The S&P 500 (SPX) and the tech-heavy NASDAQ 100 (NDX) have plunged into the bear territory, down nearly 23% and 32%, respectively, year-to-date, as of Thursday, June 16. Further, the Dow Jones Industrial Average fell 741.46 points on Thursday, coming below the key 30,000 level for the first time since January 2021. Investors are concerned that the Federal Reserve’s aggressive approach to tame inflation might push the economy into recession.

In such a tough market backdrop, the TipRanks’ Smart Portfolio tool helps investors make prudent investment decisions. This tool allows investors to benchmark their portfolios against the Top-Performing TipRanks Portfolios. It helps in comparing asset and sector allocation, dividend yield, and certain other parameters of the investor’s portfolio with the Top-Performing TipRanks Portfolios.

Let’s take a look at two consumer goods stocks that are a part of the Top-Performing TipRanks Portfolios. Interestingly, the consumer goods sector accounts for 27.57% of the Top-Performing TipRanks Portfolios.

Nio (NYSE: NIO)

Nio shares are down nearly 40% year-to-date due to supply chain pressures and the impact of COVID-led lockdowns on production. Investors were also worried about the potential delisting of several Chinese shares from the U.S. stock exchange, but Nio has now listed its shares on the Singapore and Hong Kong exchanges to mitigate such concerns.

This week, Nio launched its ES7 sports utility vehicle, for which deliveries are expected to commence on August 28. While Nio might continue to be under pressure in the near term due to supply-chain bottlenecks, Wall Street analysts remain optimistic about the electric vehicle (EV) maker’s long-term prospects.

Mizuho analyst Vijay Rakesh believes that battery EVs continue to be a “bright spot” amid macro challenges. Rakesh feels that battery EV sales in May in key EV markets could be recovering well from the impact of lockdowns in March and April. May sales were up 19% month-over-month, driven by China’s rebounding by 80%.

Rakesh highlighted that global battery EV penetration in May increased to about 11.4%, up from 8% in 2021. The analyst believes that while lockdowns in the key China market remain mixed, Shanghai re-opening and government stimulus bode well for a strong second half and could benefit Nio and Tesla (TSLA).

Despite near-term headwinds related to logistics and chip shortages, Rakesh believes that EV secular trends remain strong and Nio, Tesla, and Rivian (RIVN) are all “positioned well.”

Rakesh reiterated a Buy rating on Nio stock with a price target of $55.

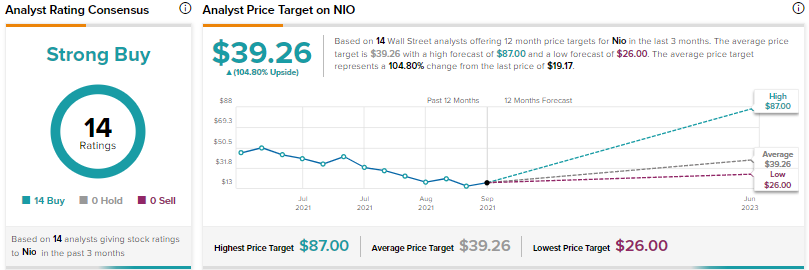

Overall, Nio scores a Strong Buy consensus rating based on 14 unanimous Buys. The average Nio price target of $39.26 implies 104.80% upside potential from current levels.

Coca-Cola (NYSE: KO)

Coca-Cola, one of the leading non-alcoholic beverage companies in the world, impressed investors with its stellar first-quarter results. The company’s first-quarter revenue grew 16% to $10.5 billion, fueled by a robust recovery in the away-from-home channels (like restaurants and movie theaters) following the reopening of the economy, and continued growth in the at-home consumption channels.

Strong top-line growth and the company’s pricing power helped drive a 16% rise in adjusted EPS to $0.64, more than offsetting the impact of inflationary pressures and higher marketing investments.

Morgan Stanley analyst Dara Mohsenian feels that analysts’ consensus estimate for Coca-Cola’s 2022 and 2023 revenue is too low, while he continues to have a “high degree of conviction” that the company will deliver above-consensus revenue growth in both the years based on his analysis.

Mohsenian believes that Coca-Cola’s pricing power and recovery in the away-from-home channel post-COVID drive much better near-term visibility for the company than its consumer packaged goods peers.

Mohsenian also sees better EPS visibility for Coca-Cola than its peers given “2022 revenue upside, stronger pricing power with limited demand elasticity, and a more manageable cost/demand elasticity vs. pricing gap.”

Mohsenian reiterated a Buy rating for Coca-Cola stock with a price target of $76.

Overall, the Street has a Strong Buy consensus rating on Coca-Cola stock based on 12 Buys and four Holds. At $71, the average Coca-Cola price target suggests 20.20% upside potential from current levels.

Conclusion

Despite macro challenges, Wall Street analysts continue to be bullish about Nio and Coca-Cola, which are part of TipRanks’ Top-Performing Portfolios. While Nio is expected to benefit from the increasing demand for EVs, Coca-Cola is anticipated to continue to dominate the non-alcoholic beverage space with its extensive global presence, continued innovation, and brand power.

Further, both Nio and Coca-Cola score nine out of 10 on TipRanks’ Smart Score rating system, indicating that these stocks are likely to outperform the broader market.

Read full Disclosure