The global economic scenario that is prevailing right now is a proverbial landmine for investors looking to deploy their capital. Multiple headwinds in the form of geopolitical tensions, supply-chain constraints, rising interest rates and inflationary issues are not only impacting their investment decisions but also limiting their choices.

TipRanks offers multiple tools to help investors make more informed decisions. One such option is TipRanks’ Website Traffic Tool. The tool uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, to highlight stocks that have been witnessing heightened website traffic in recent times. Rising website traffic alludes to the fact that these stocks are in the spotlight and can help investors in making safer choices.

Presently, the tool showcases two such stocks; let’s have a look at each of them.

Live Nation Entertainment, Inc. (NYSE: LYV)

Beverly Hills, CA-based Live Nation Entertainment is a global entertainment company that promotes, operates and manages ticket sales for live entertainment in the United States and internationally. It also owns and operates entertainment venues and manages music artists.

With a market cap of about $25.73 billion, the stock has performed better than the Nasdaq Composite Index so far this year, witnessing a decline of 6.8% against the index’s fall of 13.8%

Further, the company recently reported solid fourth quarter results. Revenues for the quarter stood at $2.7 billion, up 1039.1% year-over-year. For full-year 2021, the company’s top line witnessed a year-over-year rise of 236.8%.

Consensus among analysts is a Strong Buy based on six Buys and one Hold. LYV’s average price target of $137.14 implies upside potential of 21.4% from current levels. Shares have grown 37.7% over the past year.

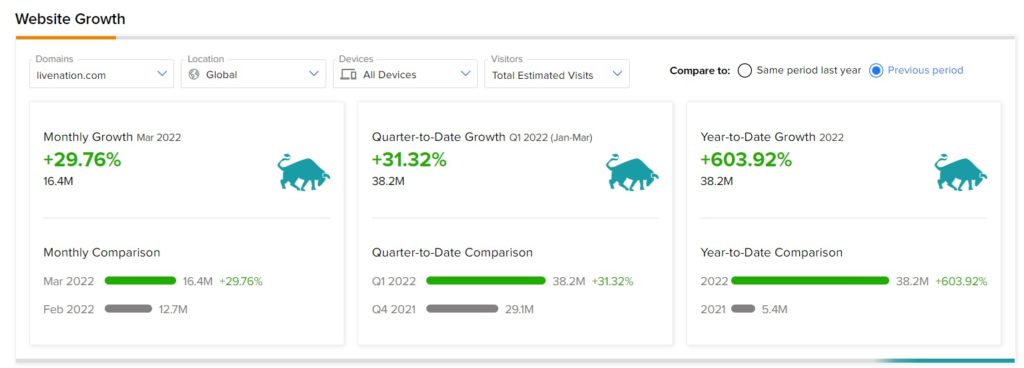

According to TipRanks’ Website Traffic Tool, the LYV website recorded a 29.76% monthly rise in global visits in March, compared to February. Further, the footfall on the company’s website has skyrocketed 603.92%, compared to the previous year.

Dada Nexus Ltd (NASDAQ: DADA)

China-based Dada Nexus is an online operator of local on-demand retail and delivery platforms. The company carries out its operations through its JD-Daojia and Dada Now platforms. It facilitates digitalized transformation for retailers and brand owners in selling products through online channels.

Although the stock has performed poorly compared to the Nasdaq Composite Index so far this year, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on DADA. Interestingly, 10.1% of portfolios tracked by TipRanks have increased their exposure to DADA stock over the past 30 days.

Overall, Consensus among analysts is a Strong Buy based on three Buys and one Hold. DADA’s average price target of $18.43 implies upside potential of 102.5% from current levels. Shares have, however, declined 63.5% over the past year.

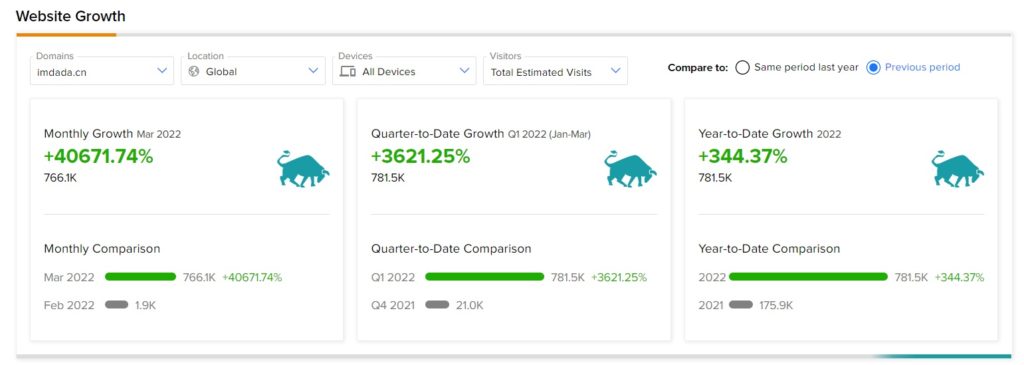

According to TipRanks’ Website Traffic Tool, the DADA website recorded a 40671.74% monthly rise in global visits in March, compared to February. Further, the footfall on the company’s website has grown 344.37%, compared to the previous year.

Key Takeaway

Although increased website traffic should not be the sole metric in making an investment decision, it sheds light on those stocks whose websites are witnessing increased visibility and provides further scope for research.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure