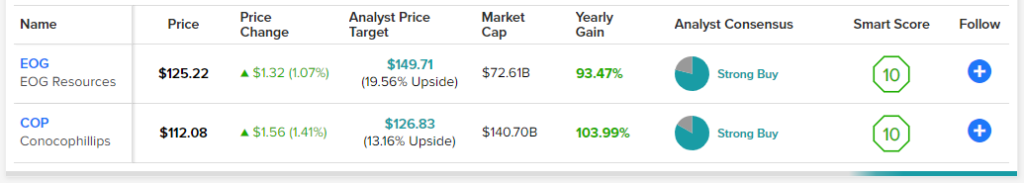

The signs of supply tightening are pushing oil prices higher. Using TipRanks’ Top Smart Score Stocks tool, we have zeroed in on EOG Resources (NYSE: EOG) and ConocoPhillips (NYSE: COP), which could gain from higher commodity prices. Both these stocks have earned a “Perfect 10” Smart Score and have decent upside potential.

Before we delve into stocks, let’s examine why crude prices are trending higher.

Saudi Arabia Considers Supply Cut

Bloomberg reported that Saudi Arabia’s Energy Minister Prince Abdulaziz bin Salman said that OPEC (Organization of the Petroleum Exporting Countries) could cut production to stabilize oil prices. The minister highlighted that oil futures are not in line with the underlying fundamentals of supply/demand.

The market is not pricing the impact of declining inventories, tight supply, and continuing demand that would eventually push prices higher.

With OPEC’s supply cut, underinvestment in new supply during the pandemic and the ongoing geopolitical headwinds could support a high oil price environment.

Against this setting, let’s look at why EOG and COP have a ‘Perfect 10’ Smart Score on TipRanks.

Is EOG Stock a Good Buy?

EOG Resources is an oil and natural gas exploration and production company in the United States. It stands to benefit from higher price realizations due to its increased exposure to oil and natural gas prices (following its strategy to reduce its hedge position), making it a stock worth considering.

Companies generally place hedges to protect themselves from the risk of large price swings in things such as commodities, currencies, interest rates, and more. A reduction in its hedge position allows EOG to gain more from oil and natural gas price increases but will protect the company less from price decreases.

Next, EOG’s low-cost structure and solid free cash flows augur well for growth and enable it to pay dividends regularly. EOG stock sports a Strong Buy rating consensus on TipRanks based on 11 Buys and three Holds.

Furthermore, the average EOG stock price prediction of $149.71 implies 19.6% upside potential.

Along with analysts, EOG stock has positive signals from hedge fund managers and retail investors. Hedge funds bought 68,900 shares of EOG last quarter. Meanwhile, 3.5% of TipRanks portfolios increased their EOG stock exposure in the past 30 days.

With positive indicators from analysts, hedge funds, and retail investors, coupled with favorable sector trends, EOG stock has a maximum Smart Score of 10 on TipRanks, implying it is more likely to beat the broader market averages.

Is COP Stock a Good Buy Now?

ConocoPhillips stock has more than doubled in the past year. Meanwhile, it is up approximately 55% this year alone. Despite the surge in its stock price, analysts remain upbeat about its prospects. COP stock has a Strong Buy rating consensus on TipRanks, and there are good reasons for that.

COP is well-positioned to benefit from the higher crude prices. Meanwhile, its acquisition of Shell’s (NYSE: SHEL) Permian assets will boost its business. Also, COP is making efforts to capture the energy transition opportunities and picked up an additional stake in Australia Pacific LNG (APLNG).

COP’s balance sheet remains strong, and the company is reducing debt (it retired $1.8 billion of debt in Q2). Further, its focus on returning solid capital to shareholders is positive.

Despite the significant rally in COP stock, its average price target of $126.83 implies 13.2% upside potential. Its Strong Buy rating is based on 10 Buys and two Holds assigned by analysts.

COP stock has a positive signal from hedge funds, which collectively bought 2.5 million shares last quarter. Meanwhile, 3.6% of TipRanks portfolios increased their COP stock exposure in the past 30 days.

With strong fundamentals and positive signals from analysts, hedge funds, and retail investors, COP stock has a maximum Smart Score of 10.

Conclusion: Favorable Commodity Prices to Support Energy Stocks

EOG and COP’s financials will likely get a boost from a higher commodity price environment. Both of these companies are strengthening their balance sheets, reducing debt, and focusing on enhancing shareholders’ returns. Further, their ‘Perfect 10’ Smart Scores indicate that they are more likely to outperform the benchmark index.