ASSURE trial currently has some 140 patients enrolled.

Finally, CymaBay has a second drug candidate at the clinical stage, MBX-2892. This drug candidate is a GPR 119 agonist, designed to treat diabetic hypoglycemia. The study is a Phase 2a proof-of-pharmacology trial evaluating the potential of MBX-2892 in the prevention of hypoglycemia in patients with Type 1 Diabetes.

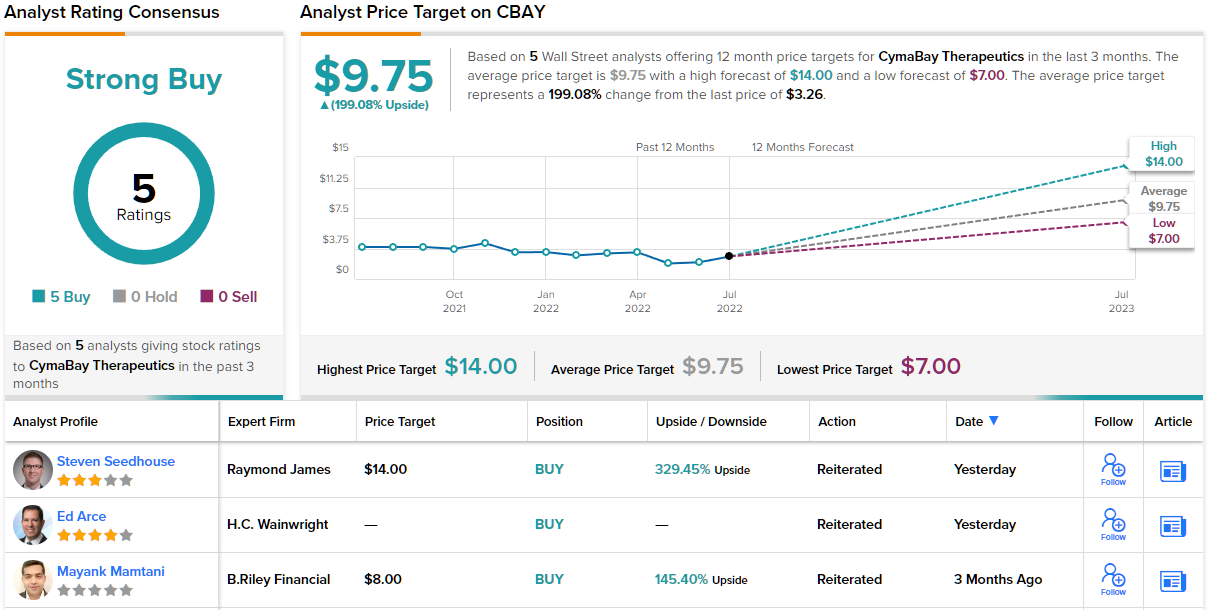

Against this backdrop, Wall Street believes CBAY’s long-term growth narrative is strong and that its $3.26 share price reflects the ideal entry point.

Covering the stock for Raymond James, analyst Steven Seedhouse sees the seladelpar trials as the key point for CymaBay moving forward, believing that the catalysts of upcoming data releases should reflect in higher share prices.

“CymaBay completed enrollment of the Phase 3 RESPONSE study evaluating seladelpar in primary biliary cholangitis (PBC), in line with guidance provided on the 1Q22 earnings call… Analysis of the available ENHANCE patient dataset collected through month 3 showed stat sig improvement in the primary composite endpoint and stat sig ALP and ALT normalization, in our view dramatically de-risking the success of RESPONSE. The only pushback on our CBAY pitch as Phase 3 has been enrolling has been ‘too much time to catalyst.’ Now with a flag in the ground (Phase 3 data 2H23E), ~12-month time horizon to an eminently de-risked Phase 3 with a proven end market should be broadly attractive, and we expect CBAY to be totally re-priced in the coming year or much sooner,” Seedhouse opined.

Seedhouse translates his upbeat view of CBAY’s forward prospects into numbers with a $14 price target – which implies a potential upside of 329%. It’s not surprising, then, why he rates the stock a Strong Buy. (To watch Seedhouse’s track record, click here)

Seedhouse is particularly bullish, but he’s no outlier on this stock. All 5 of the recent analyst reviews here are positive, for a unanimous Strong Buy consensus rating, and the $9.80 average price target gives CBAY shares a 199% one-year upside potential. (See CBAY stock forecast on TipRanks)

AbSci Corporation (ABSI)

For the second penny stock we’ll look at, we’ll stick with the medical tech field – but look at a company with a different take on it. AbSci does not directly develop new drugs or therapeutic candidates; rather, the company is focused on the methods of developing new medicines.

AbSci works with artificial intelligence (AI), machine learning (ML), and cell line generation to build a new Integrated Drug Creation™ Platform with potential to transform the way that drug candidates are researched and manufactured. AbSci’s platform can identify novel drug target, discern the optimal biological and therapeutic candidates for those targets, and create the cell lines needed to manufacture the new drugs. Combining these processes into one, more efficient, process offers new pathways toward the next generation of novel therapeutics, including protein-based drugs.

Earlier this year, AbSci entered into a collaboration with Merck for Bionic Enzyme generation. The collaboration has potential to bring AbSci substantial gains, including $610 million in upfront fees, milestone payments, and future royalty payments. On another positive note, the company also announced two new machine learning breakthroughs during the first quarter of this year, which are expected to streamline the drug discovery processes and mitigate risks in new drug development.

So far this year, AbSci has 8 new ‘Active Programs,’ collectively representing 60% year-over-year growth in the company’s research tracks.

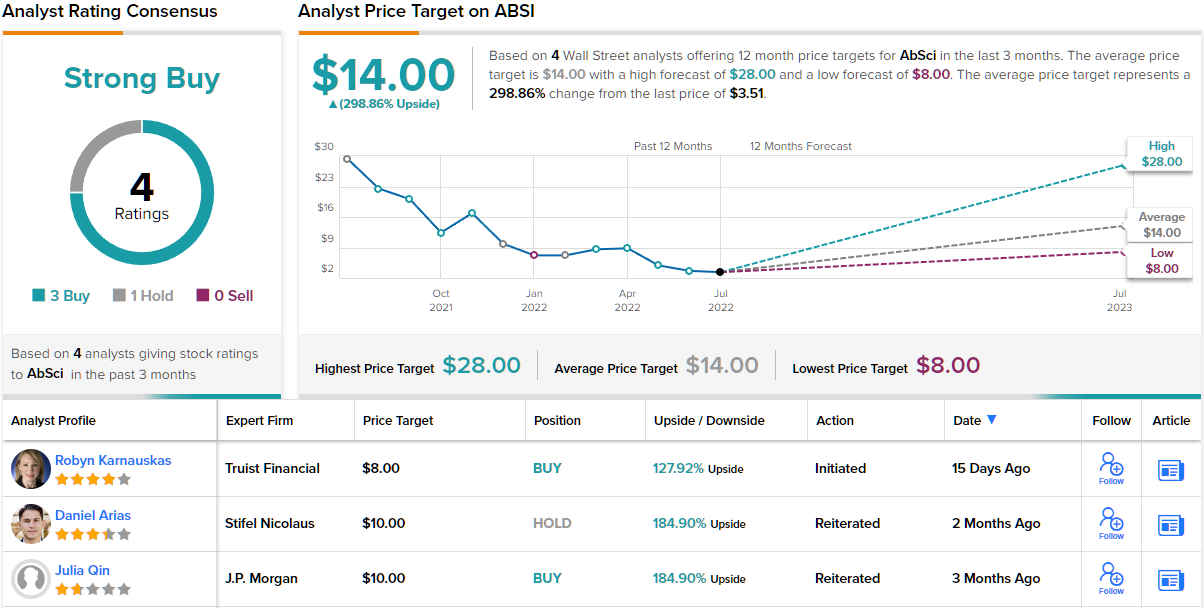

Analyst Robyn Karnauskas, writing from Truist, believes the link-up of proprietary AI/ML and bio-development platforms will create a winning combination in the field.

“ABSI’s platform is attractive to Biopharma partners interested in developing next-gen biologics that are unique, faster, and cheaper. Using their internally developed biology and tech platforms iteratively, the company can discover novel biologics which have been optimized to be better drugs — faster. And by using their in-house developed bacteria, they can make novel proteins vs. traditional methods and manufacture them faster, as well as cheaper. While still early, we believe the company’s platform has potential to address several shortcomings of traditional biologics discovery. And given the growing demand for next-gen biologics, we see this as an attractive partner for Biopharma, and an attractive play for both Biotech, as well as Tech investors,” Karnauskas wrote.

Keeping this mind, Karnauskas rates ABSI shares a Buy along with an $8 price target that indicates her confidence in ~128% one-year share appreciation. (To watch Karnauskas’ track record, click here)

Overall, Wall Street tends to agree with the bull. The 4 recent analyst reviews include 3 Buys and 1 Hold, for a Strong Buy consensus rating, and the $14 average price target indicates ~299% upside potential from the current share price of $3.51. (See ABSI stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.