As oil price reaches a new high and awareness about the environmental impact of greenhouse gas emissions continues to rise, more and more automakers are investing in the development of electric vehicles (EVs).

The latest automotive company to join the race is Germany-based Volkswagen (VWAGY), which plans to launch an all-electric SUV and pickup truck in the U.S. Other auto giants that recently entered the EV market are Ford (NYSE: F) and General Motors (NYSE: GM).

Since EVs are the future of mobility, it is the right time to invest in EV stocks. But how does one choose which stocks are worth investing in? This is where TipRanks’ Smart Portfolio tool comes into play. This tool enables investors to benchmark their portfolios against the best performing portfolios on TipRanks and also the average TipRanks Portfolios.

TipRanks’ Smart Portfolio tool has identified Lucid Group, Inc. (NASDAQ: LCID) and ChargePoint Holdings, Inc. (NYSE: CHPT) as two EV stocks worth considering. Let’s get to know more about these companies.

Lucid Group

Founded in 2007, Lucid Group manufactures EVs, batteries, and powertrains. The company manufactured its first all-electric vehicle in September last year and started the vehicle’s deliveries in October.

Lucid has an allocation of 2.8% in the Average Portfolio on TipRanks’ Smart Portfolio tool.

Last week, the California-based company reported a narrower-than-expected loss for the first quarter of 2022. The loss came in at $0.05 per share compared with the consensus estimate of a loss of $0.31 per share.

Revenues amounted to $57.7 million on deliveries of 360 vehicles during the quarter.

Peter Rawlinson, the CEO and CTO of Lucid said, “We continued to make progress in the first quarter of 2022 despite ongoing global supply chain challenges…While any extended disruptions could result in an impact to our production forecast, today we are reiterating our 12,000-14,000-vehicle production forecast for 2022 based on the information we have at this point combined with our mitigation plans.”

After the results were announced, Citigroup (NYSE: C) analyst Itay Michaeli maintained a Buy rating on the stock and lowered the price target to $36 from $45 (129.5% upside potential).

In a research note to investors, the analyst said, “There were no major surprises in Lucid’s Q1 results and the company offered a fairly encouraging update.”

Overall, the stock has a Moderate Buy consensus rating based on three Buys and one Sell. Lucid’s average price target of $38.25 implies 143.8% upside potential. Shares have lost 65% over the last six months.

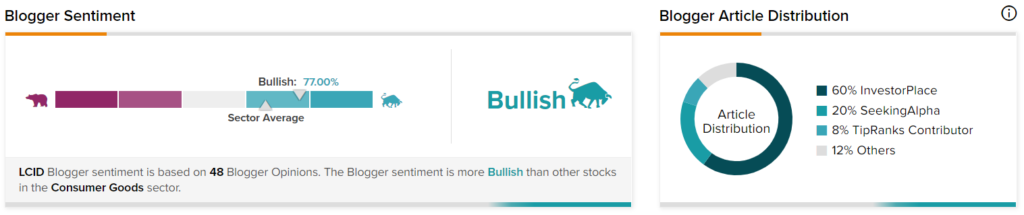

TipRanks data shows that financial blogger opinions are 77% Bullish on LCID, compared to the sector average of 66%.

ChargePoint Holdings

ChargePoint is an EV infrastructure company that develops and markets EV charging systems. It provides networked charging systems and cloud-based software and services to residential and commercial customers and fleet operators. It has EV charging stations in 14 countries.

The company has an allocation of 2.3% in the Average Portfolio on TipRanks’ Smart Portfolio tool.

Headquartered in California, ChargePoint is scheduled to release the results of its fiscal first quarter, which ended on April 30, on May 31. The consensus loss estimate stands at $0.20 per share, and the company reported a loss of $0.17 per share in the first quarter of last year.

Last month, Piper Sandler (NYSE: PIPR) analyst Kashy Harrison reiterated a Hold rating on the stock with a $20 price target (107.9% upside potential).

The analyst said, “The rapid growth they (ChargePoint) are currently experiencing will translate into FCF (free cash flow) over the next several years.”

Overall, the stock has a Strong Buy consensus rating based on nine Buys and three Holds. CHPT’s average price target of $24.58 implies 155.5% upside potential. Shares have lost 64.3% over the last six months.

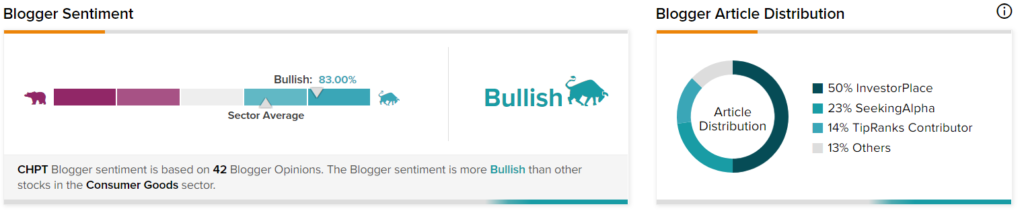

TipRanks data shows that financial blogger opinions are 83% Bullish on CHPT, compared to the sector average of 67%.

Parting Words

Even though both Lucid and ChargePoint stocks have fallen more than 60% over the last six months due to global economic uncertainties and supply chain issues, the EV sector is expected to witness significant growth in the future.

An increased number of countries across the world are adopting an electric mode of transport with an aim to bring down their carbon footprint. It is only a matter of time before the sector booms.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure