The COVID-19 pandemic brought about major disruptions in the global semiconductor chip supply, and shows no signs of ending. This has affected the automotive and electronics sectors, along with many other industries as well.

The prolonged chip shortage has given rise to a new problem — a shortage of chips for machines that manufacture chips. The ongoing Russia-Ukraine war is only adding to the pain by causing shortages in the supply of other materials that are necessary for the plating and fabrication of semiconductors.

Some executives in the chip-making business said that the time between the placement of an order to receipt of the equipment (also called lead time for chip delivery) went from months in the early 2020 to up to three years in some cases.

This condition of the chip market also tells us that the issue will not be resolved so easily and quickly. Intel (INTC) CEO Pat Gelsinger expects the chip supply scarcity to continue until 2024 at least.

GobalFoundries (GFS) CEO Tom Caulfield’s sentiments resonated with Gelsinger’s. Caulfield further said that he does not expect the balance to come soon.

Semiconductor Demand is Here to Stay

Demand for semiconductor chips is still raging. In February, global semiconductor sales grew 26.2% year-over-year to $52.5 billion, according to the Semiconductor Industry Association.

In 2021, sales activities in the chip industry crossed $500 billion for the first time, as demand for products that require chips burgeoned. This growth was recorded despite the increasing lead times for chip delivery.

Moreover, Gartner expects the global semiconductor revenues to reach a record high of $676 billion in 2022, advancing 13.6% year-over-year, fueled by demand.

It is safe to say that no matter what difficulties the chip industry faces, demand for semiconductor chips will never go out of fashion.

Looking Beyond the Shortages

Increasing sophistication and adoption of consumer electronics, automobiles (fuel-run manual, electric, and autonomous), industrial equipment, and communication products, are the biggest growth drivers for the semiconductor chip industry.

Rapid proliferation of Artificial Intelligence, Internet of Things, and Virtual Reality across various industries are also boosting chip demand.

In a fundamentally sound industry like the chip industry, investors looking for long-term gains should not fear the short- and mid-term growth obstructions. Here are two stocks that are best positioned to generate healthy returns.

Nvidia (NASDAQ: NVDA)

Nvidia is the pioneer of graphics processing unit (GPU), a chip that processes large amounts of data at lightning-fast speed. The company held more than 80% of the discrete GPU market share in 2021, and is also one of the leading companies in the data center market.

Investment bank Cowen & Co. expects Nvidia’s revenues to reach $140 billion and earnings per share to reach $28 by 2020, driven by various factors, one of which is the metaverse.

Recently, Morgan Stanley analyst Joseph Moore advised against selling Nvidia, saying that is it a “core holding” despite short-term risks.

Moore is strongly optimistic on the company’s long-term prospects, and market-leading position. However, he expects a significant deceleration in the area of gaming that can affect Nvidia’s prospects in 2023.

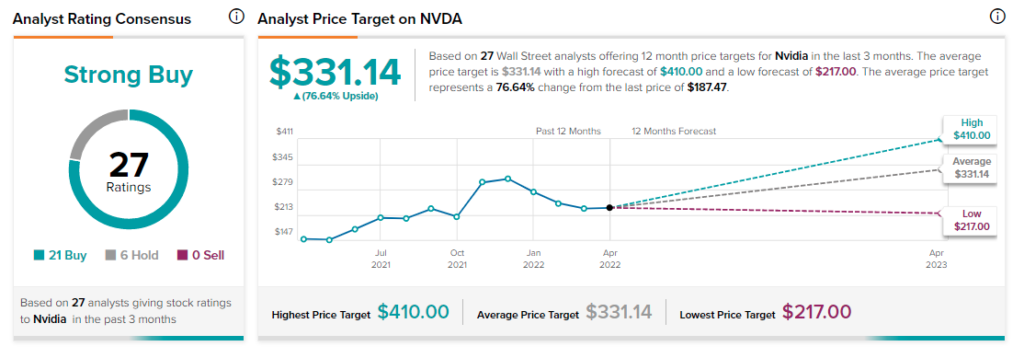

This prompted the analyst to give a Hold rating on the stock, with a price target of $217.

Wall Street maintains a bullish stance on the NVDA stock, with a Strong Buy rating based on 21 Buys and six Holds. The average Nvidia price target is $331.14.

Semtech Corporation (NASDAQ: SMTC)

Analog and mixed signal semiconductor producer Semtech is thriving in the industrial and infrastructure markets. Solid momentum in its 5G wireless and broad-based protection platforms, as well as other technologies like the LoRa Edge device-to-Cloud geolocation platform called LoRa Edge LR1120, are constantly driving its top-line growth.

Last month, Semtech introduced new features to the LoRa Edge LR1120, looking to penetrate the logistics space by addressing supply chain management challenges in the logistics industry.

In April, Piper Sandler analyst Harsh Kumar reiterated a Buy rating with a $95 price target on Semtech after an interview with C-suite executives of the company. Management was very positive about the company’s prospects in end-markets such as LoRa, data center, base station, and PON.

Management pointed out that the U.S. and China are looking to reduce supply chain dependence on each other in order to reduce geopolitical risks.

This is going to take time and keep lead times high for some years. Interestingly, as Semtech has two sources of supply, management feels that the company is better prepared than its peers to sail through this gap.

Wall Street is bullish on the SMTC stock, with a Strong Buy consensus rating based on six Buys and one Sell. The average price target for Semtech is $87.43.

Conclusion

The semiconductor industry has shown solid resilience during tumultuous times. Even as the markets have garnered big losses this year, with the technology sector being one of the largest casualties, the semiconductor industry has somewhat managed to stay afloat.

This demand is expected to continue as advanced technologies emerge across industries, as semiconductors form the core of advanced technology.

Thus, semiconductor stocks are most likely to keep a portfolio healthy and pay off in the long haul.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure.