Oversold stocks are what their name implies: stocks that have traded lower than they should, based on their fundamentals. It’s a subjective measure, of course; after all, for every seller, there’s a buyer. The key to success in buying into an oversold stock is recognizing when it’s getting near the bottom. These stocks typically make a comeback, even if they take their time about it. But once they do bounce, the potential for strong gains is very real.

We can check with Wall Street’s stock analysts to find which bargain-priced stocks are primed for gains. Once we know which stocks the experts recommend, we can start digging into their details. The data tools at TipRanks are ideal for this, letting us sort out stocks by a wide range of factors. The stock data plus the analyst commentary will together paint a comprehensive picture of any stock – a vital step before investing.

So let’s put that into practice. We’ve looked up the details on two stocks whose price is close to a one-year low – but which all have a Moderate or Strong Buy rating from the analyst community, and a one-year upside potential of at least 40%. Let’s take a closer look.

PJT Partners (PJT)

We’ll start with a look at global investment advisory firm PJT Partners. Founded in 2015 by Morgan Stanley’s Paul Taubman, PJT has quickly become one of the industry’s most prestigious investment banking and advisory institutions. The company has been involved in mergers & acquisition worth a combined $600 billion-plus in its short history, including the $59 billion T-Mobile/Sprint merger in 2020. While the firm is consistently profitable, its shares are down by 30% from the peak they reached this past October.

To start with, in 2H21, the company has shown revenues and earnings that are down year-over-year. Management described 2020 as ‘an extraordinary run up’ in reference to the firm’s business and described 2021’s environment for the firm’s core business as ‘a challenging market backdrop.’ These comments came in the context of the 4Q21 report, which showed top line revenue, at $313 million, down 3% year-over-year. EPS, at $1.52, was down 16% yoy. In line with the company’s historical patter, Q4 showed the highest quarterly results of the year. For the full year 2021, revenues came in at $991 million. This was down from $1.05 billion in previous year.

At the same time, despite the drop-off at the top and bottom lines, PJT saw fit in Q4 to raise its common stock dividend. The payment, which had been set at 5 cents, was quintupled to 25 cents per common share. At that rate, the dividend annualizes to $1 and yields a modest 1.5%. The key point to consider is not the yield, but large jump in the payment.

Covering the stock for Seaport, 5-star analyst Jim Mitchell writes that he remains bullish on PJT, including among his reasons: “1) given our greater confidence that restructuring revenue has bottomed, investors now have positive optionality should higher rates, supply chain disruptions, etc. create more restructuring opportunities; 2) momentum in strategic advisory (now PJT’s largest business) is strong heading into 2022, with new mandates doubling in the past two years; 3) Park Hill, which is highly leveraged to growth in alternative assets, also has a strong and growing pipeline…”

“We don’t believe the LT growth story is over for PJT, out year estimates are more defensible than most, and at 10.9x 2023E EPS vs. a 5-year average of 17x, the stock seems materially oversold,” the top analyst summed up.

Overall, Mitchell believes this is a stock worth holding on to. He rates PJT shares a Buy, and his $94 price target suggests ~49% upside potential. (To watch Mitchell’s track record, click here)

Are other analysts in agreement? Most are. 1 Hold rating is trounced by 3 Buys, and therefore, the message is clear: PJT is a Strong Buy. Given the $91.50 average price target, shares could surge ~45% in the next year. (See PJT stock forecast on TipRanks)

CalAmp (CAMP)

The second stock we’ll look at, CalAmp, is a change of pace from the finance industry. CalAmp deals in connected intelligence, applications, hardware, and cloud computing that make IoT function. The company’s products, from edge computing devices to subscription-based apps in vehicle tracking and management, have found niches in corporate fleet and supply chain administration. CalAmp boasts over 1 million software and services subscribers, and more than 20 million installed devices worldwide.

At the end of December, CalAmp’s stock fell sharply, dramatically accelerating a more gradual decline from the previous several months. For the past year, the stock is now down 50%.

The immediate cause of the drop was a financial release for Q3 of fiscal 2022 that failed to meet analyst expectations. The company reported $69 million at the top line, down 12% yoy. EPS, which has been positive for fiscal 3Q21, turned negative with an 8-cent per share loss. The conventional wisdom had expected a revenue total of $77 million and a positive EPS of 8 cents.

The company management cited the ongoing supply chain bottlenecks in the company’s quarterly miss. However, there were some bright spots. CalAmp’s software and subscription services gained a combined 7% year-over-year; while not enough to counter the overall hit, it was enough to prompt some analysts to maintain their bullish stance on the stock.

Among them is Michael Walkley, a 5-star analyst from Canaccord Genuity.

“We believe CalAmp shares are well oversold and present an attractive risk/reward profile. While part of the selloff followed disappointing November quarter results due to supply chain issues, we believe CalAmp’s strong recurring revenue business more than supports the current valuation even if applying no value to the profitable and strategic hardware business. In fact, we estimate CalAmp will generate roughly $150M in C2021 software and subscriptions services revenue.”

Walkley doesn’t hold back, and gives the stock a Buy rating with a $14 price target. If correct, the analyst’s objective could deliver one-year returns of ~147%. (To watch Walkley’s track record, click here)

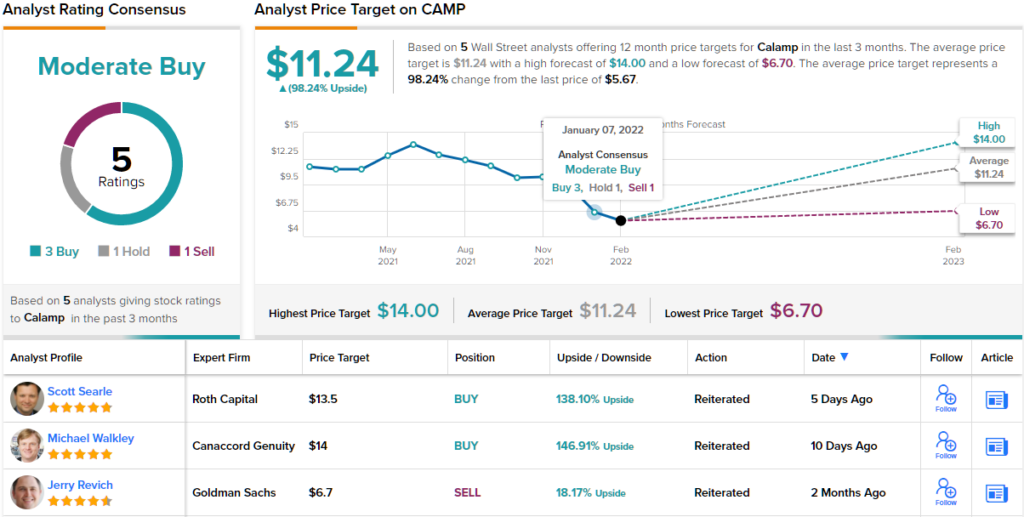

All in all, the recent reviews on CAMP, breaking down to 3 Buys, 1 Hold, and 1 Sell, give the stock a Moderate Buy consensus rating. Shares are priced at $5.67 and the average price target of $11.24 implies a one-year upside of 30%. (See CAMP stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.