Every investor wants to find the best market returns, and they’ll follow a variety of strategies to get there. One common strategy – and one that offers plenty of promise for investors who don’t mind shouldering the extra risk – is to go after penny stocks.

Traditionally seen as stocks priced for just pennies per share, these equities are now defined as those with a share price of $5 or less. For the tough-minded investors, these low-cost stocks present a combination of risk/reward that few other investment instruments can match.

The risk here stems from the same factor that fuels the potential gains. At the low share price of the ‘pennies,’ even an increase of a few cents can quickly turn into large-scale returns, sometimes on the order of a triple-digit gain. At the same time, should the stock fall, the low price will magnify the losses.

The nature of these investments presents somewhat of a dilemma. How are investors supposed to separate the penny stocks that are ready to take off on an upward trajectory from those set to remain down in the dumps?

To help with the due diligence process, we used TipRanks’ database to zero in on only the penny stocks that have received bullish support from the analyst community. We found two that are backed by enough analysts to earn a “Strong Buy” consensus rating. Not to mention each offers up massive upside potential, as some analysts see triple-digit upside potential in store.

electroCore (ECOR)

We’ll start with electroCore, a medical technology company focused on the treatment of chronic conditions, including chronic pain. The company uses proprietary gammaCore treatments to stimulate the vagus nerve, the largest of the cranial nerves, and the one responsible for transmitting sensory information from the vital organs to the brain, in the treatment and prevention of severe migraines and cluster headaches.

electroCore is currently investigating its vagus nerve treatments for efficacy in the management of a range of nervous system disorders, including Parkinson’s disease and PTSD. Other applications under investigation include the treatment of opioid addiction and subarachnoid hemorrhage. Last month, the company announced that a pilot study had shown that vagus nerve stimulation decreased inflammatory response to stress and improved symptoms in patients with PTSD.

A look at the company’s most recent financial report, for 2Q21, shows that electroCore has a steady – and improving – revenue stream from its FDA approved vagus nerve stimulation treatments. In the second quarter, the top line came in at $1.3 million, up an impressive 69% from the year-ago quarter. The company held a public offering of stock in June to raise capital, an event that brought in $18.8 million in net proceeds.

As each share is currently going for $0.96, electroCore’s price tag could present investors with an attractive entry point, according to Ladenburg 5-star analyst Jeffrey Cohen.

“Our investment thesis is a function of three key items: the gammaCore technology, the large current TAMs, and the potential for expansion into other conditions and disorders. We would note, a majority of the company’s revenue is derived from the contract with the Department of Veterans Affairs. While this provides consistent revenue from a significant number of patients, it should also be noted that the market remains largely untapped with potential for broader and deeper penetration. Additionally, the company has noted several alternative and contiguous areas of interest both within and outside of neurological disorders. The company has demonstrated a strong ability to design and execute comprehensive clinical trials to validate the safety and efficacy to date. We anticipate this know-how and expertise could and will be leveraged into ongoing and new areas of development. Finally, these adjacent markets represent large patient populations where there are few efficacious options for either the treatment or reversal of disease,” Cohen opined.

The analyst summed up, “We are firm believers in the utilization of energy either before or in conjunction with the existing SOC (standard of care). As such, we acknowledge a strong market opportunity for ECOR.”

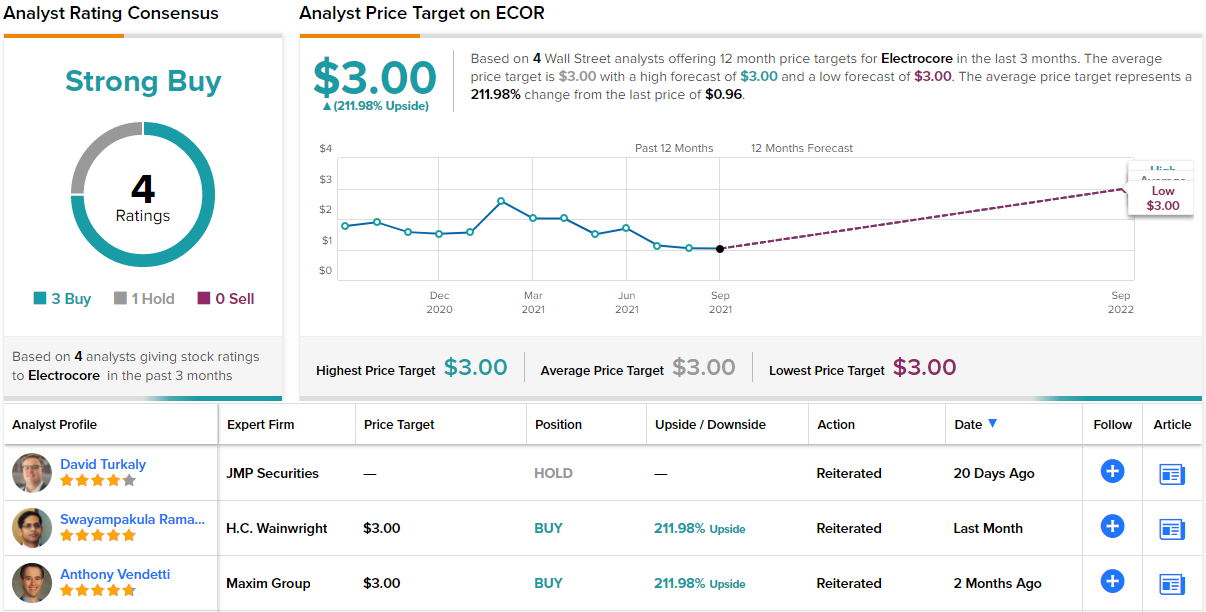

In line with his upbeat outlook, Cohen rates ECOR a Buy, and his $3 price target implies a robust upside of 212% on the one-year time frame. (To watch Cohen’s track record, click here)

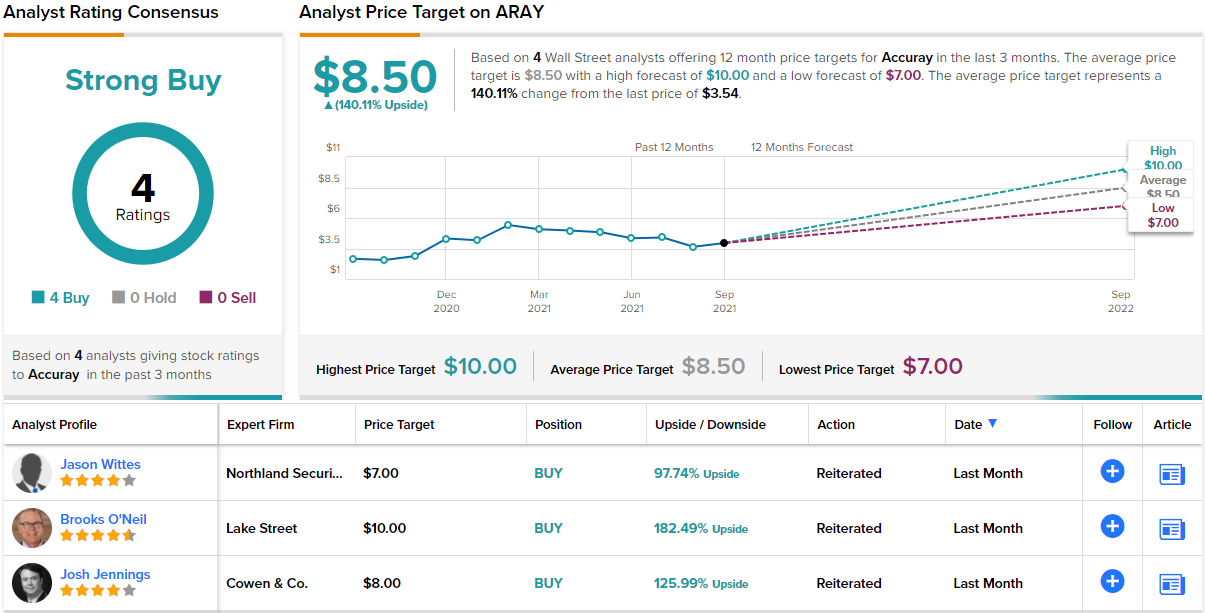

What does the rest of the Street have to say? 3 Buys and 1 Hold add up to a Strong Buy consensus rating. Given the $3 average price target, shares could climb ~209% in the year ahead. (See ECOR stock analysis on TipRanks)

Accuray Inc. (ARAY)

The next stock we’re looking at, Accuray, works in the radiation oncology niche, the treatment on cancer with radiation therapies. The company is involved in the development, manufacturing, and marketing of radiotherapy medical devices. Approved and available products include CyberKnife Systems, an AI-driven precision radiation application device capable of targeting any part of the patient’s body; TomoTherapy Systems, an image-guided radiation therapy system using 3D images to guide the treatment; and the Radixact Delivery Treatment Platform, another image-guided system that shapes the radiation application to the tumor, and leaves normal tissue untouched.

These products drive Accuray’s revenues, which in the most recent quarter (Q4, of fiscal year 2021, ending on June 30) reached $110.9 million, the best print since fiscal 4Q19. The revenue number was up 17% year-over-year, and looking forward, the company’s gross orders rose 19% yoy to reach $112.7 million. Accuray finished its fiscal 2021 with a record-setting backlog of $616.4 million, giving the company a clear path for future deliveries.

Accuray has been expanding its global reach, and this month its Radixact system made its Japan debut at the Nagoya city university hospital. Accuray boasts that its products are used in over 50 countries around the world, and in more than 700 medical practices. The company claims to have over 930 systems installed and in use. The company is also expanding into the Chinese market.

5-star analyst Marie Thibault of BTIG writes of Accuray: “We found plenty to like in this quarter, including trade-ins/trade-ups making up 27% of global orders, strong order bookings from the Americas, and good revenue contribution from EMEA and APAC. The ClearRT imaging solution on Radixact brought in 30 orders in the quarter, an increase from the first 14 orders booked last quarter. We expect this demand to continue over the coming months…”

The analyst added, “With an expanding opportunity in China, a stronger balance sheet, customer interest in new features, and a strong replacement tailwind, we think ARAY continues to make the right moves.”

To this end, Thibault gives this stock a Buy rating, while her $9 price target indicates room for 156% growth in the year ahead. (To watch Thibault’s track record, click here)

Overall, ARAY boasts a unanimous Strong Buy analyst consensus rating, based on 4 recent reviews. The stock has an average price target of $8.50, which suggests a 12-month upside of 140% from the current trading price of $3.57. (See ARAY stock analysis on TipRanks)

To find good ideas for penny stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.