Tesla (NASDAQ:TSLA) and Nvidia (NASDAQ:NVDA) stocks declined over 65% and 50%, respectively, in 2022, significantly underperforming the benchmark index. However, both of these stocks quickly recovered in 2023. TSLA gained about 60%, while NVDA marked an increase of approximately 46% year-to-date. While both of these stocks outperformed the S&P 500 Index (SPX) this year, analysts’ one-year price targets show limited or no further upside. Let’s dig deeper.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Is Tesla Stock Likely to Go Up?

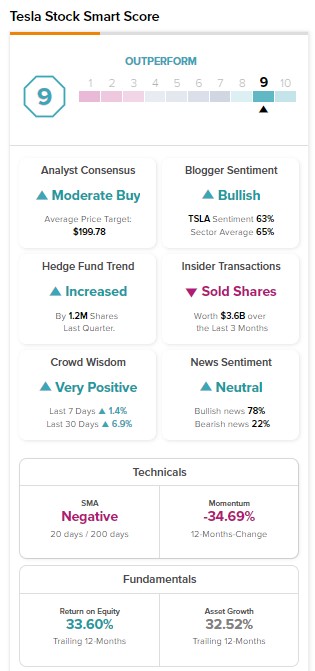

The consensus 12-month price target of $199.78 on TSLA stock suggests a limited upside of 1.47% over the next 12 months. Notably, Tesla stock jumped this year following its CEO Elon Musk’s positive commentary about demand and production during the Q4 (fourth quarter) conference call. Meanwhile, the company is seeing solid orders that are outpacing production.

However, economic uncertainty and pressure on consumer spending indicate a contraction in the automotive market in 2023, which could restrict the upside.

Tesla stock has received 21 Buys, six Holds, and three Sells for a Moderate Buy consensus rating. While analysts see limited upside, hedge funds are bullish about TSLA stock. Our data shows that hedge funds bought 1.2M shares of TSLA last quarter. Overall, TSLA stock has an Outperform Score of nine on TipRanks.

What is the Prediction for Nvidia Stock?

The demand uncertainty, slowdown in the end market, and inventory issues dragged NVDA stock lower in 2022. However, inventory issues are waning, which is a positive for semiconductor stocks like NVDA. Furthermore, the company will likely benefit from new products, including AI (artificial intelligence) and high-performance computing applications. In addition, Nvidia will likely benefit from the momentum in the Data Center segment.

The company is returning a significant amount of cash to its shareholders through share buybacks and dividends. However, positives appear to be priced in. Also, global macroeconomic uncertainty could pose challenges in the short term.

Nvidia stock has a Strong Buy consensus rating on TipRanks based on 22 Buy, five Hold, and one Sell recommendations. However, analysts’ average price target of $209.19 implies a downside of 1.63% from current levels.

Besides for analysts, hedge funds are also bullish about NVDA stock. Hedge funds bought 10.2M shares in the last three months. Also, NVDA stock scores a “Perfect 10” on TipRanks’ Smart Score system. Note: Shares with a “Perfect 10” Smart Score have historically outperformed the benchmark index.

Bottom Line

TSLA and NVDA stocks outperformed the broader markets in 2023. Moreover, both of these companies have an Outperform Smart Score on TipRanks. However, given the recent surge in their stock prices, the positives appear to be priced in.