The market’s keyword heading into the last few weeks of 2021 is ‘volatility.’ Since the beginning of November, we’ve more pronounced swings, both up and down, especially on the NASDAQ index.

Watching the markets from Wall Street, the major banking firms are finding it hard to come to agreement. There are bulls who say, ‘Buy,’ but the bears are active, too. On that latter note, Morgan Stanley’s CIO of wealth management, Lisa Shalett, writes: “We expect the S&P 500 to be range-bound and volatile, and bond returns to be negative net of inflation… Investors should move toward stock picking and away from passive index funds.”

What this means for retail investors is clear: take some proactive steps toward portfolio protection. A defensive move will provide some cover in an increasingly volatile market environment, and the natural such move is to dividend stocks. The steady income stream will guarantee a return, even when stocks are slipping.

Using TipRanks database, we’ve pinpointed two dividend stocks that are offering outperforming yields of 7% or better. These are Strong Buy stocks, too, with recent positive ratings from the Street’s analysts and better upside potential than is typical for high-yield dividend payers. Here are the details.

Blackstone Mortgage Trust (BXMT)

We’ll start with Blackstone Mortgage Trust, a real estate investment trust (REIT) focuses on mortgage loan packages rather than direct real estate ownership. Blackstone originates collateral-based senior loans, targeting its investments in the North American, European, and Australian markets; the global portfolio includes 157 loans totaling $22 billion.

The company’s investment strategy has been profitable; EPS in Q3 came in at 63 cents, although flat from the year ago quarter. In the past year, EPS has held between 59 and 63 cents. Revenues have been rising this year, from $185.7 million in Q1 to $198.5 million in Q3.

The positive earnings were more than enough to cover Blackstone’s dividend, which has been held at 62 cents per common share for several years now. The company has an 8-year history of keeping the payment reliable, and at $2.48 annualized, the dividend yields 8.2%. This compares favorably to the average dividend yield among S&P-listed stocks, which is currently around 2%.

In coverage for Wells Fargo, analyst Donald Fandetti lays out the bullish case for BXMT, writing, “It’s positive to see quarterly earnings above the dividend as they continue to move past the pandemic. Loan origination yields remain attractive despite more competition in the sector. We view BXMT as well positioned in the CRE lending markets given their relationship with private equity firm BX which is one of the largest real estate property owners in the world. We believe multiples will continue to grind higher for the sector…”

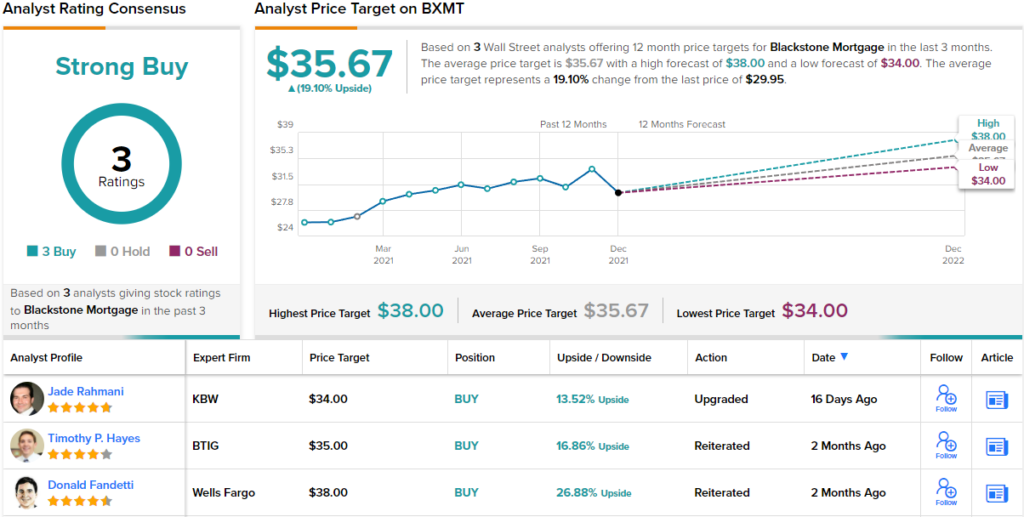

In line with his optimistic approach, Fandetti gives BXMT shares a Buy rating and his $15 price target suggests ~27% potential upside for the coming year. (To watch Fandetti’s track record, click here)

While there are only 3 recent reviews for this stock, they all agree: Blackstone Mortgage Trust is a stock to Buy, making for a Strong Buy consensus view. The shares are trading for $29.95 and their $35.67 average price target suggests a 19% upside in the next 12 months. (See BXMT stock forecast on TipRanks)

Starwood Property Trust (STWD)

The second stock we’re looking at is Starwood, another real estate investment trust (REIT). These companies are well known for their reliable and high dividend payments. The company’s main focus is commercial mortgages, but it also has investments in residential and infrastructure loans. Overall, Starwood reaches $17 billion in total investments.

Starwood’s earnings have been recovering since the low point in the spring of last year. Q3 EPS came in at $51 cents — the highest in over two years. The company’s financial results were more than enough to sustain the dividend payment of 48 cents per common share, a payment that has been held steady for several years now. The dividend annualizes to $1.92 and yields a strong 7.7%.

Among the bulls is BTIG analyst Tim Hayes who is upbeat on the company’s prospects.

“So far in 4Q21 (as of 12/3), STWD has deployed $3.2B across its investment strategies, and we expect the company could be in store for a record quarter of investment given a robust forward pipeline and strong liquidity position. We believe STWD is uniquely position to gain market share in the multifamily lending market given its ability to be more flexible with underwriting than banks/insurance companies and not just rely on trailing data in underwriting. As such, we expect the multifamily market will offer an outlet for significant capital deployment and attractive risk-adjusted returns,” Hayes opined.

“We view shares of STWD to be attractively valued, now trading below 1.2x our year-end book value estimate of ~$21.20/share and at a 7.7% dividend yield — a very attractive yield with the company being well positioned to face higher rates, inflation, and/or market volatility,” the analyst summed up.

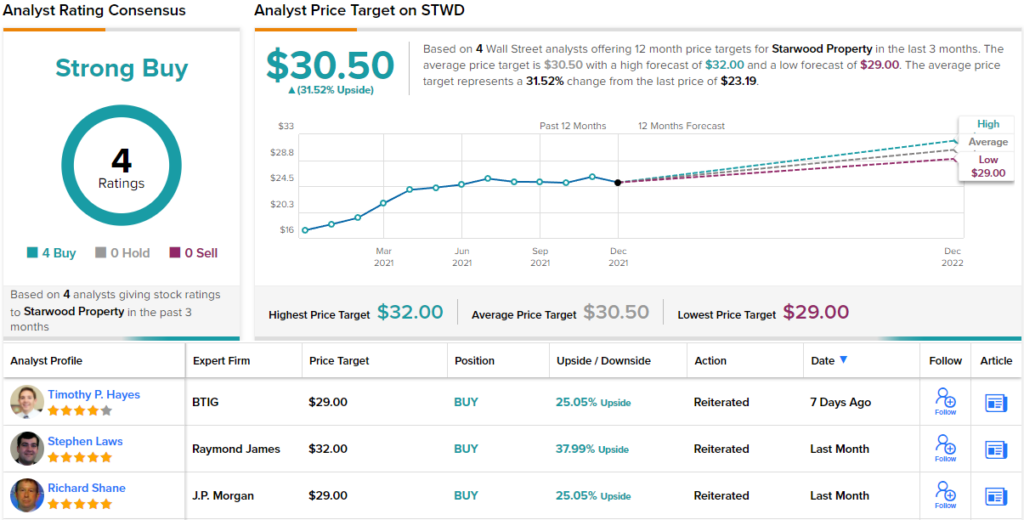

These comments support Hayes’ Buy rating, and his $29 price target indicates potential for a 25% upside in the year ahead. (To watch Hayes’ track record, click here)

Overall, it’s clear that Wall Street agrees with the bullish take on Starwood. The stock has 4 recent analyst reviews, and they all agree that it’s a Buy proposition, for a Strong Buy consensus rating. The average price target of $30.50 implies a one-year upside of 31.5% from the current trading price of $23.19. (See STWD stock forecast on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.