One thing is clear in the current market conditions: it’s a time of transition. Over the past four months, the stock market has shifted from the bull run we saw in 2021 into a far more volatile state of affairs. The market dipped into correction territory in March, bounced back out in April, and now is heading down again.

One result of this has been an increase in bond yields, as equities have dropped. And with the Federal Reserve embarking on a new round of interest rate hikes, that promises a move toward higher yields.

Weighing in on current market conditions, Morgan Stanley chief European equity strategist Graham Secker noted, “There’s a plausible argument that equity valuations had already derated in advance of this move and that the rise in real yields has simply recoupled the two series back together. Hence, if real yields move higher from here, equities will need to derate further.”

Secker’s outlook, if taken at face value, makes it plain that investor will need to take defensive measures to protect their portfolios. Any farmer can tell you that there’s no point slamming the barn door after the horses have bolted, and the same holds true for stocks. The best time to shore up the portfolio is before the worst becomes obvious.

With this in mind, we’ve used the TipRanks database to pinpoint two stocks that match a solid defensive profile: a Strong Buy from the analyst’s collective wisdom and a dividend yield of 7% or more. Let’s take a closer look.

OneMain Holdings (OMF)

We’ll start with OneMain, a financial services company with a twist. OneMain focuses its efforts on the low-end retail customer segment, offering affordable loans, consumer finance, and insurance products. This is a customer base that won’t necessarily qualify for credit services from larger banking companies, due to higher risk factors and lower credit scores. OneMain, however, sees this as a lucrative potential market.

The company’s revenue stream would tend to indicate that OneMain is correct in its assessment of the customer base. In the past two years, the quarterly top line has been consistently high, between $1.2 billion and $1.28 billion. The last reported quarter, 4Q21, was at the top of that range, and was up 5% year-over-year. Quarterly EPS came in at $2.38, down from $2.77 in the year-ago quarter. On the positive side, EPS came in just above the $2.35 forecast – and marked the 7th consecutive quarter that the bottom line beat the estimates.

For the full year 2021, OneMain reported $9.87 in earnings per share, a strong increase from the $5.41 per share reported for the full year in 2020.

Overall, management was pleased with the 4Q earnings, and expressed that confidence through a 36% increase in the quarterly common share dividend. This payment was bumped up to 95 cents per share, and was paid out in February of this year. With an annualized payment of $3.80, OneMain’s dividend yields 8%.

In coverage for Wells Fargo, 5-star analyst Michael Kaye notes that recession fears have put pressure on OneMain’s stock price recently, but points to a relatively sound position for US consumers – OneMain’s key customer base – as reason for optimism on the stock.

“OneMain shares (along with the consumer finance sector) have been weak on recession fears exacerbated by inflation/higher energy prices. While this certainly contributes to downside risks to the U.S. economy, our belief is that we will avoid tipping into a recession. We think the backdrop for the U.S. consumer remains solid driven in part by a strong employment picture. Thus, we think recession risk ultimately fades, and we view the current share price as a buying opportunity,” Kaye opined.

In line with this comments, Kaye rates OMF stock an Overweight (i.e. Buy), with a $70 price target that indicates room for ~41% upside in the coming year. (To watch Kaye’s track record, click here)

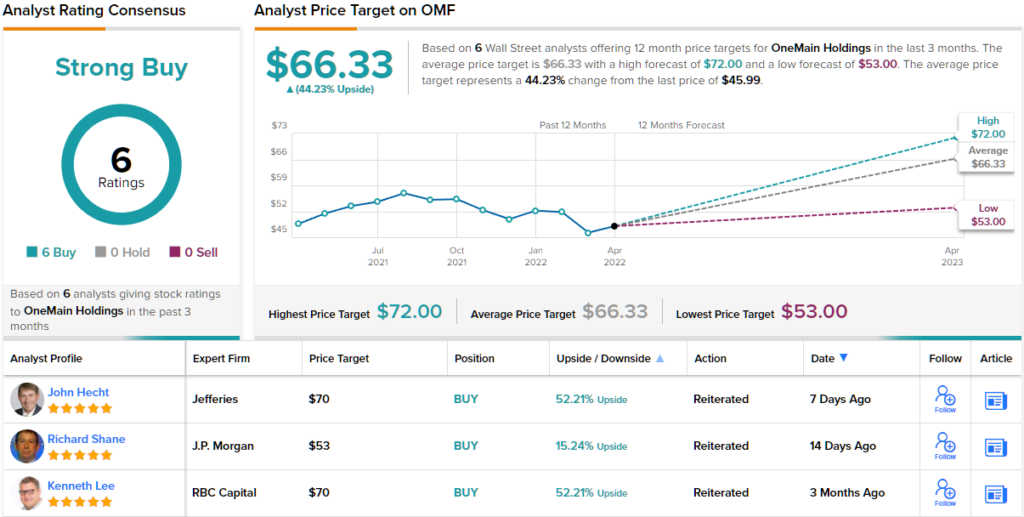

While upbeat, Kaye’s take on OneMain in certainly not an outlier – this stock has a unanimous Strong Buy consensus rating, supported by 6 positive analyst reviews. The shares are priced at $46.09 and their $66.33 average price target suggests an upside of 44% for the year ahead. (See OMF stock forecast on TipRanks)

Enterprise Products Partners (EPD)

The second stock we’ll look at is a midstream energy company. Like the finance sector, the energy sector has long been known for offering high dividends. Enterprise Products Partners supports its own dividend with operations in the collection, transport, storage, processing, and export of hydrocarbon products, including crude oil, refined petroleum, natural gas, and natural gas liquids. High prices in the energy sector over the past year and more have supported Enterprise’s stock price; where the S&P 500 is down 12.5% year-to-date, EPD stock has gained 20% in that same time.

Enterprise moved to increase its asset network recently, and in January the company announced that it had entered an agreement to acquire Navitas Midstream. This move brought more than 1,700 pipeline miles and over 1 billion cubic feet per day of natural gas processing capabilities into Enterprise’s network. The transaction cost Enterprise $3.25 billion in cash, and was completed in February.

The company’s revenues have been consistently increasing, with 5 sequential gains since bottoming out in 2Q20. The last quarter reported was 4Q21, in which the top line came in at $11.65 billion, up 65% year-over-year. Quarterly EPS was 47 cents, missing the 54-cent forecast but more than tripling y/y. For the full year 2021, Enterprise reported $4.6 billion in net income, delivering an EPS of $2.10 per share. These full-year results were up significantly from the 2020 figures, with net income growing 21% and full year EPS growing 22%.

Of particular interest to dividend investors, Enterprise’s free cash flow in 2021 grew y/y from $2.7 billion to $6.3 billion. This is the metric that supports the dividend, and earlier this month Enterprise declared its next common share dividend payment at 46.5 cents, payable on May 12. This payment annualizes to $1.86 and gives a yield of 7%. Enterprise has a long history, 13 years, of slowing growing its common share dividend payment.

Justin Jenkins, 5-star analyst with Raymond James, is bullish on Enterprise, writing: “EPD’s unique combination of asset integration, balance sheet strength, and ROIC track record remains best in class. Further, said track record is more relevant than ever in the context of the recent Navitas deal. We see EPD as arguably best positioned in midstream from a volatility vs. recovery perspective — and buybacks remain an upside lever in 2022+. Meanwhile, EPD still trades at an attractive ~7% yield and a historically discounted ~9.5x 2023E EV/EBITDA (~11.5x 5-year average).”

“With a healthy outlook and a compelling entry point,” Jenkins rates EPD a Strong Buy along with a $30 price target. Shares could appreciate ~17%, should the analyst’s thesis play out in the coming months. (To watch Jenkins’ track record, click here)

Wall Street is in broad agreement with the bull here, as evidenced by the 7 to 2 split in the recent share reviews, favoring Buys over Holds and backing a Strong Buy consensus rating. The stock is selling for $25.70 and the $30.13 average target is practically the same as Jenkins’ objective. (See EPD stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.