They used to say that investors should ‘sell in May and go away.’ It was a reference to a historical pattern, long noticed by investors, that markets frequently swooned in the summer months. From May until October, on average, the S&P 500 has registered an average drop of 1.7%. While this loss is usually subsumed by larger full-year trends, it does affect shorter-term investment decisions.

LPL Financial’s chief market strategist Ryan Detrick, however, believes that we’re in for a deeper loss this summer, perhaps as high as 5%. Detrick notes that, since 1950, the markets have average three 5% retreats of the S&P 500 each year – but that there has not been such an event so far in 2021. “This doesn’t mean a 5% correction is directly around the corner, but note that most stocks are actually already down as much as 10% off their recent highs, suggesting the internals of the market are a tad weak and risk is higher than normal.”

If Detrick is right, then investors are in for an interesting time in the dog days of summer. Add to that the historical quirk that November is typically one of the market’s best months, and we could be looking at a roller coaster end to the year.

In a situation like this, many investors start looking to shore up the defensive end of their portfolio – and that will naturally cause an interest in dividend stocks. These are the classic defensive plays, giving investors a dual path toward returns, from both the share appreciation and the dividend payments.

Bearing this in mind, we used the TipRanks’ database to zero-in on two stocks that are showing high dividend yields – on the order of 7%. Each stock also holds a Strong Buy consensus rating; let’s see what makes them so attractive to Wall Street’s analysts.

TotalEnergies (TTE)

We’ll start with a major name in the energy industry, TotalEnergies. This French-based oil and gas ‘supermajor’ firm has been a stalwart of Big Oil since the 1920s. Total Energies’ operations include the full gamut of the energy industry, from oil and gas exploration to drilling and extraction to transport and refining of crude oil, gas products, and petrochemical products. TotalEnergies is also a major chemicals manufacturer in the European markets, and is heavily invested in power generation.

While TotalEnergies is a well-established company, with a market cap of $114 billion, investors may know it better by its previous name, Total. The company changed the moniker in early June of this year, with management explaining that ‘TotalEnergies’ is more descriptive of the company’s long-term vision. TotalEnergies is shifting its focus to the green economy, as indicated by the company’s commitment to become ‘carbon neutral’ by 2050 and its ongoing efforts to promote renewable energy sources.

TTE pays out a dividend of 66 Eurocents per share (78 cents US at current rates). It has held this dividend steady for the last 6 quarters. At the current rate, the dividend gives a yield of 7%. This is more than triple the average yield, about 2%, found among S&P companies.

In its latest quarterly statement, for 2Q21, the results were somewhat of a mixed bag. While revenue of $41.63 billion showed a 93.1% increase on the same period last year, it missed the consensus estimate by $570 million. That said, Adj EPS of $1.27 slightly beat the $1.23 EPS analysts were anticipating.

Piper Sandler’s Ryan Todd sees enough to be buoyed about in the quarter’s performance.

“Strength in refining/chems offset slight weakness in the upstream,” the analyst said. “Strategic progress continued across both legacy (Suriname, PNG) and renewable businesses, befitting what we view as likely the most balanced outlook of the IOCs (international oil companies).”

Todd rates TTE as Overweight (i.e., Buy) and his $66 price target suggests shares will be adding 47% of muscle over the next 12 months. (To watch Todd’s track record, click here)

There are 6 reviews on record for TTE, and they include a 5 to 1 breakdown of Buys versus Hold, making for a Strong Buy consensus rating. The shares are selling for $44.82 and their average target of $61.13 implies a 36% upside for the next 12 months. (See TTE stock analysis on TipRanks)

Altria Group, Inc. (MO)

Let’s shift gears from the energy industry, and look at sin. OK, we’ll look at Altria, a classic ‘sin stock.’ Altria is one of the Big Tobacco firms, and the producer, among other brands, of Marlboro cigarettes.

Altria has shown a solid ability to adapt to the changing environment and public attitudes toward its core product, and has been moving toward smokeless tobacco systems as an alternative to cigarettes. Altria has invested in the development and marketing of iQOS, a system that heats tobacco without burning it, to deliver the nicotine vapors that smokers crave with lower carcinogen levels and no second-hand smoke. Altria has received FDA approval to commercialize iQOS3, and is moving forward.

Like many ‘sin stocks,’ Altria is also known as a dividend champion. The company pays out regularly and consistently, and offers investors a high yield. The current dividend is 86 cents per common share, annualizing to $3.44 and yielding 7.2%. The company’s dividend history extends back to 1988, and it has been growing the dividend steadily for the past 12 years.

Moving on to the company’s financials, the recent Q2 results were strong. The company notched revenue of $5.6 billion, although a year-over-year decline of 12.1%, the figure came in $240 million above the Street’s expectations. There was a beat on the bottom-line too, as Non-GAAP EPS of $1.23 beat the analysts’ forecast by $0.06.

Addressing the elephant in the room, RBC’s Nik Modi admits that from an ESG (Environmental, Social, and Governance) perspective, the company represents a “tough sell.” However, the analyst believes the company is making a concerted effort to move with the times.

“While not an overnight fix, we believe Altria management is doing its part to transition adult smoking to a non-combustible future,” the 5-star analyst opined. “Altria has laid out its 10- year vision, whereby it will continue to invest behind non-combustible products and work closely with the FDA to be able to offer smokers a scientifically proven, safer alternative to traditional cigarettes.”

Modi’s rating for Altria is an Outperform (i.e., Buy) and is backed by a $56 price target. Investors could be sitting on returns of 16%, should the figure be met over the next 12 months. (To watch Modi’s track record, click here)

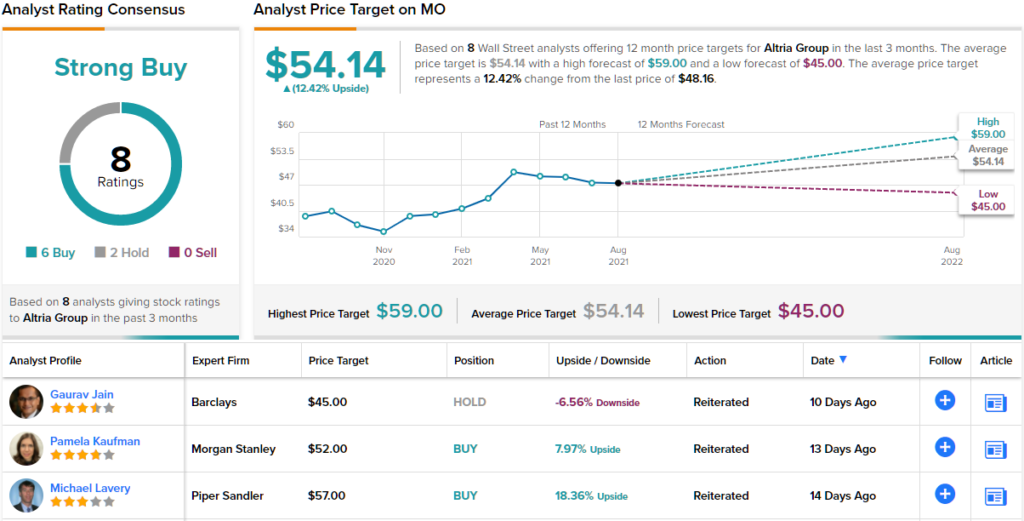

With a share price of $48.2 and an average price target of $54.14, Altria has a one-year upside forecast of ~12%. The analyst consensus view on the shares is a Strong Buy, based on 8 reviews that include 6 Buys and 2 Holds. (See MO stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.