Investors looking to generate passive income can consider investing in dividend stocks. At this juncture, the TipRanks Stock Screener tool comes in handy to shortlist stocks offering a dividend yield higher than 5% that have received Strong Buy recommendations from Wall Street analysts.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Let’s take a look at two such stocks with impressive dividend histories, W. P. Carey (NYSE:WPC) and Stellantis (NYSE:STLA).

W.P. Carey, Inc.

W.P. Carey is a real estate investment company that invests primarily in commercial properties. The company’s well-diversified portfolio supports its dividend hike strategy. Since going public in 1998, it has increased dividends every single year. Currently, WPC stock has an attractive dividend yield of 5.44%.

Last week, JMP Securities analyst Mitchell Germain reiterated a Buy rating on the stock with a price target of $86. The analyst sees a 10% upside potential in WPC’s share price from its current level.

Is WPC a Good Stock to Buy?

Wall Street is optimistic about W.P. Carey, giving it a Strong Buy consensus rating based on three unanimous Buys. The average WPC stock price target of $88 implies upside potential of 12.5% from here. Shares are up 13.6% over the past six months.

Stellantis N.V.

Stellantis is one of the largest automakers in the world. The company has been distributing generous returns to its shareholders. Last month, Stellantis raised its dividend by 28%. The company’s dividend policy seems sustainable based on its strong free cash flow generation and low payout ratio. Furthermore, the stock has a rock-solid dividend yield of 8.18%.

Earlier this month, RBC Capital analyst Tom Narayan upgraded the stock’s rating to Buy from Hold, while maintaining a price target of $20.61.

According to Narayan, Stellantis’ operating income margin levels are encouraging and compare well to those of its competitors. Furthermore, Narayan pointed out that the business has little presence in China, where automakers are facing increased competition.

Is STLA a Good Stock to Buy?

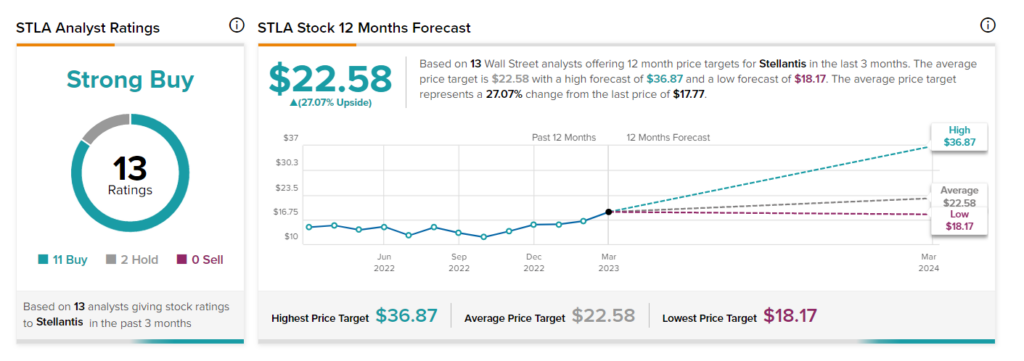

STLA stock has a Strong Buy consensus rating on TipRanks. This is based on 11 Buy and two Hold recommendations from Wall Street analysts. The average stock price target of $22.58 implies 27.1% upside potential. Shares have gained 21.8% so far in 2023.

Furthermore, Stellantis sports a “Perfect 10” Smart Score, implying it has the potential to beat the market averages.

Concluding Thoughts

As per analysts, WPC and STLA have the potential to generate strong returns based on solid fundamentals. Investors might want to consider adding these stocks to their portfolios to generate steady passive income.