Thanks to continued fear and uncertainty, the stock market is heading down lately. The escalation of Russia’s threat to invade Ukraine comes at a time when the market is already vulnerable given inflation worries and growing expectations for Federal Reserve interest rate hikes. The NASDAQ is down 13% so far this year, while the S&P is just a whisker north of correction territory, at a 9% loss.

It’s no secret that you can find some tasty morsels at the bottom of a river or a lake or a shallow sea – but you can also find some excellent stocks at the bottom of a market trough, too. Fortunately, there’s a trick to finding them. Just look for the right signals: strong ratings and solid upside potential come to mind, but so does a bullish outlook from the corporate insiders.

The insiders are just that, people on the ‘inside’ of a company, with access to information that the retail investor usually can’t get. Insiders are typically corporate officers, and they carry a heavy responsibility to both Boards of Directors and company shareholders to maintain profits and increase share values. They don’t take their stock trading lightly, and for investors, this means that insiders’ purchases aren’t just a signal on a stock’s prospects – they’re often a brilliant 1000-watt flashing neon sign.

And when those insiders start picking up beaten-down stocks, the ones hanging out at the bottom of the pond with the catfish, then it’s time to really take notice. We’ve done just that, using TipRanks’ Insiders’ Hot Stocks tool to pick out two stocks that have seen recent ‘informative’ action from the insiders – and that are trading at bottom-level prices. Here are the details.

Crocs (CROX)

We all know Crocs, those foam clogs that brought ‘ugly chic’ to footwear and sparked a whole line of shoes – the signature clogs, sandals, sneakers, even more formal shoe styles. Crocs offers us an example of a company that has survived and thrived by branching out from its initial breakthrough product – without losing its original brand. Crocs can be found in more than 90 countries worldwide, and the company has sold over 720 million pairs of shoes since its debut in 2002.

It’s not just the company’s lifetime aggregate that makes for good numbers. Crocs has been consistently beating the analyst expectations on revenues and earnings since the middle of 2020, and the most recent report, for the fourth quarter and full year of 2021, was no exception. The company reported $586.5 million at the top line, just edging over the $585 million forecast, and showed a total of $154.9 million in earnings, for an adjusted EPS of $2.15 – where analysts had been predicting $1.98.

On a full-year basis, Crocs’ results were record-breaking. The company reported an impressive $2.31 billion in revenue for 2021, up 66% year-over-year, and, for the first time, exceeding $2 billion annually.

Even with those big gains, however, investors were disappointed with Crocs’ outlook which factored in supply chain snags and came in below Wall Street’s expectations. Crocs shares have been falling since November; the stock peaked above $180, but is down 56% since then.

Turning to insiders, we find that the corporate officers are willing to buy in at current prices. Two company directors, Douglas Tref and Thomas Smach, have made ‘informative buys’ in recent days, for considerable sums. Tref bought 8,100 shares, spending more than $740K. Smach made a larger purchase, spending $1.066 million to pick up 12,356 shares.

These insiders are not the only ones bullish here. Jonathan Komp, 5-star analyst with Baird, sees opportunity for investors here. He writes: “We have been impressed by CROX’s multi-year efforts to improve operations, drive higher operating performance, and unlock significant growth potential globally. As a stand-alone story, we have held a very favorable view of the company’s ability to deliver a +low-20% EPS CAGR through 2026E based on plans to emphasize digital, product innovation, and ESG initiatives among other factors.”

“We see an improved risk-reward following the Q4 report, since we think investor sentiment regarding the sustainability of growth for the core Crocs brand and current operating margin, as well as the potential for upside relative to 2022E HEYDUDE assumptions could become more clear. Looking on a one-year-out basis, assuming CROX can achieve our current estimates, we see a compelling return potential,” the analyst added.

To this end, Komp puts an Outperform (i.e. Buy) rating on CROX, and his $200 price target suggests a one-year upside of a hefty 152%. (To watch Komp’s track record, click here)

The consensus view on CROX shows that Wall Street, generally, is upbeat on the shares. The stock gets a Strong Buy rating, based on 9 reviews with a 6 to 3 split in favor of Buys over Holds. The share price is $79.26, and the average target, at $178.13, indicates room for ~125% appreciation in the year ahead. (See CROX stock analysis on TipRanks)

Albemarle Corporation (ALB)

Now let’s take a turn to the chemical industry. Albemarle, a North Carolina-based company, is a maker of lithium and bromine products, and is the world’s largest provider of the lithium needed in electric vehicle (EV) battery packs. The company has a global operations network, with facilities and ops in the US and Europe, Chile, Australia, the Middle East, and East Asia.

Albemarle presents us with a difficult picture to interpret. The company reported its 4Q and full year 2021 results earlier this month – and the numbers were roughly in-line with the Street’s expectations. For 4Q21, the top line of $894 million was a shade below the $894.5 million forecast, while the bottom line of $1.01 for adj. EPS was slightly better than the 99-cent estimate. For the full year, the company reported revenues of $3.3 billion, up 6% from 2020. The trouble comes in, however, with the full-year earnings.

GAAP EPS, at $1.06 per share for the year, was down 70% from 2020, and the company’s free cash flow turned negative. These are the factors that spooked investors and helped push the stock down by 20% in the subsequent session.

But should they have got that sort of beating? Albemarle has been pursuing an active expansion/acquisition strategy, which has left the company cash-poor for now – but in a position to expand production to meet expected increased demand in coming years. Investors should remember that, according to industry experts, lithium production can take up to two years to ramp up. Albemarle appears to be preparing for that now, rather than waiting to scramble when new orders come in.

A look at some recent announcements helps to tell the story. In January, Albemarle signed a development agreement with 6K, a leader in microwave plasma technology, for the exploration of novel lithium battery materials and a possibly disruptive new manufacturing process. And in February, Albemarle signed a non-binding agreement with Mineral Resources Limited on the potential expansion of the MARBL Lithium Joint Venture.

Albemarle’s insiders appear sanguine on the stock. Last week, Netha Johnson, President of the company’s bromine specialties, bought up 1,060 shares, spending just over $199K on them. In the second purchase, Kent Masters, President, CEO, and Chairman of the Board, made a purchase of 5,241 ALB shares for $999,983.

In the meantime, 5-star analyst Colin Rusch, of Oppenheimer, believes the company is setting itself up for future gains. He says of Albemarle, “We note that management’s increased estimates for lithium demand through the end of the decade may prove conservative as EV production continues to ramp and as power infrastructure integrates a higher percentage of renewables capacity augmented by energy storage. We believe some investors may be concerned about inflationary pressures on ALB’s production costs, but we believe the company will be in a position to not only pass those costs on over time but also to enjoy substantial operating leverage.”

Based on the above, Rusch rates ALB shares an Outperform (i.e. Buy), and his $307 target implies a 12-month upside potential of 61%. (To watch Rusch’s track record, click here)

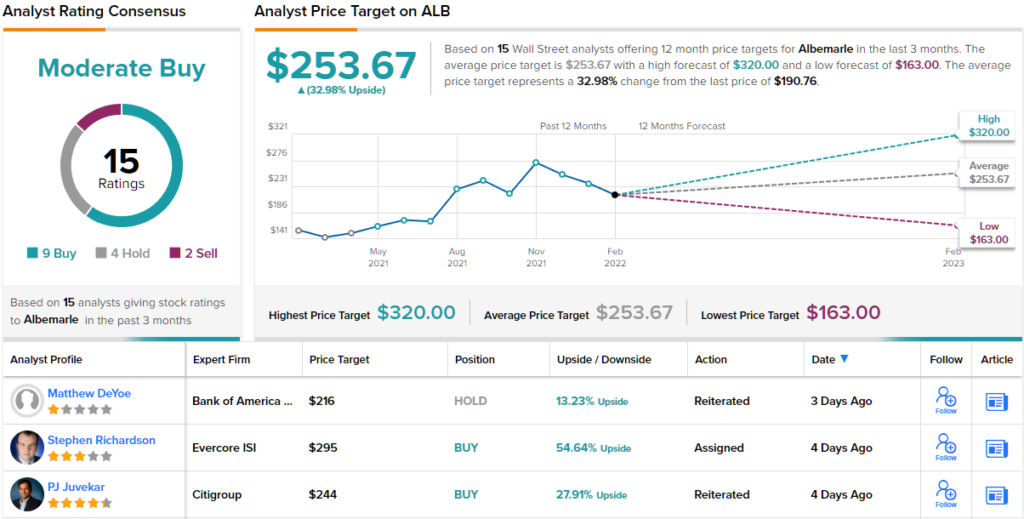

All in all, ALB holds a Moderate Buy rating from the analyst consensus, based on 15 reviews including 9 Buys, 4 Holds and 2 Sells. Meanwhile, the average price target stands at $253.67, suggesting a 33% upside potential. (See ALB stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.