In this piece, we used TipRanks’ Comparison tool to look closely at two fast-food firms — Yum! Brands (NYSE:YUM) and McDonald’s (NYSE:MCD) — to see which one is more capable of serving up solid gains for investors.

Fast-food stocks are great dividend payers for investors seeking to ride out a storm. Undoubtedly, demand for cheap (but still tasty) fast food tends to hold steady during times of economic turmoil. Though it’s tough to tell when the Federal Reserve will become dovish, I think it’s safe to say that today’s fast-food plays are a great way to do relatively well, regardless of the severity of next year’s economic slowdown or downturn.

Yum! Brands and McDonald’s are two top fast-food firms that boast attractive dividend yields just north of 2% at writing. Though both quick-serve restaurant (QSR) firms face stable prospects in a recession year, shares of both companies have been under pressure in recent months.

At writing, Yum stock is down 24% from its high, while McDonald’s stock is off just north of 12% from its peak. Indeed, broader market volatility has spread to the two QSR juggernauts despite the stable traits that helped them power through recessions in the past.

Yum! Brands

Yum is the firm behind the impressive trio of brands in KFC, Taco Bell, and Pizza Hut. Like most other franchisee-focused fast-food firms, Yum boasts an asset-light model that can allow it to sustain impressive earnings growth without having to bear the weight of hefty capital expenditures.

The company came up just shy of earnings estimates for three straight quarters. In the latest quarter (Q2), Taco Bell found itself doing a bit more of the heavy lifting versus KFC or Pizza Hut.

Undoubtedly, Taco Bell is just beginning an expansion at the international level after staying primarily within the U.S. market (around 90% of chains are in the states) for most of its lifetime. With intriguing menu innovation and the ability to command margins in the 20% range, Taco Bell is definitely a sleeper chain with a world of growth opportunities ahead of it.

Meanwhile, exclusive partnerships with delivery firm GrubHub and investments in ordering tech can help KFC and Taco Bell get up to speed with digital orders and catch up to the likes of Pizza Hut.

Undoubtedly, Yum’s managers know the ins and outs of delivery, thanks to their experience with the takeout-focused Pizza Hut. Around 5,000 KFC chains have delivery capacity. The firm wants to improve KFC’s delivery capabilities further and, of course, there’s Taco Bell, which has much catching up to do on the delivery front. I’d argue delivery is one of Taco Bell’s most intriguing growth opportunities over the next few years.

After slipping into a bear market (YUM stock is down pretty much in-line with the S&P 500), Yum stock trades at a modest 21.2 times trailing earnings and 4.7 times sales.

While Yum is a steady Eddie capable of growing its payout, investors aren’t getting much in the way of growth relative to other fast-food chains. Undoubtedly, Pizza Hut may act as a drag as Yum looks to increase unit counts across its banners. KFC and Taco Bell are top dogs in their respective fast-food sub-industries (fried chicken and Mexican food). Pizza Hut, though, faces stiff competition. Thus far, it’s been difficult to stand out from the pack.

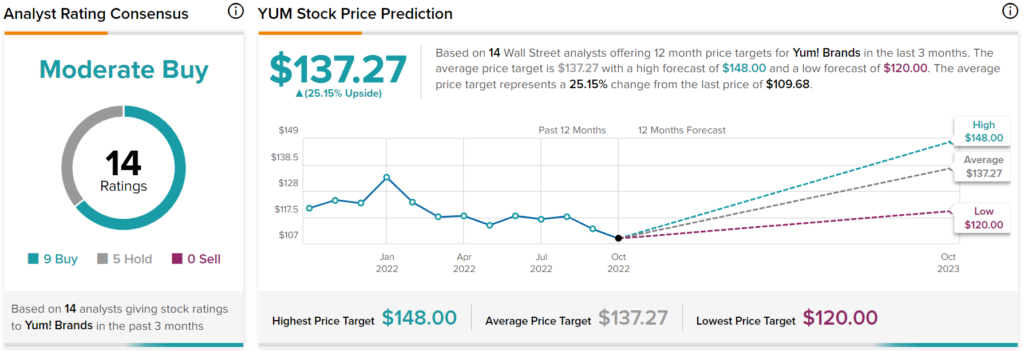

Is Yum a Good Stock to Buy?

Wall Street has a favorable view of Yum! Brands, with a “Moderate Buy” consensus rating based on nine Buys, and five Holds assigned in the past three months. The average YUM stock price target of $137.27 suggests 25.2% upside over the next year. Though Yum faces challenges, its strong brands and recession resilience make it a worthy pick-up going into a potential recession year.

McDonald’s

McDonald’s is a fast-food behemoth that only seems to get stronger with time. Under CEO Chris Kempczinski, McDonald’s has found a way to stand out from the crowd, with intriguing concepts like celebrity-endorsed meals. Menu innovation has also hit the spot for consumers, with the likes of the McCrispy chicken sandwich, which may very well take the throne away from the McChicken.

Indeed, McDonald’s hasn’t shied away from experimentation, and it’s paid off. With adult Happy Meals launched in the U.S. market, consumers have yet another reason to visit their local McD’s. With a magnificent mobile app, loyalty program, and digital-ordering capabilities, McDonald’s has also been able to dodge and weave past labor woes better than most other firms.

Now, the labor shortage was still a pressure spot for McDonald’s, given it serves tens of millions daily. Still, the company has done a fine job of doing everything under its power to power through industry headwinds.

Looking ahead, I’d look for McDonald’s to continue to use tech to its advantage, driving customer engagement and translating into more frequent sales.

Even without efforts, the harsh economic environment puts McDonald’s and its value-conscious menu at an advantage over its pricier peers in the restaurant industry. If anything, a hard-landing type of recession could allow McDonald’s to take more share and take its comparable store sales growth to the next level.

In the latest quarter, same-store sales surged nearly 10%. That’s much higher than the 6.2% that the Street was forecasting.

With capable leaders, promising momentum in digital orders, and newfound tech-savvy, I think MCD stock deserves every penny of its premium price tag. At writing, shares go for a rich 29.2 times trailing earnings and 7.3 times sales.

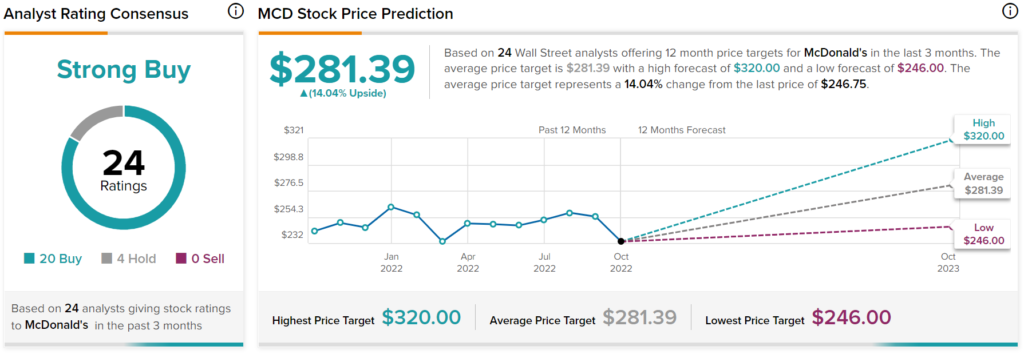

Is MCD Stock Overvalued?

Wall Street is still lovin’ McDonald’s with a “Strong Buy” consensus rating based on 20 Buys and four Holds assigned in the past three months. The average MCD stock price target of $281.39 implies 14% upside from current levels.

Conclusion: YUM and MCD are Stable Stocks for Unstable Markets

Yum! and McDonald’s are two fast-food heavyweights built for challenging economic environments. While valuations on both firms are on the rich side, I think they’re more capable of even richer multiples, as they look to raise the earnings bar while most other firms lower theirs.