From an investment standpoint, the first quarter of 2022 brought confusion more than anything else, markets fell down and bounced back up. The main question to answer right now is whether the bounce is real or just a dead cat. Either way, however, there are going to be opportunities for investors.

As for choosing stocks to buy into, investors will need some clear signal. One popular sign to follow: the corporate insiders. These company officers can leverage their positions with their companies to gain advantages in trading stock – after all, they have an ‘inside’ view of the company workings, putting them in a better position to predict share movements. To keep the field level, the Federal regulators require that they regularly publish their trades; the TipRanks Insiders’ Hot Stocks tool makes it possible to quickly find and track those trades.

And now we come to something unique. There are thousands of companies on the open market, and hundreds in any given niche – but only a limited pool of qualified people to fill the top positions. It’s not uncommon to find one individual wearing multiple hats, with seats on two or more Boards of Directors of public companies. And when such a person starts going big on his trades – to the tune of several million dollars for each – that could be the song that investors want to hear.

Against this backdrop, we’ve used the database at TipRanks to pinpoint two stocks that should spark investor interest. They both trade for under $10 a piece, providing a low entry point with the prospect of at least 100% growth ahead, according to the analyst community. And even better, they shared officer who’s gone big on both. Let’s take a closer look.

Cue Biopharma (CUE)

The first stock we’ll look at, Cue Biopharma, is developing a pipeline of new immunotherapy treatments. The company is working on a new class of biologic medications, to be delivered by injection, that will engage and modulate targeted T cells. T cell therapy has numerous applications, including the treatment of cancers, autoimmune disorders, and some infectious diseases. Cue’s products are the results of work with two proprietary platforms, Immuno-STAT and Neo-STAT; the company also has important partnerships with larger pharmaceutical firms.

Cue’s partnerships brought in ~$8.2 million in revenue during the recently reported 4Q21. This was well above the ~$3 million expected, almost 3x higher than the $2.7 million reported in the previous quarter, and far more than the $475,000 in the year-ago quarter. The company’s partnership program is clearly taking off.

Looking at clinical trials, the ‘main event’ for research-oriented biopharmas, Cue’s main drug candidate, CUE-101, has entered Phase 1 testing. The company has multiple clinical studies underway for CUE-101, both in the treatment of HPV-positive recurrent or metastatic head and neck squamous cell carcinoma. One trial is testing -101 as a monotherapy, and the other in combination with Keytruda. The trials began in September 2019 and February 2021, and data on both is expected later this year.

On the insider front, we find that Aaron G.L. Fletcher, of the company Board, has swung the needle sharply positive on Cue, with a recent informative buy. He spent $3.498 million buying 735,000 shares of CUE stock, and now holds a stake in the company worth $4.989 million.

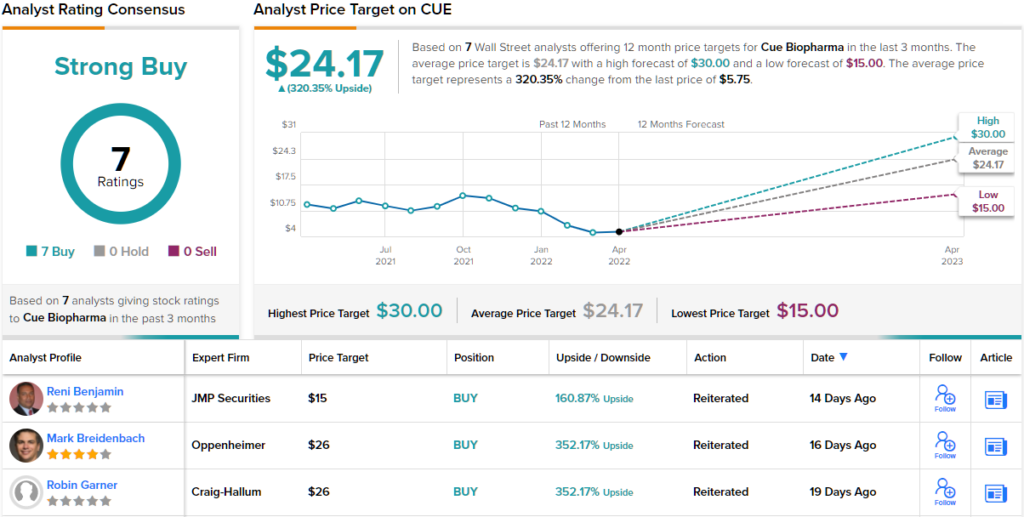

JMP analyst Reni Benjamin is also bullish on this stock, and lays out a clear case for buying in, as the potential gains clearly outweigh the risks: “With early signs of clinical benefit from the dose expansion study of CUE-101, including an ongoing PR, a combination trial with pembro showcasing tumor regressions, a versatile platform to address multiple targets in oncology and autoimmune disease, and a solid cash position, we believe Cue represents a unique investment opportunity whose shares are attractively priced.”

To this end, Benjamin sets an Outperform (i.e. Buy) rating on CUE, and his $15 price target implies an upside of ~161% for the coming year. (To watch Benjamin’s track record, click here)

Benjamin isn’t the only bull here. The Street has given Cue a total of 7 positive reviews recently, for a unanimous Strong Buy consensus rating. Shares are priced at just $5.75 and their $24.17 average target indicates potential for 320% upside over the next 12 months. (See CUE stock forecast on TipRanks)

TFF Pharmaceuticals (TFFP)

The second stock we’ll look at is TFF Pharmaceuticals. This company gets its name from the technology behind its research program – Thin Film Freezing. The company is using this tech to create safe, precisely-dosed dry powder versions of pharmaceutical agents, for use with inhaler delivery systems. The company is developing the system to counter known drawbacks to traditional delivery systems, such as pills; the TFF offers potential for higher efficacy and lower adverse events.

TFF has two main clinical programs in the pipeline. VORI, or voriconazole, is a new inhaler-based treatment for IPA, or Invasive Pulmonary Aspergillosis. This is a deadly fungal lung disease, with mortality rates of 90% or worse. The company has used the TFF platform to create a dry powder inhaler version of the anti-fungal drug voriconazole, which is now in Phase 2 study. The new delivery of an established drug has already demonstrated reduced side effects, and greater efficacy than other treatments.

The second main clinical program, also in Phase 2, is TFF-TAC. This is another new dry powder inhalant of an established drug – this time of tacrolimus, an anti-rejection drug used on organ transplant patients. TFF’s inhalant version of this drug is designed to circumvent known problems of toxicity when tacrolimus is used in high doses. Interim data on both of these studies is expected in the second half of this year.

In addition to these two clinical trials, TFF has also been working to expand its footprint and ramp up operations. The company at the beginning of March announced a partnership with the pharma manufacturer Catalent, in a move to increase production of TFF’s products.

In a second major announcement, also in March, TFF revealed that it had entered into a Cooperative Research and Development Agreement (CRADA) for the development of dry powder inhalant medications that could deliver countermeasures to biological warfare agents. The program will be carried out in conjunction with the U.S. Army Medical Research Institute of Infectious Diseases (USAMRIID).

And now we get to the insider buy here. Aaron Fletcher, referred to above, is a member of TFF’s board, too, and purchased 542,000 shares this week. He spent $3.5 million on the buy, and now controls stock in TFFP worth a total of $4.468 million.

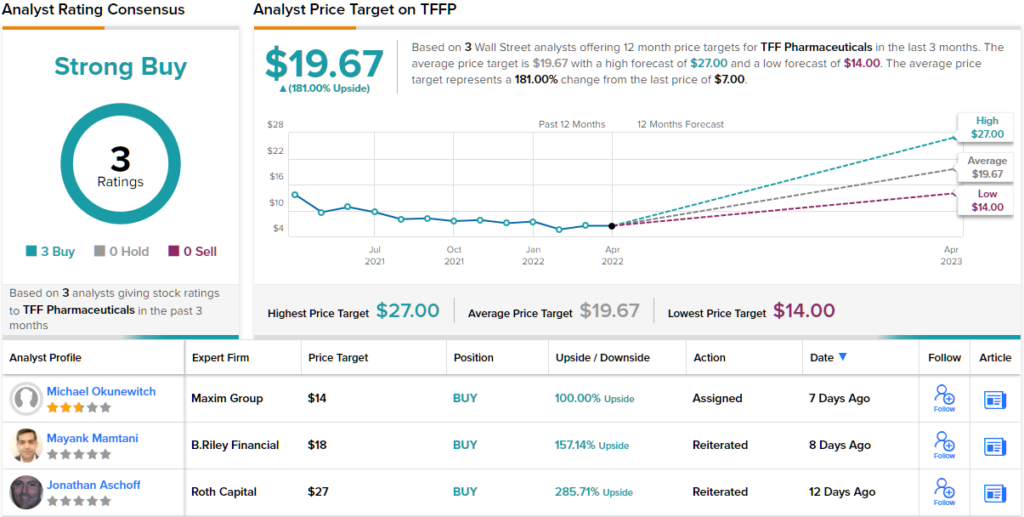

Also bullish here is analyst Michael Okunewitch, of investment firm Maxim Group. He believes that this stock presents a definite opening for investors, writing: “The TFF platform continues to be validated, in our view, through additional government and big pharma partnerships. With interim data approaching in 2H22 that could enable partnering discussions for TAC and VORI, as well as a growing pipeline of partnered programs, we view the company, at a market cap of <$165 million, as undervalued.”

These comments back up his Buy rating on the stock, and his price target of $14 implies a 12-month upside of 100%. (To watch Okunewitch’s track record, click here)

Overall, TFF shares get a unanimous thumbs up, with 3 Buys backing the stock’s Strong Buy consensus rating. Shares sell for $7, and the average price target of $19.67 suggests an upside potential of 181%. (See TFF stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.