Let’s take a moment to talk about opportunity, share price, and risk/reward considerations. These are some of the factors investors must consider when moving into penny stocks – and we haven’t even touched on the fundamental soundness of the company or its business model.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Penny stocks – as their name suggests, they once traded for just a pennies per share, but these days are considered those equities trading at less than $5 – are a challenging market niche. The penny stock critics make valid points when defending their stance. Sure, the price tag may look like a steal, but the fact that shares are trading at such low levels could reflect overwhelming headwinds or weak fundamentals.

That being said, the fans offer up a solid argument as well. Not only does the low price mean you get more shares for your money, but hefty returns are also on the table. Even seemingly insignificant share price appreciation can result in colossal percentage gains that other more well-known or expensive names aren’t as likely to deliver.

The nature of these investments presents somewhat of a dilemma. How are investors supposed to separate the penny stocks that are ready to take off on an upward trajectory from those set to remain down in the dumps?

To help with the due diligence process, we used TipRanks’ database to zero in on only the penny stocks that have received bullish support from the analyst community. We found two that are backed by enough analysts to earn a “Strong Buy” consensus rating. Not to mention each offers up massive upside potential, as some analysts see them surging 400%, or more.

EyePoint Pharmaceuticals (EYPT)

We’ll start with a micro-cap biopharma stock, EyePoint Pharmaceuticals. As the name suggests, this company is focused on the discovery, development, and commercialization of treatments for disorders and disease conditions affecting the eyeball, with the end-goal of promoting better seeing. The company has two products on the market, Yutiq (a treatment for chronic non-infectious uveitis at the rear of the eye) and Dexycu (a post-operative ocular steroid treatment to prevent inflammation and promote healing after cataract surgery). In addition, EyePoint has an active pipeline program, with research tracks at both the pre-clinical and clinical trial stages.

In the clinical program, EyePoint has EYP-1901. This drug candidate is an experimental treatment for wet AMD, a form of long-lasting macular degeneration that can cause blurred vision or blind spots. EYP-1901 is currently under investigation as a twice-yearly anti-VEGF treatment. EyePoint has presented data from the Phase 1 DAVIO clinical trial, showing positive 12-month safety and efficacy results. The company has already started dosing patients in two Phase 2 trials; the DAVIO 2 trial was initiated in July of last year, as a follow-up in the treatment of wet AMD, and the PAVIA trial was initiated in September, for the treatment of nonproliferative Diabetic Retinopathy (NPDR). Topline data on the DAVIO 2 trial is expected during the fourth quarter of this year.

On the commercial side, 3Q22 net product revenue for Yutiq and Dexycu was $9.7 million, up 13% from a year ago, including $7.3 million for Yutiq and $2.4 million for Dexycu. Customer demand was ~890 units of Yutiq and ~14,100 units for Dexycu.

Based on the potential of the company’s pipeline, and with its share price at $3.35, several analysts believe that now is the time to buy.

Among the bulls is Guggenheim analyst Yatin Suneja who takes a bullish stance on EYPT shares.

“EYPT is using a completely different paradigm (long-lasting TKI erodible insert to keep dry eyes dry) to extend dosing and reduce the treatment burden in patients with wet AMD. This is a pivotal year for the company as data from the randomized DAVIO2 study in wet AMD are expected in 4Q23. Given our high conviction on positive outcome from DAVIO2, which is likely to drive substantial upside in share price, we are adding EYPT to our top 3 picks for 2023. We model risk-adjusted peak sales for EYPT-1901 of $825MM,” Suneja opined.

To this end, Suneja rates EYPT a Buy, and his $52 price target implies room for a stunning 1,452% upside potential in the next 12 months. (To watch Suneja’s track record, click here)

Other analysts are on the same page. With 4 additional Buy ratings, the word on the Street is that EYPT is a Strong Buy. On top of this, the average price target is $32.80, suggesting robust growth of 879%. (See EYPT stock forecast)

Alpha Tau Medical, Ltd. (DRTS)

Next up is Alpha Tau Medical, a biotech company working on new modes of focal alpha-radiation treatment for various cancers. The company’s delivery Alpha DaRT (Diffusing Alpha-emitters Radiation Therapy) is designed to release high-energy dosages over a range of just a few millimeters – giving a high level of precision that will target the tumor only while sparing nearby healthy tissues. Alpha DaRT is administered by inserting tiny amounts of radiu-224 directly into the tumor cells, where it will decay rapidly, releasing alpha particles directly into the cancer cells. These particles themselves have a short half-life, preventing their spread outside of the target area.

In recent updates, Alpha Tau has outlined several steps that have put the company on the track toward active clinical trials. In the UK, the company has received regulatory approval for a trial in the treatment of squamous cell carcinoma of the vulva, while in Canada, regulatory authorities have approved a second site for a clinical trial in the treatment of advanced pancreatic cancer.

The company has several anticipated milestones coming in the near-term, including an Israeli feasibility trial for the treatment of pancreatic tumors to start in 1Q23, and Canadian approval to start a feasibility trial in the treatment of liver cancer, also in 1Q23.

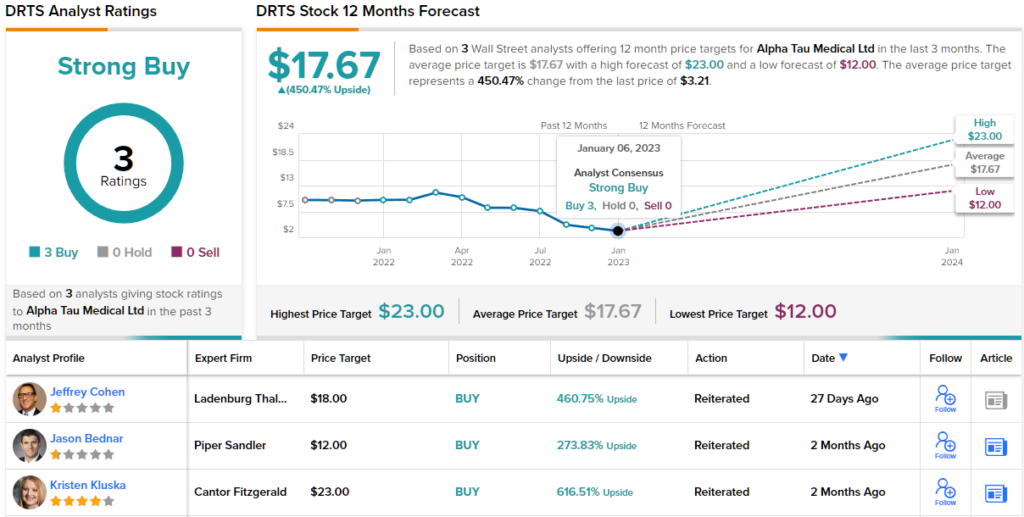

Ladenburg Thalmann analyst Jeffrey Cohen covers this early-stage biotech, and takes an upbeat stance, based on the quality of the program and the plethora of upcoming catalysts.

“DRTS has demonstrated competency and clinical execution, in our opinion. We also note the continued efforts around building a strong body of data to support the clinical and regulatory opportunities for the Alpha DaRT technology. Overall, we are encouraged by the progress to date and the multiple near-term milestones as well as potential catalysts. As such, we continue to view DRTS as an attractive investment opportunity compared to peers,” Cohen wrote.

In line with his optimistic approach, Cohen gives DRTS shares a Buy rating, and his $18 price target suggests an impressive 460% potential upside for the coming year. (To watch Cohen’s track record, click here)

Cohen is not the only analyst to see a solid upside here; all three of this stock’s recent reviews are positive, for a Strong Buy consensus rating. The stock is trading for $3.21, implies a gain of ~450% on the one-year horizon. (See DRTS stock forecast)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.