Every class of stocks has its promoters and detractors, but few generate such extreme opinions among investors as the penny stocks. The reality is, they’re a class of assets that offer some unique opportunities combined with a higher risk profile.

The ‘pennies’ are stocks selling at ultra-low prices per share. Originally, they were priced for just a few pennies, but today this class of stocks is generally valued at less than $5 per share. Such low share prices generally happen for clear reasons, and those reasons usually revolve around something fundamentally wrong with the issuing company.

But not always. Sound companies can see their stock price fall – and that can open up unparalleled opportunities for smart investors. A sound penny stock can bring outsized returns when the share price rises, as even a small gain – just a few cents – will quickly translate into a high percentage appreciation.

Bearing this in mind, we used TipRanks’ database to find compelling penny stocks with bargain price tags. The platform steered us towards two tickers sporting share prices under $5 and “Strong Buy” consensus ratings from the analyst community. Not to mention substantial upside potential is on the table. We’re talking about over 200% upside potential here.

9 Meters Biopharma (NMTR)

We’ll start with 9 Meters Biopharma, a medical research company that takes a narrow-focus approach, working on new treatments in the gastrointestinal field for rare conditions with unmet needs. The company’s leading drug candidates are treatments for celiac disease and short bowel syndrome. While very different in origin, both conditions affect the ability of the patient’s GI system to properly digest food – and so have a huge impact on quality of life. 9 Meters, which gets its very name from the average length of the human GI tract, aims to improve outcomes for gastrointestinal patients.

The company’s leading drug candidate is larazotide, an orally-administered gut-restricted tight-junction regulator designed to ameliorate the worst symptoms of celiac disease. In this condition, patients experience a dangerously inflammatory response to gluten, a common component of the modern diet, with resultant pain, bloating, and gas that can reach severe levels. There is no current medical treatment for celiac; patients must adhere to a strictly gluten-free diet to avoid symptoms.

Larazotide works by preventing gluten’s breakdown product, gliadin, from ‘leaking’ through the intestinal cells and prompting the inflammatory reaction. The drug candidate is intended as an adjunct therapy to current dietary treatments, to minimize symptoms. The drug is currently undergoing a Phase 3 clinical trial, with top line interim results expected in 2Q22.

9 Meters’ other leading drug candidate is vurolenatide, a treatment for short bowel syndrome (SBS). In this condition, the patient suffers from poor absorption of nutrients and consequent malnutrition; even with a proper diet, patients may experience severe nutritive deficiencies. Vurolenatide works by slowing down digestive times, allowing better nutritive absorption in a shortened intestinal tract. The immediate effects of this slowing are to reduce the malnutrition and chronic diarrhea experienced by most patients. The company expects to release the top-line results of the VIBRANT Phase 2 study in 1Q22, and to initiate a Phase 3 trial after the End-of-Phase 2 meeting with the FDA.

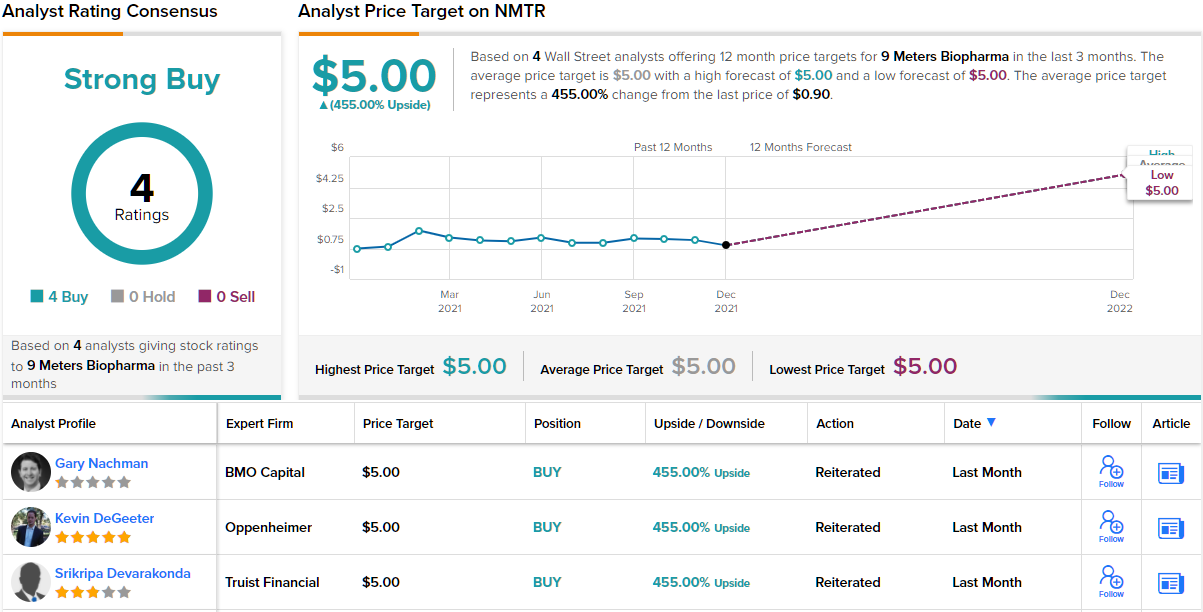

As the company gears up for key potential catalysts, several members of the Street are pounding the table on NMTR, which trades for $0.90 per share.

Among the fans is Oppenheimer’s 5-star analyst Kevin DeGeeter, who points out the SBS track as the key catalyst for this stock in the near term.

“NMTR now expects top-line readout from Phase IIb study of Vurolenatide in patients with short bowel syndrome (SBS) in 1Q22 vs. prior guidance of December. We would look to accumulate shares of NMTR into the update based on expectation for data to provide insights on effect size of change in Total Stool Output (TSO) to power Phase III development… We view diarrhea control for all-comer SBS population as a critical point of differentiation for Vurolenatide and opportunity for upside to our forecast from patients not on parenteral support.”

Overall, DeGeeter’s investment thesis is based on the following assumptions: “1) potential of NM-002 to capture 15% of market for patients with short bowel syndrome (SBS), 2) opportunity to build GI-focused commercial organization to fully leverage value of NM-002 and other GI products, and 3) expectation the company will remain active in acquiring late-stage GI products.”

To this end, DeGeeter rates NMTR an Outperform and his $5 price target implies a robust 455% upside for the next 12 months. (To watch DeGeeter’s track record, click here)

It’s clear from the aggregate reviews that Wall Street generally agrees with the Oppenheimer take on this stock. The Strong Buy consensus is based on 4 positive analyst reviews, and the $5 average price target matches DeGeeter’s. (See NMTR stock forecast on TipRanks)

Verona Pharma (VRNA)

The second stock we’ll look at, Verona, is also a biopharma – and it also takes a ‘system centric’ approach to therapeutic development. In this case, the company is working on new drug treatments for respiratory diseases. Verona has one major drug candidate, ensifentrine, under development as a treatment for chronic obstructive pulmonary disease (COPD), cystic fibrosis (CF) and asthma. The first two conditions are both terminal, and lack any highly effective medication options.

Verona sees ensifentrine as a potential novel treatment with broad-based applications. The drug candidate is an inhaled therapy, common in drugs to treat lung condition, and has a dual action as both a bronchodilator and an anti-inflammatory. In simpler terms, this means that one dose of one drug has potential to both open the airways and reduce inflammation in the lung tissue. Both actions are known to improve breathing in affected patients.

Ensifentrine is currently undergoing several concurrent clinical trials, for various applications. The two leading trials are on the COPD track; the company currently has two ongoing Phase 3 trials, ENHANCE-1 and ENHANCE-2. Enrollment in the full ENHANCE-1 study is expected to complete in 2Q22, followed by top-line data report, which is anticipated by the end of 2022. As for the ENHANCE-2, the study is expected to fully enroll by the end of 2021, with top-line data expected by mid-2022.

During the third quarter of this year, Verona received and booked a $40 million payment from Nuance Pharma, pursuant to an agreement on development and commercialization rights in China. This brings the company’s liquid asset holdings to $166.5 million as of September 20, 2021, which management believes is sufficient to fund activities through the end of 2023.

In his note for BTIG, analyst Thomas Shrader lays out a bullish case for buying into Verona.

“There remains an unmet need for patients living with COPD, and the dearth of true innovation in COPD since roflumilast’s approval >8 years ago remains frustrating. With a clean safety profile, ensifentrine looks differentiated from SOC in late-line COPD as a drug that shows: 1) the anti inflammatory effects (reducing exacerbations) and 2) the bronchodilator effects (improved breathlessness). COPD patients and physicians are always searching for more,” Shrader opined.

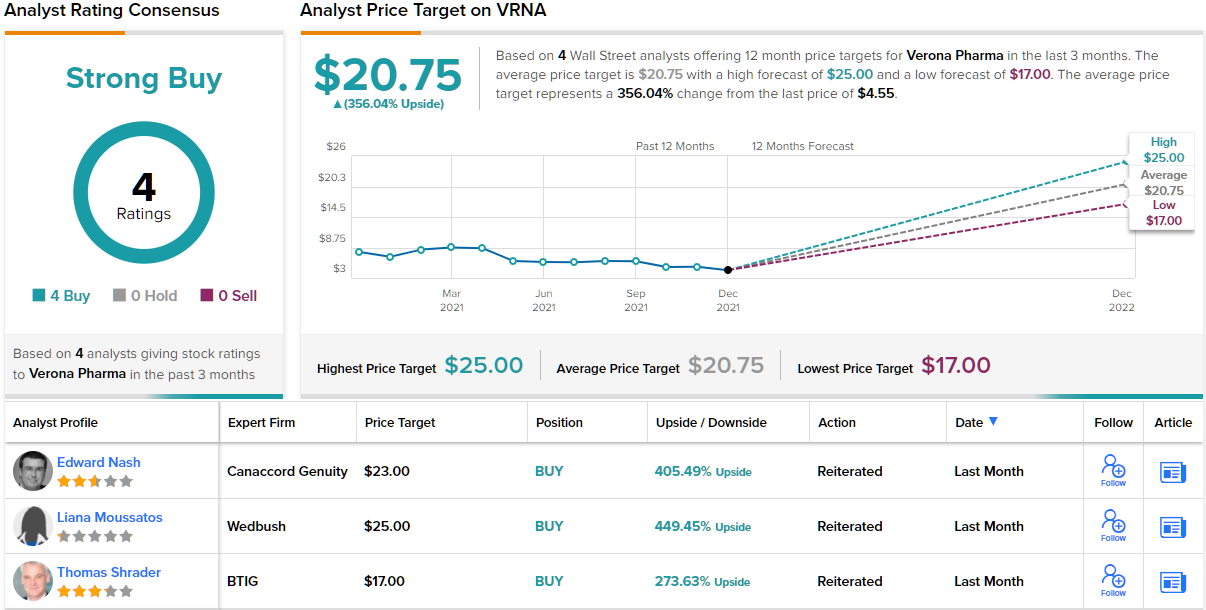

In line with his bullish stance, Shrader rates VRNA a Buy, and his $17 price target implies room for ~271% upside potential in the next 12 months. (To watch Shrader’s track record, click here)

It’s clear that Wall Street is generally impressed by VRNA’s potential; the 4 recent analyst reviews here are all positive, for a unanimous Strong Buy consensus rating. The shares are priced at $4.55 and have an average price target of $20.75, suggesting a one-year upside of 356%. (See VRNA stock forecast on TipRanks)

To find good ideas for penny stocks stocks trading at attractive valuations, visit TipRanks’ Penny Stocks Screener.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.