The rising back-breaking inflation, geopolitical tensions and supply-chain challenges continue to haunt companies and capital markets across the globe. Adding to this is the slowdown in the Chinese economy, which is further expected to put additional pressure on costs and supply chains.

We, at TipRanks, understand that choosing the right stocks in these most uncertain times can be both tedious and daunting. Therefore, we bring to you TipRanks’ Smart Portfolio tool, which can help investors in making prudent as well as profitable investment choices.

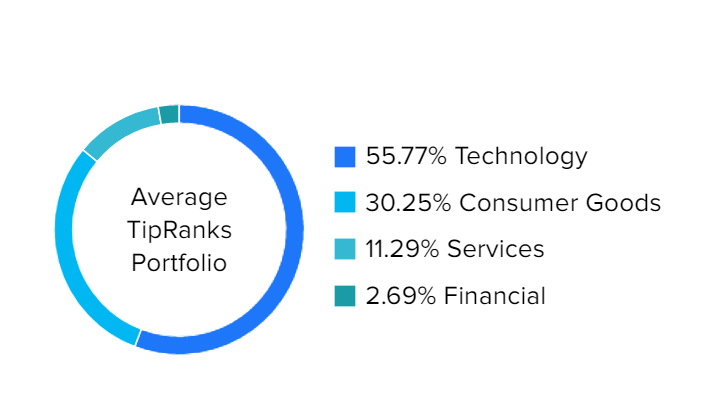

The TipRanks Smart Portfolio allows investors to benchmark their portfolios against the best performing portfolios on TipRanks and also the average TipRanks portfolios.

Consumer goods is one of the top-performing sectors on TipRanks. The sector enjoys a 27.13% allocation on Top-Performing TipRanks Portfolios and 30.25% on Average TipRanks Portfolios.

Now, let’s take a look at two stocks that are a part of Top-Performing TipRanks Portfolios.

Ford Motor (NYSE: F)

With a market capitalization of $52.7 billion, Ford is a global automobile company engaged in designing, manufacturing, and selling cars, trucks and automobile parts. The company occupies 3.1% of Top-Performing TipRanks Portfolios.

Last month, Ford reported better-than-expected results for the first quarter. Also, it reiterated its 2022 outlook based on the strong demand and pricing environment for new and existing vehicles.

Last week, Ivan Feinseth of Tigress Financial maintained a Buy rating on Ford with a price target of $22 (67.7% upside potential from current levels).

Overall, the Street has a Moderate Buy consensus rating on the stock based on eight Buys, nine Holds and two Sells. Ford’s average price target of $19.94 implies 52% upside potential from current levels.

Lucid Group (LCID)

Lucid Group has a current market capitalization of $31.5 billion. The company is involved in manufacturing EVs, batteries, and powertrains. LCID stock enjoys a 3% stake in Top-Performing TipRanks Portfolios.

Despite supply-chain constraints, the company’s earnings and revenue surpassed Street’s estimates. Further, Lucid has been able to maintain its production volume outlook of 12,000 to 14,000 vehicles for the year.

Recently, Citigroup analyst Itay Michaeli reiterated a Buy rating on Lucid with a price target of $36 (90.6% upside potential from current levels).

Overall, the Street has a Moderate Buy consensus rating on the stock based on three Buys and one Sell. LCID’s average price forecast of $38.25 implies approximately 102.5% upside potential from current levels.

Closing Note

Given their presence in Top-performing Portfolios on TipRanks and a sound financial outlook, the above-mentioned consumer goods stocks can be considered by investors.

Read full Disclosure