It’s fair to say, with hindsight, that 2021 was a year for the bulls – but so far, 2022 is starting out with the bears. Over the past three weeks, markets are moving from overall gains into correction territory, with drop most pronounced – upwards of 10% – in the tech-heavy NASDAQ.

The Wall Street pros are somewhat divided in their approach to the situation. The bulls are telling us that this is a normal correction, stay the course, and we’ll get back to positive territory. The bears have a different tale to tell. Prominent among them is Mike Wilson, of Morgan Stanley, who sees a combination of slowing growth and a shift in Federal Reserve monetary policy weighing on the markets in the near future.

Wilson believes that the coming month will see another sharp drop in the markets. “This type of action is just not comforting. I don’t think anybody is going home feeling like they’ve got this thing nailed even if they bought the lows,” he says, adds that the Q4 earnings and guidance reports now coming out are unlikely to calm investors’ worries.

“I need something below 4,000 to get really constructive. I do think that’ll happen.” Such a drop would mean at least 9% fall for the S&P, from current levels. Against this backdrop, Wilson advises investors to buy into defensive stocks.

And that, of course, brings us to dividend stocks. These are the classic defensive plays, giving investors a dual path toward returns, from both the share appreciation and the dividend payments.

Using TipRanks database, we’ve pulled up the info on two dividend stocks that recently gotten some love from the Street’s stock watchers. These are Strong Buy equities with dividend yields at ~7%. Here are the details.

Ladder Capital (LADR)

We’ll start with a real estate investment trust (REIT), a logical place to start looking for high-yield dividends. These companies face regulatory requirements on the return of profits to shareholders, and frequently use dividends as the vehicle for those returns. The result: reliable dividends, yielding well above the ~2% found in the broader markets.

Ladder Capital specializes in commercial mortgages, providing capital in the commercial real estate (CRE) sector. The company’s main business is in senior first mortgages and floating rate loans, with commercial properties as collateral. It also invests in CRE mortgage-backed securities, and owns and operates a portfolio of commercial properties. Overall, Ladder has over $5.4 billion in assets, as of the end of 3Q21.

That quarter was the company’s last reported, and Ladder beat expectations on its earnings. At the bottom line, the company reported 14 cents per share in distributable income, against a forecast of 9 to 10 cents. This marks a 40% minimum beat, as well as a 40% gain from the second quarter. Taken together with the company’s reported $758 million in cash and liquid assets, it’s easy to see how the company had the confidence to maintain its dividend.

The most recent dividend, declared in December and paid out earlier this month, was for 20 cents per common share. After cutting the dividend in the spring of 2020, Ladder has held it at its current level for seven consecutive quarters. At 80 cents annualized, it yields a strong 7%.

In coverage of Ladder for B. Riley Securities, analyst Matt Howlett points out that some stocks are better-positioned for rising interest rates than others, and Ladder is one of them.

“With investor attention now squarely focused on higher interest rates, LADR remains uniquely positioned to benefit from the anticipated 3-4 rate hikes in 2022… LADR is the only CRE mREIT that we reviewed in which its interest rate sensitivity showed positive NII for an increase in interest rates. At 3Q21, LADR showed a positive $17.5M ($0.11/share) for a 100-bp simultaneous rise in interest rates. This sensitivity should increase as the portfolio shifts to new production with LIBOR floors,” Howlett noted.

“With the stock trading at 0.9x adjusted or undepreciated book value, we believe investors still have an attractive entry point… We continue to expect LADR to cover its $0.20 dividend with core earnings by 1Q22 and then begin increasing it by mid-2022,” Howlett summed up.

These comments, and a price target of $14, support Howlett’s Buy rating on the shares. His target suggests it has an upside of 21% for the rest of this year. (To watch Howlett’s track record, click here)

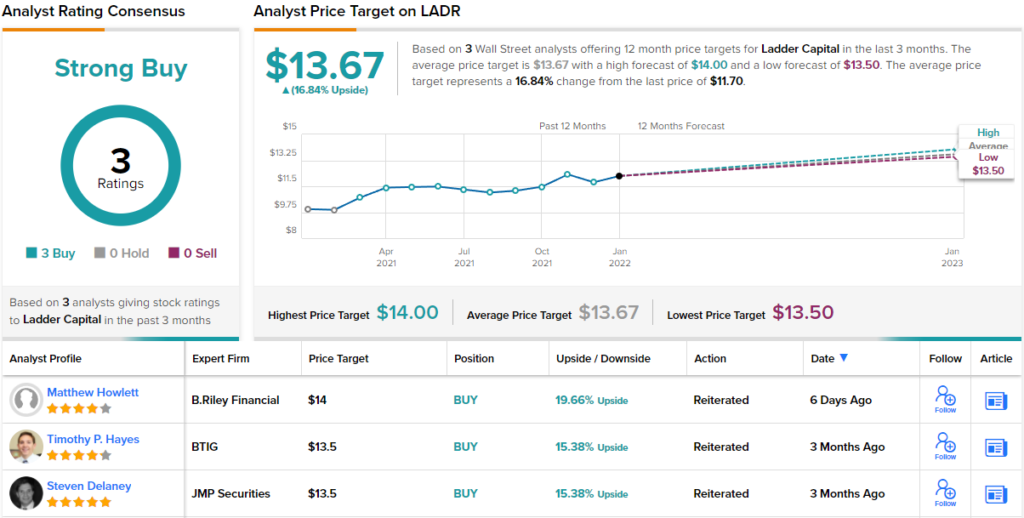

Turning now to the rest of the Street, other analysts are on the same page. With 3 Buys and no Holds or Sells, the word on the Street is that LADR is a Strong Buy. The stock has a $13.67 average price target and a share price of $11.72, for a one-year upside potential of ~18%. (See LADR stock forecast on TipRanks)

Redwood Trust (RWT)

The second dividend stock we’re looking at, Redwood Trust, is another REIT. Redwood’s focus is on the residential real estate sector, where it invests in ‘resis,’ or residential mortgage-backed securities. The company also has investments in prime jumbo residential loans and multifamily securities backed by the Federal government through Freddie Mac and Fannie Mae.

Redwood’s shares have gained steadily last year, and even with this January swoon, the stock is still up 48% in the last 12 months. The gains come as the company has been reporting steadily, profitable earnings – earnings which saw a hefty jump in 3Q21. In that quarter, Redwood reported $88 million GAAP net income, or 65 cents per share, almost 6x the Q2 result and more than 9x the 3Q20 earnings. The company also reported a sound balance sheet, with a powerful reserve of unrestricted cash totaling $557 million as of September 30, 2021.

Large profits and plenty of cash make the foundation of a reliable dividend. Redwood has a history of keeping up its payments, although it did have to cut back on them in the spring of 2020 due to the COVID crisis. Since then, however, the company has been edging the dividend back up. The cut took it down to 13 cents per common share in June 2020; the most recent payment was 23 cents, in December 2021.

That 23 cent dividend payment marked a 9.5% sequential increase, and the fourth consecutive increase, in the payout. Since the dividend was pared back, it has been raised 5 times. The current payment annualizes to 92 cents per common share, and gives a robust yield of 7.7%.

Eric Hagen, writing from BTIG, sees the dividend as a key point here. He says in a recent note on Redwood: “It has raised the dividend each quarter this year, reinforcing the healthy earnings which were generated on the back of strong home price appreciation (HPA), coupled with the significant liquidity underpinning capital markets… We still think the company is capable of at least a 14% gross ROE next year, or about 10.5% net of expenses…”

In line with this outlook, Hagen rates the stock a Buy, and his $14.50 price target indicates a potential for 19% share appreciation over the next 12 months. (To watch Hagen’s track record, click here)

Overall, there are 5 recent reviews on Redwood’s shares, and while they are not unanimous they do break down 4 to 1 in favor of Buys over Hold, for a Strong Buy consensus view. The stock has a $15.20 average price target, which suggests an upside of 25% form the current trading price of $12.10. (See RWT stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.