With China ready to leave its zero-COVID policy behind, the subsequent reopening and recovery could be a huge global boon. Undoubtedly, the consequences of Chinese lockdowns have spread well beyond China’s borders. With so many international firms dependent on the Chinese market for growth, many such names could experience a tailwind, even as a potential recession begins to move in.

The real question is whether China’s economic reopening and recovery can help offset the macro headwinds we’ve all grown familiar with.

Various analysts familiar with the matter think China’s economic recovery could arrive quicker than expected. Specifically, Citigroup (NYSE:C) economists are upbeat on China’s post-COVID recovery as it looks to bounce back from a sluggish 2022 that was its second-worst growth year in decades.

Therefore, let’s examine two stocks — Alibaba (NYSE:BABA) and Starbucks (NASDAQ:SBUX) — that look like prime candidates to rally higher on the back of a potential Chinese recovery in 2023.

Alibaba (NYSE:BABA)

Chinese e-tail and diversified tech kingpin Alibaba is one of the tech stocks that stands to benefit significantly from an easing of COVID-19 restrictions in China. Undoubtedly, Alibaba is likely one of the first names to come to mind when one hears of Chinese stocks. Though Alibaba has been making headlines for all the wrong reasons over the past two years, I finally think the behemoth is ready to turn a corner. I am bullish on the stock.

Recently, news broke that billionaire activist investor and “meme-stock king” Ryan Cohen had taken a big stake in Alibaba. Cohen is reportedly looking to encourage the firm to increase its share buybacks.

Alibaba stock endured a brutal peak-to-trough tumble, losing nearly 80% of its value at its worst. The stock has been trending higher in recent months but is still miles below where it was during its 2020 peak.

I think there’s still plenty of value in the name, and calls for share buybacks are more than warranted. At writing, shares of BABA trade at a mere 16.2 times trailing earnings multiple. That’s cheap, especially considering BABA stock has tended to trade at well above 20 times price-to-earnings (P/E) in the past.

It’s not just the sluggish Chinese economy that’s caused Alibaba stock to fall under such considerable pressure in recent years. Additional risks exist for U.S. investors. Delisting risk and other geopolitical unknowns make Chinese stocks, like Alibaba, a bit of a difficult name to value.

The way I see it, though, the perceived risks seem to be at or around a high point for the name, given how fast best-in-breed Chinese tech stocks have fallen out of favor. Further, I think Cohen’s influence could go beyond just pushing for buybacks. Even without further activism, Alibaba stock is just a bruised name that may not need much influence to march higher once China’s post-COVID recovery starts to kick in!

Personally, I think Cohen is making yet another brilliant and potentially timely investment when it comes to Alibaba. Yes, it’s a risky investment, but one that could accompany a sizeable payoff.

What is the Price Target for BABA Stock?

Wall Street still likes Alibaba, with a “Strong Buy” rating and a $138.53 average BABA stock price target that entails 15.8% gains from here.

Starbucks (NASDAQ:SBUX)

Starbucks is a coffee giant that views China as a key pillar of its growth. At this juncture, it’s difficult to gauge how much boom China’s post-COVID economy will give to Starbucks. Cowen recently stated that it thinks per-share earnings could surge up to 20% through 2025 due to China’s reopening. Such upbeat comments about Starbucks’ growth keep me bullish.

Undoubtedly, the Chinese expansion has been anything but smooth sailing. However, longer term, China’s fast-growing middle class could pave the way for a new leg of growth in a coffee giant that’s had mixed success in its home market of late.

Indeed, 2022 was a mixed year for Starbucks. The stock staged a big comeback after its 2021-22 “caffeine crash.” Over the past year, the stock is up just north of 10% and up 57% from its 2022 lows. The stock has heated up in a major way and could be poised to eclipse new highs if all goes well with China’s reopening and recovery.

Beyond the China expansion, I’m also bullish on Starbucks’ automation efforts, which could enhance longer-term margins and give a “jolt” to shares.

At 37.1 times trailing earnings, SBUX is slightly pricier than average restaurant stocks (which trade at 35.2 times trailing earnings). However, for the rich multiple, you’ll get powerful tailwinds that could kick in sooner rather than later.

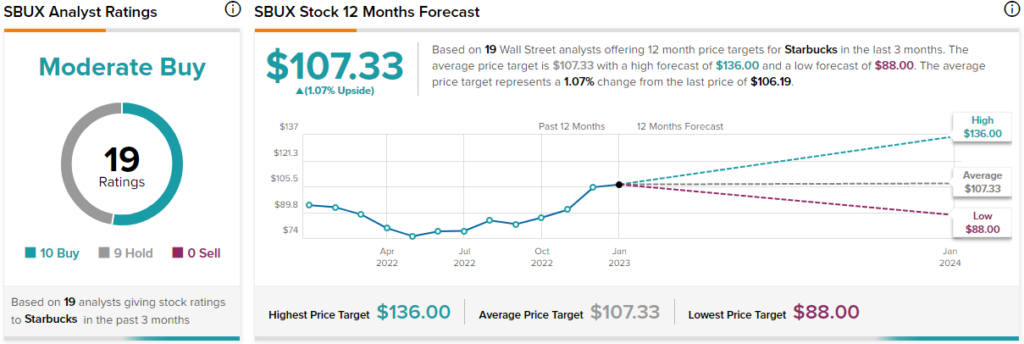

What is the Price Target for SBUX Stock?

Wall Street has warmed up to Starbucks. The average SBUX stock price target of $107.33 implies upside potential of just 1.1%. For a stock with a “Moderate Buy” rating, I expect price target upgrades to flow in over the coming weeks.

The Takeaway

Starbucks and Alibaba stocks are intriguing options to play a Chinese recovery. Out of the two, analysts expect more gains from BABA stock at current levels.