In an action that the world community neither needed nor desired, Russia nevertheless made the dangerously unsettling decision to invade neighboring Ukraine earlier this year. In doing so, the terrifying action solidified Ukrainian resolve and identity, leading to a remarkable fight for independence. Sadly, the Kremlin broadcasted no intention of backing down, thus cynically bolstering two defense stocks to buy in particular, RTX and AVAV.

During the onset of the military invasion, few observers gave the Ukrainians a chance. While undoubtedly intrepid, the beleaguered nation was going up against one of the great military powers of human history. Yet, the will to fight for independence – along with critical western-supplied weapons systems – shockingly kept the Ukrainians in the arena.

From that fateful February invasion, three events materialized that indicated that the Russian belligerents had and still have zero intention of backing down. First, in retaliation for western support of Ukraine, Moscow cut critical energy outflows to Europe. This decision removed any pretense about Russia reentering normal relations with the global community for at least several years to come.

Second, after suffering steep losses and setbacks, Russian President Vladimir Putin issued a partial military mobilization. Significantly, the declaration represented a tacit admission that the invasion was no longer a “special military operation.” Instead, it was a full-blown war, one that Putin appears determined to engage in until the bitter end.

Third and finally, Ukrainian forces in September launched a massive counteroffensive, retaking significant chunks of land in the nation’s eastern region. Recently, Ukraine also achieved significant successes in the Kherson area, suggesting a further escalation of the conflict. Already, Russia hinted at the use of nuclear weapons.

All this is to say that the Ukraine conflict will likely not end anytime soon. Therefore, from a purely cynical perspective, certain defense stocks to buy may benefit from battlefield tailwinds.

Raytheon Technologies (NYSE: RTX)

One of the most instrumental defense stocks to buy throughout this conflict, Raytheon Technologies undergirded much of Ukraine’s early campaigns to defend key cities and regions. For one thing, Raytheon – in partnership with Lockheed Martin (NYSE: LMT) – developed the Javelin anti-tank missile. With the ability to shoulder fire the weapon, the Javelin caught several Russian tanks off guard, to their catastrophic detriment.

In the second phase of the conflict, Raytheon’s Stinger anti-aircraft missile helped Ukrainian forces impose fear on Russian pilots. Also capable of being fired from the shoulder, death could come from anywhere. As a result, Russia was unable to gain air superiority, leading to their battlefield losses.

Moving forward, as Ukraine aims to take back all of its territory (including Crimea), these portable weapons systems will be invaluable. Therefore, RTX easily ranks among the defense stocks to buy.

Financially, Raytheon rates as a fairly-valued investment, according to GuruFocus, which pegs its fair value at $90.77 per share. Although its longer-term growth trajectory could use improvement, in the second quarter of 2022, the company posted revenue of $16.3 billion, up 2.7% against the year-ago period.

Perhaps most significantly, the defense contractor’s net margin stands at 6.8%. In contrast, the defense and aerospace industry features a median net margin of 3.67%.

Is RTX a Good Stock to Buy?

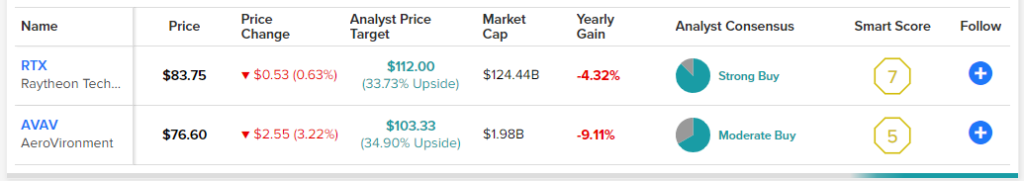

Turning to Wall Street, RTX stock has a Strong Buy consensus rating based on seven Buys, one Hold, and zero Sell ratings. The average RTX price target is $112.00, implying 33.7% upside potential.

AeroVironment (NASDAQ: AVAV)

One of the lesser-known defense stocks to buy outside of sector experts, AeroVironment widely drew acclaim for helping Ukrainian forces get out of purely defensive postures and begin launching counteroffensives. AeroVironment specializes in unmanned aerial vehicles (UAVs), particularly its Switchblade drone.

Known as a suicide drone, the Switchblade can loiter over several miles, keeping the operator away from immediate harm. From there, it seeks viable targets. Once identified, the operator gives the signal, sending the Switchblade barreling into the target and hopefully destroying it.

Drones have played significant roles in this conflict, both as weapons systems and as intelligence-gathering platforms. As the conflict continues to march on toward the winter season, Ukrainian forces will be motivated to take back as much territory as possible. Therefore, the Switchblade should maintain its relevance.

Financially, AVAV represents one of the most intriguing defense stocks to buy, mainly because it’s still modestly undervalued, with its fair value calculated at $94.55. The company enjoys decent stability in its balance sheet, notably an equity-to-asset ratio of 0.67 times. In contrast, the industry median is 0.46.

On its income statement, AeroVironment’s three-year revenue growth rate stands at 11.4%, much higher than the sector median’s 1.8%. Also, the company features a nine-year history of profitability. Given the relevance boost, AVAV could possibly rise higher.

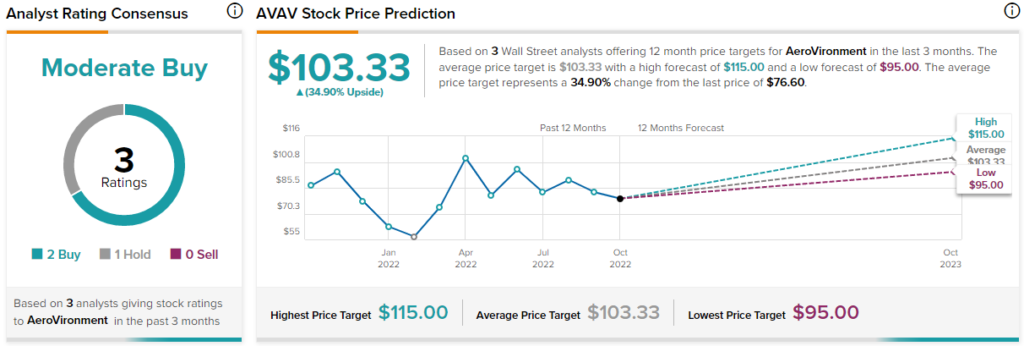

Is AVAV Stock a Buy or Sell?

Turning to Wall Street, AVAV stock has a Moderate Buy consensus rating based on two Buys, one Hold, and zero Sell ratings. The average AVAV price target is $103.33, implying 34.9% upside potential.

Conclusion: Cynical Hedging Opportunities

Since military conflicts do not represent everyone’s cup of tea, the above defense stocks to buy carry a controversial profile. However, those that are geopolitically agnostic and looking to hedge against other macroeconomic headwinds may want to look closely at RTX and AVAV.