Earnings reports, analyst evaluations, corporate announcements, inflation, supply-demand mismatch, and a number of other variables might influence a company’s share price to rise or decrease.

But sometimes, it’s nothing more than market movers changing their positions from time to time. When day traders notice that a stock is rising in value, they purchase it, adding to the momentum. Likewise, when the stock’s price falls, they sell it, creating a market uproar.

This kind of price movement may not remain for long, and therefore trading them could be risky even for an experienced investor.

In such a scenario, TipRanks’ Smart Score System allows an investor to perform a more complete analysis of a company.

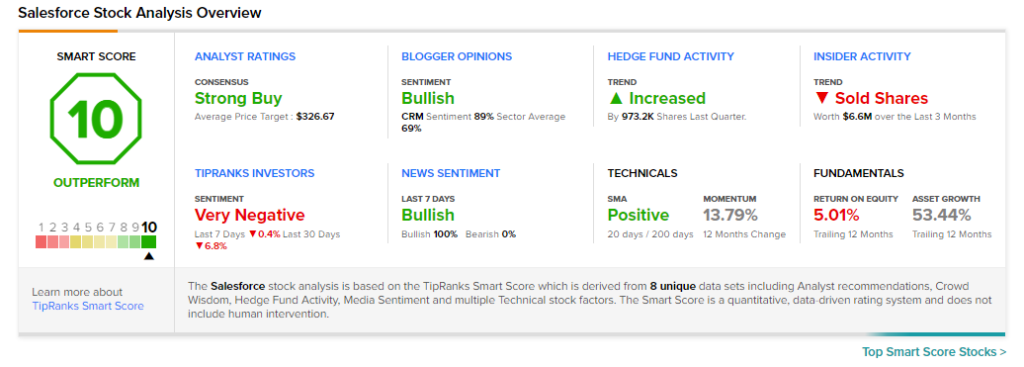

The Smart Score System is a data tool that combines eight important criteria, including fundamentals, technicals, hedge funds, investor and news attitudes, and insider trading activity. Each stock is then evaluated on a scale of one to 10, with ten being the best, to aid investors in making better decisions.

According to TipRanks’ Top Smart Score Stocks system, CRM and ACM are two “Perfect 10” stocks for investors to consider. Both stocks have received the maximum possible score of “10,” indicating that they represent attractive investment opportunities at the moment.

Salesforce

Salesforce (CRM) has been rated a “Perfect 10” since yesterday.

The firm is a pioneer in its sector, designing and developing cloud-based enterprise software for customer relationship management (CRM). The stock should continue to rise as the company’s array of commercial software services expands.

The firm will release its Q3 earnings on November 30.

Ahead of the earnings release, Morgan Stanley analyst Keith Weiss believes that Salesforce’s growth will be sustainable.

Weiss provides a number of compelling reasons to be positive about Salesforce. First, he says Salesforce will be able to take advantage of a robust software expenditure environment, because of its expertise in cloud computing and rapid digital transformation. Second, he believes the Slack buyout, completed earlier this year, will boost the upcoming quarter’s performance. Third, he expects Salesforce’s margins to continue to improve and increase in the foreseeable future.

Weiss, therefore, reiterated a Buy rating on the stock and a price target of $360.00, which implies about 21.3% upside potential to current levels.

Wall Street analysts have given Salesforce a Strong Buy consensus rating, with 38 recent ratings, including 32 Buys and 6 Holds. The company is now trading at $296.84, with the average CRM price target of $326.67, implying 10.1% upside from that level.

Interestingly, we used TipRanks’ new Website Traffic tool, which gets its data from Semrush (SEMR), to verify the company’s website traffic numbers. We saw that the number of unique visitors to Salesforce’s website climbed by 3.5% for the upcoming third quarter. This period was also highlighted by growing stock prices, which rose by 23.9%.

Salesforce’s fundamentals and prospects remain robust, as seen by increased website traffic and share price gain.

AECOM Technology

AECOM (ACM), an infrastructure consulting firm, has been rated a “Perfect 10” for the past two days. Planning, architectural and engineering design, consultancy, and construction management services are all provided by the organization.

AECOM reported its fiscal fourth-quarter 2021 earnings on November 15. The firm earned $0.81 per share in the fourth quarter, up 35% year over year. It’s worth noting that AECOM’s EPS has increased significantly during the last three years.

Revenue, on the other hand, fell 6% year-over-year to $3.35 billion. Despite this, net service revenues (NSR) increased by 6% for the quarter. This is the third quarter in a row that organic NSR growth has accelerated.

AECOM CEO Troy Rudd sounded bullish about the company’s future prospects on the Q4 conference call.

He said, “Demand for our technical, advisory and program management capabilities is increasing against a backdrop of an improving funding environment, highlighted by the recent passing of the federal infrastructure bill in the U.S., and rising demand for ESG (environmental, social and governance) related services, which underpins our expectation for accelerating revenue growth in fiscal 2022 and continued margin, adjusted EBITDA and adjusted EPS growth.”

Citigroup analyst Andrew Kaplowitz is likewise enthusiastic about the company’s future growth.

According to the analyst, the company’s end-market visibility in fiscal 2022 and beyond has improved as federal, state, and local government budgets have strengthened, as has private investment.

As a result, Kaplowitz reiterated a Buy rating on the stock but increased the price target to $85.00 from $81.00 per share, which implies about 15.9% upside potential to current levels.

In addition to its perfect Smart Score, AECOM also has a consensus rating of a Strong Buy. The stock is now trading at $73.35, with an average AECOM price target of $82.14 implying around 12% one-year upside potential.

Disclosure: At the time of publication, Shalu Saraf did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.