With the New Year just a few days away, it’s time to start looking for the best portfolio choices going forward. This past year has been a mess for investors, and putting 2022’s bear market behind us will come as a relief – but finding solid choices for big gains will still require a high tolerance for risk.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Fewer stock segments are more risky – or more potentially rewarding – than the penny stocks. Priced under $5 per share, these low-cost equities give investors a chance to double their money or more. The combination of low share price and high upside potential makes the pennies always worth a closer look.

Of course, the risk is there, too. Stocks trade at ultra-low prices for a host of reasons, and sometimes those low prices are justified by poor prospects. Sifting the wheat from the chaff here will take some effort – but Wall Street’s analysts are up to the task, and have picked out two penny stocks that are primed for outsized gains as we head into the 2023.

According to the TipRanks database, these are Strong Buy equities and offering extraordinary upside potential of 200% or better. Let’s take a closer look.

Clearside Biomedical, Inc. (CLSD)

We’ll start with Clearside Biomedical, an ocular health company focusing on new treatments for eye conditions. The company has therapeutic agents at the development, clinical, and commercial stages – giving it, from an investor’s perspective, multiple shots on goal. The company has developed a novel SCS injection technology, along with a line of small-molecule therapeutic agents designed to take maximum advantage of that delivery pathway.

Clearside’s commercial stage, FDA-approved product is Xipere, an injectable suspension of triamcinolone acetonide. It is the first therapeutic agent approved for delivery directing into the suprachoroidal space, and is marketed as a treatment for macular edema associated with uveitis. Clearside has seen several recent steps in relation to the commercialization of Xipere, including entry to royalty agreement with HealthCare Royalty Partners and the receipt, by partner Bausch, of a permanent reimbursement J-code – used by commercial insurance and government payers in the US healthcare system – for provider billing effective this past July. The company is in the early stages of commercialization, and revenues are, for now, mostly nominal.

Turning to the pipeline, Clearside recently released highly positive data on CLS-AX. This drug candidate is undergoing a Phase 1/2a study in the treatment of Wet AMD; the data, based on Cohorts 3 and 4, showed positive results in safety, durability, and biologic effects, along with a meaningful reduction in treatment burden. The company expects to release 6-month data from an extension study in 1Q23. In addition, in the same quarter, Clearside expects to initiate a Phase 2 trial.

With Clearside shares changing hands for $1.00 apiece, Needham analyst Serge Belanger sees an attractive entry point for investors.

“In our view, cohort-3 and-4 results of the OASIS trial establish CLS-AX as a bonafide TKI treatment candidate that is administered via a safe and unique in-office procedure (suprachoroidal delivery) and has demonstrated the ability to deliver durability and efficacy with a clean safety profile. CLSD ended 3Q22 with cash of ~$53MM, which should fund the planned phase 2 trial and provide runway into 2024. We believe CLSD’s current valuation fails to capture CLS-AX’s potential and is significantly below peers with retinal disease assets in phase 2 development,” Belanger opined.

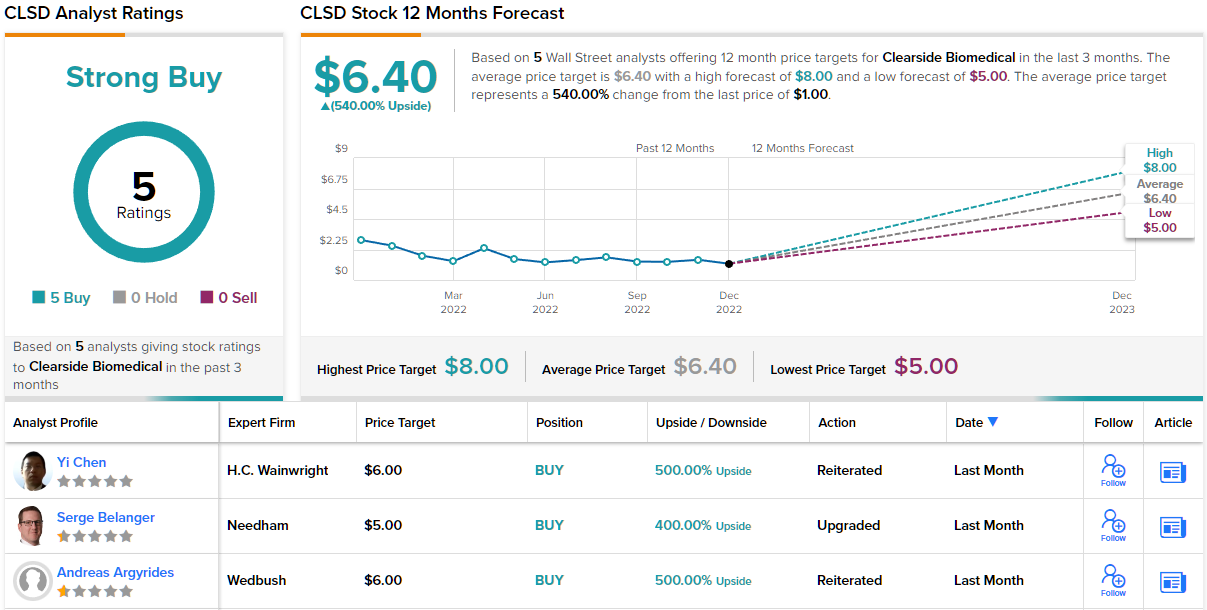

Putting a number to his optimism here, Belanger gives CLSD shares a $5 price target, suggesting a powerful 400% upside potential for the coming year – and fully supporting his Buy rating on the shares. (To watch Belanger’s track record, click here)

Overall, Clearside has picked up 5 unanimously positive analyst reviews recently, for a Strong Buy consensus rating. The $6.40 average price target is even more bullish than the Needham view – and indicates potential for 540% upside on the one-year timeframe. (See CLSD stock forecast on TipRanks)

Fusion Pharmaceuticals (FUSN)

Now we’ll turn to the oncology field, and look at Fusion Pharmaceuticals. This early clinical-stage biotech researcher is working on new radiation therapies for cancer treatment. Fusion has a pipeline featuring three clinical-stage drug candidates plus another in preclinical development. The company uses a propriety platform and technology, TAT, or Targeted Alpha Therapies, in its development work, and is aiming at a safer approach to radiopharmaceuticals.

The leading drug candidate in the pipeline is FPI-1434, under investigation as a treatment for solid tumors expressing IGF-IR. The company is studying two dosing regimens in a Phase 1 trial, and expects to report safety, pharmacokinetics, and imaging data – including evidence of anti-tumor activity – during 1H23. Once the Phase 2 monotherapy dose is determined, the company expects to initiate a Phase 1 combination study with Keytruda within 6 to 9 months.

Other clinical trials include a Phase 1 open label clinical trial of FPI-1966 as a treatment for solid tumors expressing FGFR3. The study will look at safety, tolerability, and pharmacokinetics with the aim of determining the proper Phase 2 dose. Patient enrollment and dosing in the Phase 1 study are still ongoing. Finally, the company remains focused on initiating a Phase 1 study for FPI-2059, which last June received clearance from the FDA for clinical trials. This drug candidate is a targeted alpha therapy for various solid tumors, with prostate, colorectal, and pancreatic cancers suggested as particular lines of study.

Maintaining a large and active clinical trial pipeline does not come cheap, but Fusion is blessed with deep pockets. The company reported having $205.5 million in cash and other liquid assets on the balance sheet as of the end of 3Q22, a sum sufficient to keep up operations in to the third quarter of 2024.

Wedbush’s 5-star analyst David Nierengarten details multiple upcoming catalysts for Fusion, seeing them as the most important factor for investors’ consideration, and says, in part, “The main near-term catalyst for shares remains Ph 1 data, including safety, PK, and imaging data from its ongoing study of FPI-1434 in patients with solid tumors… We expect to see enhanced activity for FPI-1434 when the data reads out in 1H23… We continue to believe FUSN is significantly undervalued at current levels and see a favorable risk/reward for shares in light of the upcoming readout for FPI-1434.”

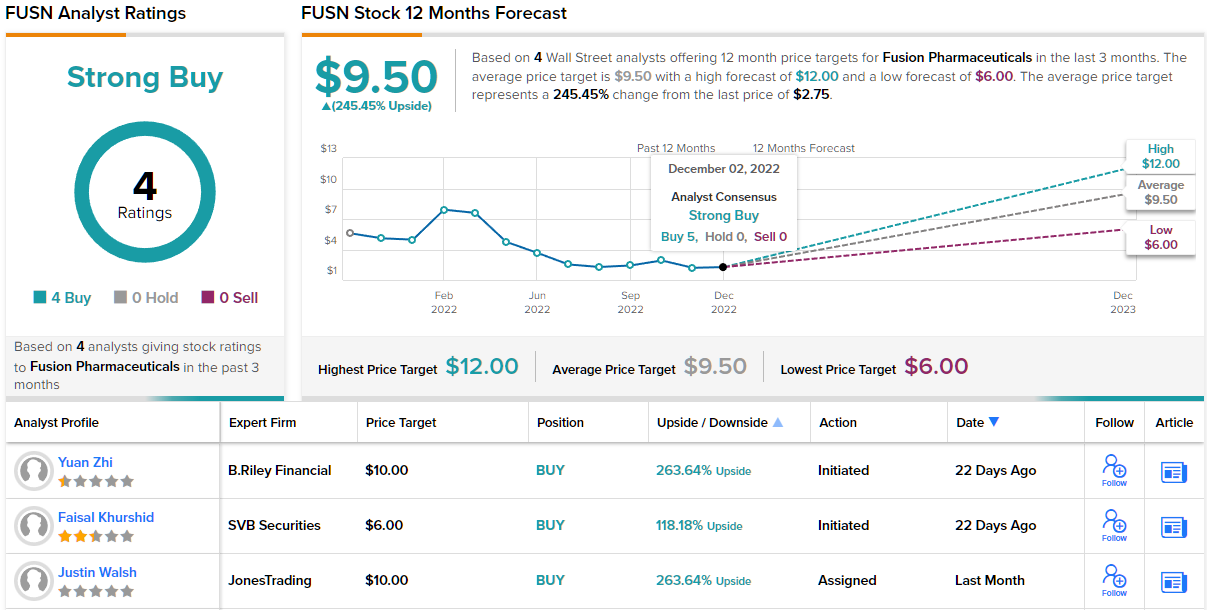

Nierengarten goes on to give FUSN shares an Outperform (i.e. Buy) rating, with a price target of $12 that implies a robust upside of 336% for the next 12 months. (To watch Nierengarten’s track record, click here)

It’s clear from the aggregate reviews that Wall Street generally agrees with the Wedbush take on this stock. The Strong Buy consensus is based on 4 positive analyst reviews, and the $9.50 average price target suggests a one-year upside potential of 245% from the current share price of $2.75. (See FUSN stock forecast on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Penny Stocks screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.