As investors dumped stocks that produced great returns amid the pandemic, shares of several high-growth companies lost considerable value.

Furthermore, the U.S. Fed’s aggressive policy to curb inflation, an elevated cost environment, supply-chain disruptions, and an uncertain economic trajectory all contributed to a further decline in the growth stocks.

While the steep correction in high-growth stocks provides an opportunity to invest, not all stocks are worth buying the dip. To find stocks with strong potential to bounce back, let’s turn to the TipRanks Top Analyst Stocks tool. This tool helps investors identify the stocks that are most recommended by the best-performing Wall Street analysts. Leveraging this tool, let us take a look at two top-rated growth stocks.

Amazon (NASDAQ: AMZN)

Internet giant Amazon lost substantial value amid the recent selloff. Normalization in demand, incremental cost pressure, and the bleak short-term outlook are to be blamed for this decline.

Undeniably, tough year-over-year comparisons and cost pressure could hurt its near-term financials. However, the company’s growth could reaccelerate as comparisons ease and benefits from its investments start to show up. Also, incremental cost pressure could subside as the year progresses and the company begins to lap the higher cost environment.

What stands out is the continued momentum in its high-margin cloud business. Moreover, the strength in its advertising business is positive.

Showing confidence in AMZN stock, Stifel Nicolaus analyst Scott Devitt stated that Amazon is poised to benefit from its leadership position in the e-commerce and cloud sector. Moreover, he remains upbeat about the “emerging high margin marketing business.”

Devitt added, “we believe Amazon remains well positioned in a recovery scenario given cloud services, marketing services and certain eCommerce categories/geographies are still in the early phases of development.”

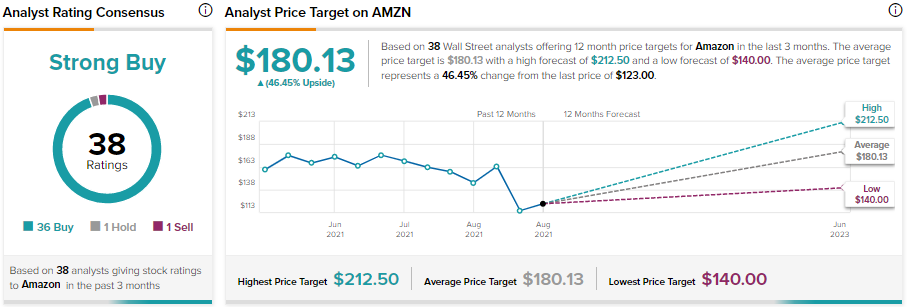

Along with Devitt, most Wall Street analysts are bullish about AMZN stock. It sports a Strong Buy consensus rating based on 36 Buy, one Hold, and one Sell. Further, the average analyst price target of $180.13 implies 46.5% upside potential.

Marvell (NASDAQ: MRVL)

Chipmaker Marvell continues to witness strong demand for its products, reflected by the stellar growth in its revenues. Despite the robust demand environment, MRVL stock has fallen quite a lot due to industry-wide supply constraints. Further, the negative investors’ sentiment amid the worsening of the macro headwinds remained a drag.

Nevertheless, the company’s management is upbeat about achieving strong growth driven by solid demand from the data center, 5G, and automotive end markets. Also, higher average selling prices led by increased sales of products with more content and features augurs well for growth.

What’s worth mentioning is that the company expects to see the benefits of its investments in supply-chain, leading to a much-improved supply outlook that would add to its growth. All in all, strong demand and an improving supply outlook bode well for growth.

Needham analyst Quinn Bolton has termed MRVL stock as his “Top Pick in Semis in 2022.” He added that Marvell is “one of the fastest growing large-cap semiconductor companies.” Bolton finds MRVL’s valuation attractive compared to its peers and recommends accumulating it at current levels.

Including Bolton, 17 analysts have rated MRVL stock a Buy. Meanwhile, it sports a Strong Buy consensus rating on TipRanks. The average analyst price target of $85.44 implies 40% upside potential.

Bottom Line

While these stocks have lost significant value, their fundamentals remain intact. Notably, most of their challenges are transitory, and they have multiple growth catalysts. Furthermore, analysts are optimistic about the prospects of these growth stocks.