Penny stocks, you either love them or you hate them. One of the obvious draws of these stocks trading for under $5 per share is the ability to get more bang for your buck. And should these bargain priced stocks see their share prices rise by only a small amount, the rewards can be staggering.

However, before jumping right into an investment in a penny stock, Wall Street pros advise looking at the bigger picture and considering other factors beyond just the price tag. For some names that fall into this category, you really do get what you pay for, offering little in the way of long-term growth prospects thanks to weak fundamentals, recent headwinds or even large outstanding share counts.

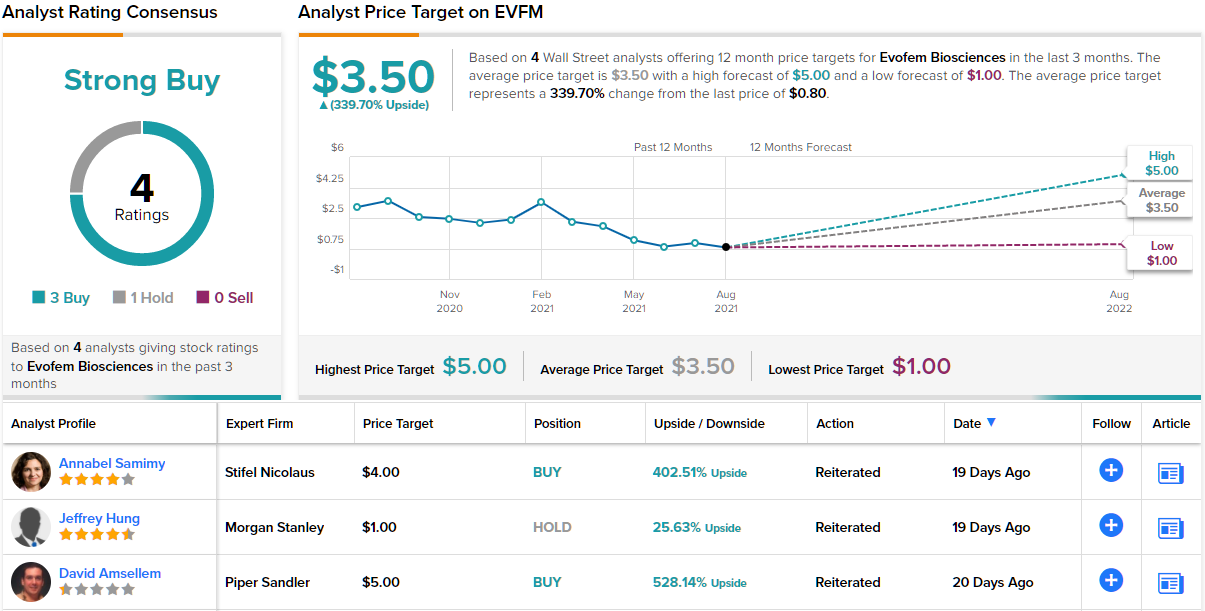

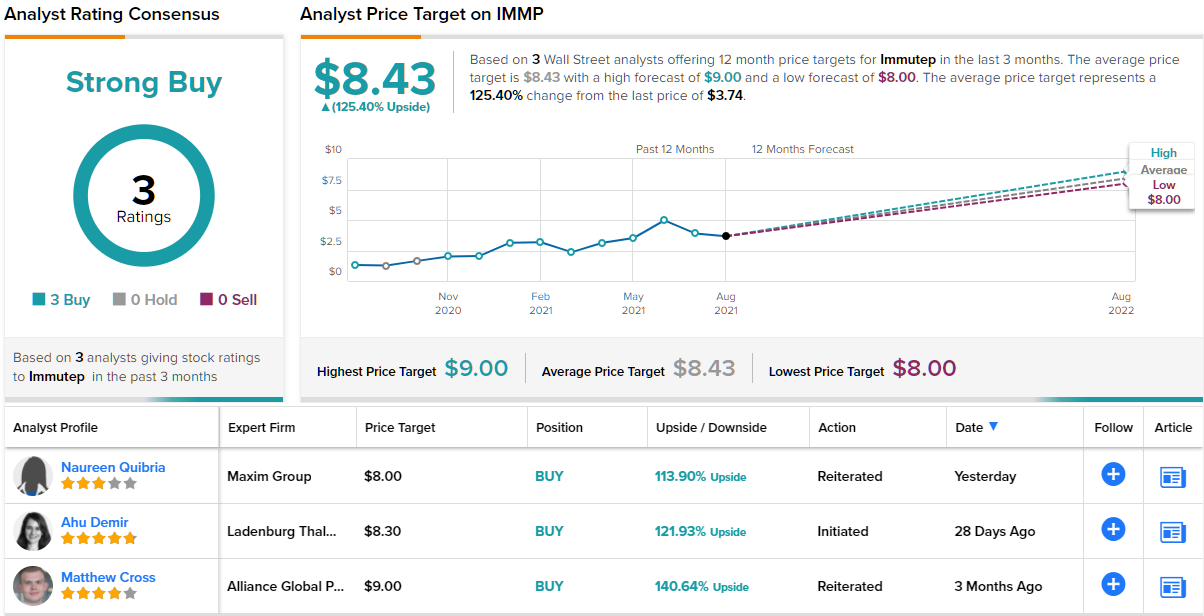

Taking the risk into consideration, we used TipRanks’ database to find compelling penny stocks with bargain price tags. The platform steered us towards two tickers sporting share prices under $5 and “Strong Buy” consensus ratings from the analyst community. Not to mention substantial upside potential is on the table.

Evofem Biosciences (EVFM)

We’ll start with Evofem, a biopharma research firm with a specialized niche focus on women’s reproductive and sexual health. The company is working to develop products that are controlled by women, allowing users to take charge of non-invasive methods for contraception and prevention of STDs. The company put its first approved product, the hormone-free prescription contraceptive vaginal gel Phexxi on the market in September of last year. Another product, EV0100, is also a vaginal gel product and is undergoing clinical trials as a preventative treatment for chlamydia and gonorrhea.

The company has reported dispensing over 14,000 Phexxi units in 2Q21, with prescriptions written by over 5,400 healthcare providers during the quarter. The product saw a 68% sequential gain in sales from Q1 to Q2, a 47% increase in prescriptions written, and 65% increase in dispensed unit. For forward-going prospects, 60% of new users of Phexxi are in the prime 18 to 34 demographic.

On the financial end, the company reported that Phexxi sales revenue grew sequentially from $1.1 million in Q1 to $1.9 million in Q2. Evofem reported an EPS loss of 27 cents per share in Q2, which was an improvement from the 56-cent EPS loss in Q1 and the 91-cent loss in the year-ago quarter.

Also of interest to investors, the EV0100 track continues to progress. The drug candidate, which showed positive results from a Phase 2b trial earlier this year, is currently enrolling for the Phase 3 EVOGUARD trial. Enrollment is expected to be completed by the end of this year, with top line results to come in 2022. In the Phase 2b study, EV0100 usage yielded statistically significant reductions in chlamydia and gonorrhea infection rates versus placebo after 6 months.

Even though COVID-19 has impacted the company’s performance, Piper Sandler analyst David Amsellem believes that at $0.80, Evofem’s share price presents an opportunity to get in on the action.

“Though pandemic-related headwinds are a reality, prescription (Rx) volume growth was brisk, and notably, management did cite more aggressive growth amid societal normalization in the back half of 2Q21. We continue to believe that Phexxi represents a highly differentiated modality (i.e., a non-hormonal, on-demand, female-controlled option that has barrier method-like efficacy) in the vast prescription contraceptive space, and believe that the product will eventually reach critical mass (with peak U.S. sales potential of $400M+ as realistic, in our view). Given that backdrop, we believe that EVFM shares are trading at an attractive risk reward profile,” Amsellem opined.

In line with his bullish stance, Amsellem rates EVFM an Overweight (i.e. Buy), and his $5 price target implies room for a whooping 528% upside potential in the next 12 months. (To watch Amsellem’s track record, click here)

What does the rest of the Street have to say? 3 Buys and 1 Hold add up to a Strong Buy consensus rating. Given the $3.50 average price target, shares could climb ~340% in the year ahead. (See EVFM stock analysis on TipRanks)

Immutep (IMMP)

The second penny stock we’ll check out is Immutep, a clinical-stage biopharma company engaged in developing new immunotherapies for cancer and autoimmune disorders. The company is using Lymphocyte Activation Gene-3, or LAG-3, as a base for its therapeutic research. LAG-3 is a cell surface molecule with an immune regulation role. Immutep has several clinical-stage research lines based on LAG-3.

The company’s lead drug candidate, Eftilagimod alpha (efti, IMP321), is being assessed in combination with PD-1/PD-L1 agents or chemotherapy in numerous clinical trials in metastatic breast cancer, non-small-cell lung carcinoma (NSCLC), head and neck squamous cell carcinoma, solid tumors, melanoma, and Covid-19 diseases. The second asset IMP761 is at the preclinical stage for autoimmune disease.

Based on the strength of data from Immutep’s key trials – Phase 2b AIPAC trial in metastatic breast cancer (mBC) and Phase 2 TACTI-002 trial in 1st line non-small cell lung cancer patients and 2nd line head and neck cancer patients, Immutep has expanded the clinical development of efti to later stage settings. The company is expected to start 3 new trials in 2022.

Among the bulls is Ladenburg’s 5-star analyst Ahu Demir who writes: “In our view, Immutep is one of the most diverse players in the LAG-3 arena. The company has shown compelling data in multiple indications. Immutep is not only pursuing multiple opportunities in cancer including head and neck squamous cell carcinoma (HNSCC), metastatic breast cancer, and non-small cell lung cancer (NSCLC) but also in advanced stages of development versus competitors and also tapping into autoimmune disease.”

The analyst summed up, “Given the current market cap… we see attractive value creation and upside potential for IMMP stock, with also upcoming key potential catalysts in 2H21/1H22.”

Demir’s comments back up her Buy rating on the shares, and her $8.30 price target implies a one-year upside of ~122%. (To watch Demir’s track record, click here)

Overall, Immutep gets a unanimous Strong Buy from the Wall Street analysts, with 3 recent reviews all in agreement that the stock is a Buy. The shares are priced at $3.70 with an average price target of $8.43, slightly more bullish than Demir’s and suggesting an upside of ~125% for the year ahead. (See IMMP stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.