Media reports are abuzz that OPEC+ (Organization of the Petroleum Exporting Countries and allies) nations are planning significant production cuts to increase oil prices. Notably, oil prices have trended lower over the past several weeks, and have fallen to 82.91/BBL (a barrel of crude oil) from about $110/BBL three months back. Production cuts to prop up oil prices will benefit companies like Exxon Mobil (NYSE:XOM) and ConocoPhillips (NYSE:COP).

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Production cuts, declining inventories, and ongoing demand could eventually drive oil prices higher. Reuters reported that OPEC+ could cut output by one million barrels per day (BPD). The move follows Saudi Arabia hinting that oil prices are not correctly mirroring the underlying fundamentals of demand and supply.

Against this backdrop, let’s examine why XOM and COP stocks could gain.

Is Exxon Mobil Stock Expected to Go Up?

Higher oil prices are a boon for Exxon, one of the world’s largest integrated oil and gas companies, and XOM stock could rise as a result. Investors should note that Exxon’s earnings and cash flows got a solid boost from higher price realizations in the first half of 2022.

Further, increased production and cost control measures will cushion earnings, support cash flows, help lower debt, and position Exxon to boost shareholders’ returns.

XOM stock commands a Strong Buy consensus rating on TipRanks based on eight Buy and two Hold recommendations. Further, these analysts’ average price target of $111.15 implies 27.3% upside potential.

It also has positive indicators from insiders who bought $88.2M worth of Exxon stock last quarter. However, hedge funds have sold 5.6M XOM stock during the same period.

Exxon stock has an Outperform Smart Score of 9 out of 10 on TipRanks.

What is the Target Price for COP Stock?

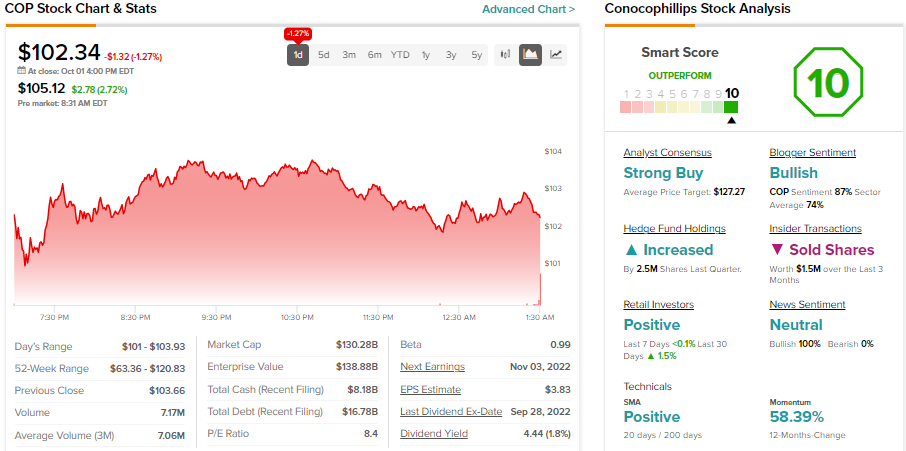

Wall Street is upbeat about ConocoPhillips stock, and analysts’ average price target of $127.27 implies upside of about 24.4%. ConocoPhillips is poised to benefit from higher oil prices, which is why analysts are bullish about its prospects.

COP stock commands a Strong Buy consensus rating on TipRanks based on nine Buy and two Hold recommendations. Further, TipRanks’ data shows that hedge funds have accumulated COP stock. Notably, hedge funds bought 2.5M COP stock last quarter. However, insiders have been net sellers. Per TipRanks’ data, insiders sold ConocoPhillips stock worth $1.5 million in the past three months.

With an increase in oil prices, COP is well-positioned to deliver robust earnings. Further, it could continue to reduce debt and return cash to shareholders. COP stock has a maximum Smart Score of 10 on TipRanks.

Bottom Line

A higher oil price environment is a positive for XOM and COP, which will drive their profits and fortify their cash position. For instance, the higher price realizations led COP to end Q2 with $8.5 billion in cash and short-term investments. Meanwhile, XOM had $18.8 billion in cash and cash equivalents at the end of the second quarter.

A strong cash position, a focus on debt reduction, and tight cost controls will likely act as catalysts for XOM and COP stocks.

Read full Disclosure