The Federal Reserve, for now, remains committed to its low-rate policy, so the stock market is the place to look for investors seeking a high return. To find names that can deliver solid returns and now come with a bargain price tag, investors will often turn to penny stocks, or those trading for less than $5 per share.

Sure, there could be a very good reason these tickers are so affordable, but should there be even minor share price appreciation, massive percentage gains could materialize, along with hefty profits for investors. The risk is that a small drop in value can also cause a high-percentage loss, so investors need to do their homework carefully before buying into the pennies.

Bearing this in mind, we used TipRanks’ database to pinpoint two Strong Buy penny stocks that have earned a thumbs up from members of the analyst community. Not to mention each boasts substantial upside potential of over 200%.

Surgalign Holdings (SRGA)

First up is Surgalign, a medical device maker with a focus on spinal ailments and treatments. The company develops and markets a comprehensive line of devices for both surgical and non-surgical treatment of spinal problems. Originally founded in Marquette, Michigan, the company now has offices in Illinois and Germany, and sells its products globally.

In October 2020, Surgalign acquired Holo, a surgical technology maker focused on improving spine procedures with augmented reality and artificial intelligence. Surgalign filed its initial 510(k) submission to the FDA for the Holo digital surgery platform in May, and anticipates clearance during 2H21.

While many medical and medical-related companies found a boost in increased business during the Covid crisis, Surgalign found itself facing a headwind: the cancellation and reduction of many in-patient surgical procedures, both essential and elective. However, there is some evidence that the company is starting to recover. It’s 2Q21 report did show a net EPS loss of 9 cents, but that was not as deep as the 12-cent loss predicted. At the top line, revenue came in at $24.8 million, growing 20% year-over-year. The company noted that the increase in revenue came as the partial resumption of elective surgical procedures has begun to goose demand for Surgalign products.

In another point of note for investors, company President and CEO Terry Rich last week purchased well over 1 million shares of SRGA. He paid $1.01 million for the stock, and brought his total holding in the company to $2.498 million.

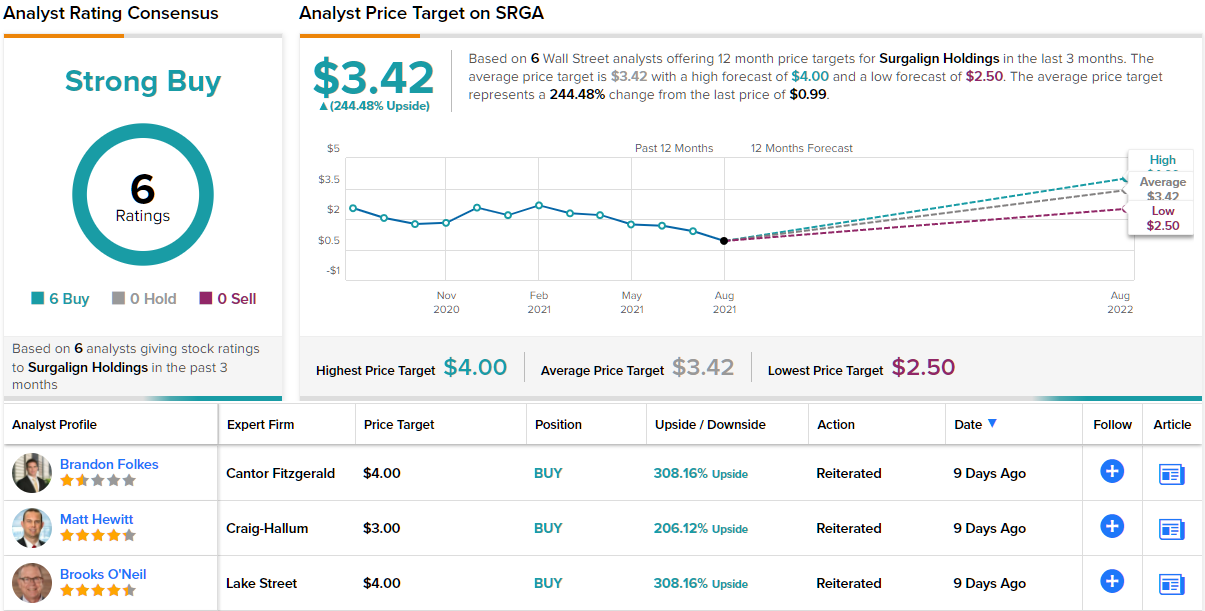

With a price tag of $1.00 per share, analysts also believe that now is the time to pull the trigger. Among the bulls is Cantor analyst Brandon Folkes who rates SRGA an Overweight (i.e. Buy) along with a $4 price target. Should his thesis play out, a twelve-month gain of 308% could potentially be in the cards. (To watch Folkes’ track record, click here)

“We believe Suralign is in the process of building out its spine competencies and specialization since the company became a standalone spine company, and continues to build on its software capabilities with Holo. We view SRGA as still in the early stages of a turnaround and portfolio refresh that will likely drive long-term growth, but we believe investors are likely to be rewarded for their patience from 2022 and beyond as the investments the company have made to date begin to pay off. We expect upwards earnings estimate revisions and multiple expansion to drive SRGA stock higher,” Folkes opined.

Judging by the consensus breakdown, other analysts also like what they’re seeing. 6 Buys and no Holds or Sells add up to a Strong Buy consensus rating. Based on the $3.42 average price target, the upside potential comes in at ~244%. (See SRGA stock analysis on TipRanks)

Flexion Therapeutics (FLXN)

The second penny stock we’re looking at, Flexion, is a biopharmaceutical company focused on discovering and developing, and marketing, new drugs for local pain relief, especially for patients suffering from musculoskeletal conditions. The company’s chief focus is on paid relief medications for osteoarthritis (OA).

To some extent, Flexion is a biopharma company that has achieved the Holy Grail of its niche; that is, the company has an approved drug on the market. Flexion’s Zilretta, the brand name for the synthetic corticosteroid Triamcinolone acetonide was approved for use in 2016. Zilretta is dosed as an extended-release injectable suspension and is used for knee pain due to osteoarthritis. The drug is also being investigated for shoulder indications, and recently released results of the Phase 2 Pharmacokinetics (PK) and Safety Study showed efficacy in that application. The company expects to begin a registration trial of Zilretta for osteoarthritic shoulder pain later this year.

In addition to Zilretta, Flexion has two drug candidates in earlier stages of the development pipeline. FX201 is in an open-label Phase 1 trial for OA knee pain. As of this month, the trial has 40 patients enrolled and dosed, and early results are expected by the end of this year. FX301, or fuanpide, is an extended release thermosensitive hydrogel intended as an analgesic nerve block for patients with post-operative pain. This drug candidate is undergoing a Phase 1b proof-of-concept trial with patients post-op from foot and ankle surgeries. As with FX201, clinical trial results are expected later this year.

For the second quarter of this year, Flexion reported sales revenue (from Zilretta) of $28.2 million. This was up 15% sequentially. The company’s net loss moderated from $32.6 million in 2Q20 to $22.2 million in the current report; the moderation of the net loss was credited to the increasing Zilretta sales.

In his note for Raymond James, analyst Elliot Wilbur lays out a bullish case for buying into Flexion.

“With Zilretta sales largely back to pre-pandemic trajectory, coupled with the almost recovered patient flow base and sales increase… we view the risk/reward as very favorable for the name. Refinancing of debt in the quarter removed any near-term financial overhang that the name had, extending cash runway into 2023, furthering our positive outlook on the name. Lastly, shares recently experienced a strong sell-off period in the month of July, without any change to underlying business fundamentals, providing investors with an accumulation opportunity with strong upside in our view,” Wilbur noted.

To this end, Wilbur rates the stock as a Strong Buy, and his $16 price target indicates potential for ~252% upside this year. (To watch Wilbur’s track record, click here)

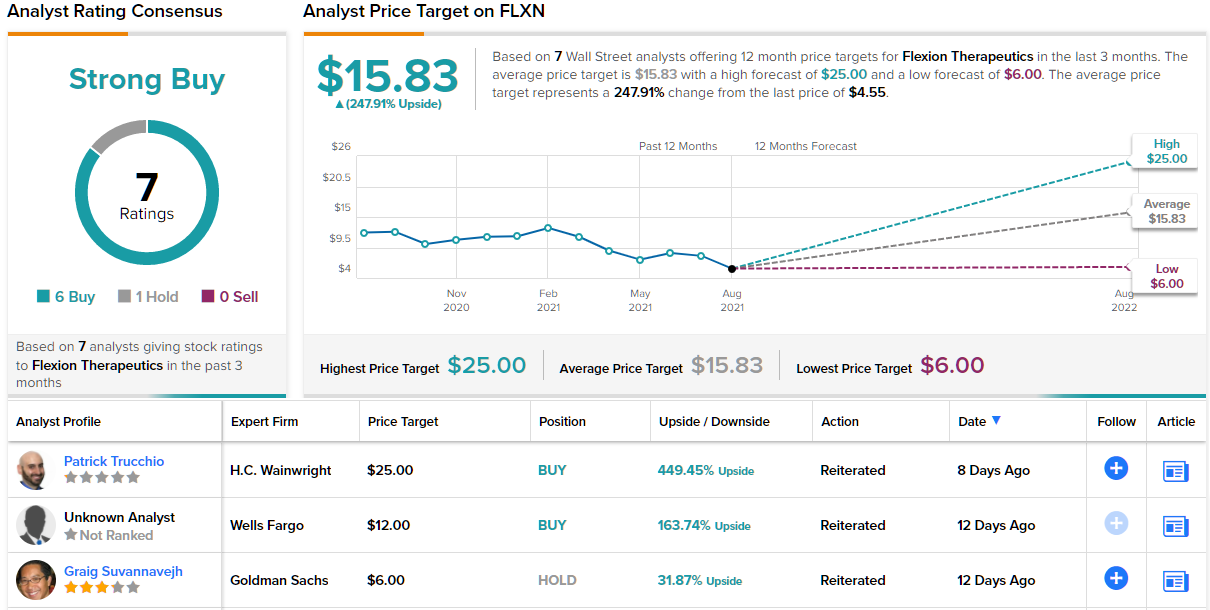

Like Surgalign above, Flexion has 6 recent Buys from the analysts. These overbalance a single Hold, and the stock has a Strong Buy consensus rating. The average price target is $15.83, suggesting an upside of ~248% from the current share price of $4.54. (See FLXN stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.