Recent earnings reports of several U.S. companies have clearly revealed how inflation is cutting into corporate profits and consumer spending. The S&P 500 (SPX) is now down 17.7% year-to-date as concerns about inflation, rising interest rates, supply chain woes and geopolitical pressures continue to weigh on investor sentiment.

In such turbulent times, investors can find it difficult to process huge data to pick attractive stocks from a universe of companies across various sectors. This is where the TipRanks’ Smart Score Tool comes to the rescue.

This data-driven, proprietary scoring system is built on eight key factors, including analyst ratings, hedge fund activity, insider transactions, as well as fundamental and technical indicators. Based on the 8 factors, the TipRanks Smart Score system arrives at a single rating for each stock, ranging from 1 to 10, with 10 being the highest.

Backtested results since 2016 reveal that stocks with a “Perfect 10” TipRanks Smart Score have generated an alpha of 73.2% over the S&P 500 index.

Let us look at two stocks with a “Perfect 10” TipRanks Smart Score, which indicates that they are likely to outperform the market.

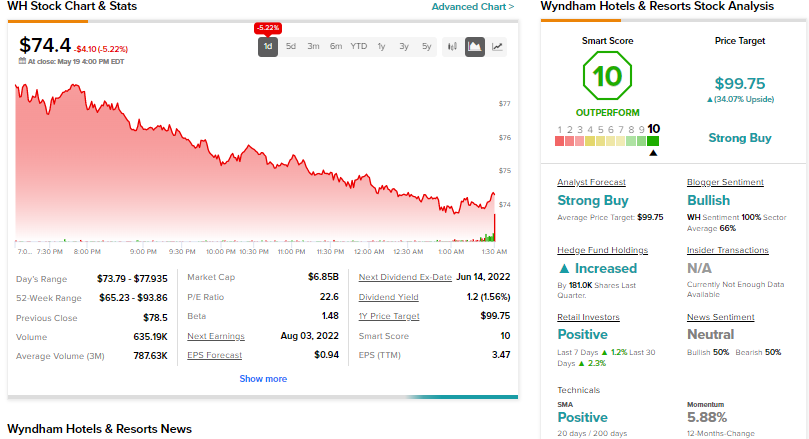

Wyndham Hotels & Resorts (NYSE: WH)

Wyndham is a leading hotel franchisor, with a strong presence in the economy and midscale segments of the lodging industry. It has over 8,900 hotels in more than 95 countries under 22 brands, including Super 8, Days Inn, Ramada, Microtel, La Quinta, and Wyndham.

Wyndham recently reported upbeat Q1’22 results, with revenue growing 22.4% to $371 million. RevPAR or Revenue per Available room, a key metric for hotels, grew 39% year-over-year on a constant currency basis to $34.06 fueled by stronger pricing power and higher occupancy levels.

Adjusted EPS jumped 164% to $0.95 driven by higher revenue, lower net interest expense and the impact of share repurchases.

Wyndham reaffirmed its RevPAR growth estimate of 12% – 16% for 2022, but raised the adjusted EPS outlook to $3.39 – $3.51 from the prior guidance of $3.28 – $3.40.

Calling the Q1 results “meaningfully better than expected,” Jefferies analyst David Katz stated that the quarter illustrated “the merits of WH’s business, which brings increased portfolio quality and continued stable cash flow generation.”

He also noted that asset sales and termination fees helped in bringing the company’s leverage below its target range, thus resulting in “increased flexibility on capital returns or prospective M&A, both of which should be key stock drivers.”

Katz maintained a Buy rating on Wyndham with a price target of $106.

Other analysts agree with Katz, with the stock earning a Strong Buy consensus rating based on four unanimous Buys. The average Wyndham price target of $99.75 implies 34.07% upside potential from current levels. Shares are down 17% year-to-date.

Turning to Smart Score, Wyndham recently earned a “Perfect 10” and has favorable signals from hedge funds and TipRanks investors, who have increased their exposure to the stock.

Costco Wholesale (NASDAQ: COST)

Costco is a membership-only warehouse chain, which sells an extensive range of products, including groceries, and discretionary items like electronic appliances and furniture, through 829 warehouses.

Costco has historically delivered consistent performance even during challenging times due to its lower price offerings, a low-cost business model and a loyal customer base.

Shares of Costco and several retailers plunged significantly on May 18, Wednesday, after investors were spooked by Target’s (TGT) weak earnings due to cost pressures. It will be interesting to see how Costco has fared in the most recent fiscal quarter when it announces its Q3 FY22 results on May 26.

Earlier this month, Costco reported better-than-anticipated sales for the April retail month (ended May 1, 2022). Costco’s April net sales grew 13.9% year-over-year to $17.3 billion, with comparable sales growth of 12.6%. The company stated that the April retail month had one less shopping day (due to the calendar shift of Easter), which adversely impacted its overall and comparable sales by 2% – 2.5%. That said, Costco’s April sales surpassed analysts’ expectations.

Heading into earnings, Evercore ISI analyst Greg Melich recently initiated a positive tactical trading call on Costco stock and increased his base case price target to $600 from $590. The analyst sees the upcoming results as the “outperformance catalyst.”

Melich noted that while Costco’s management doesn’t historically provide guidance, he believes that they might signal a solid start to May and provide enough information for the Street’s EPS estimate to move higher.

Melich stated, “Costco is posting three year same store sales trends of +33% on a core basis (ex gas/fx) globally vs. U.S. grocery sales trends that are up around 20%. Member additions have been accelerating during the pandemic, with renewal rates at record highs (+94%).”

Melich also feels that the stock’s 12-18 month outlook might benefit from two key potential catalysts—a potential membership fee hike and the possibility of a special dividend.

Overall, the Street has a moderate Buy consensus rating based on 16 Buys and three Holds. At $612.26, the average Costco price target implies 42.59% upside potential from current levels. Shares have plunged 24% so far this year.

Also, Costco has a “Perfect 10” Smart Score based on several factors, including positive signals from hedge funds, TipRanks investors, and financial bloggers.

Conclusion

Amid a broader market sell-off, shares of both Wyndham and Costco are in the red currently. That said, as indicated by the TipRanks Smart Score, both Wyndham and Costco have a higher likelihood of outperforming the broader market averages over the long-term.

This factor is something that investors will have to take into consideration when deciding where to place their cash. If indeed the U.S. economy is entering a recession, investing in fundamentally quality companies would most likely be highly beneficial.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure