The Federal Reserve’s hawkish stance in hiking interest rates may not be news for many, but the country’s financial sector seems to be enjoying it. This is because the rising interest rates have allowed the companies in the sector to grow their margins and profitability.

Keeping this in mind, let’s talk about two financial services stocks, which, as per TipRanks, have strong potential to outperform the market in the near term.

Goldman Sachs (NYSE: GS)

New York-based financial services behemoth Goldman Sachs has been in business for more than 150 years. The company provides global investment management and advisory services.

Presently, the company commands a market cap of $102.77 billion. Its dividend yield of 2.67% is higher than the sector average of 2.11%.

On TipRanks, the company score a 9 out of 10, indicating that the stock has strong potential to outperform market expectations. Shares have declined 17.3% over the past year.

Overall, the Street has a Strong Buy consensus rating on the stock based on 10 Buys and two Holds. Goldman Sachs’ average price target of $406.30 implies upside potential of 35.8% from current levels.

Citigroup Inc. (NYSE: C)

Another New York-based global financial giant is Citigroup. Citigroup provides a whole gamut of financial services, including asset management, banking, equities trading, insurance and risk management.

Currently, the company commands a market cap of $91.02 billion. Its dividend yield of 4.35% is way above the sector average of 2.11%.

Citigroup scores a 9 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform the market. Shares have declined 29% over the past year.

Overall, the Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on seven Buys, seven Holds and one Sell. Citigroup’s average price forecast of $60.79 implies that the stock has upside potential of 29.7% from current levels.

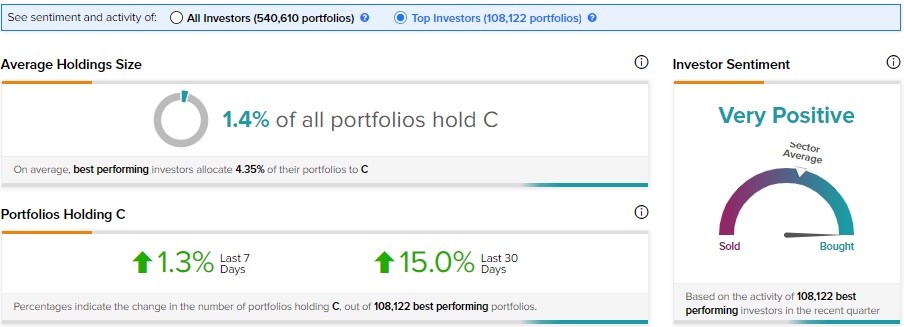

As per TipRanks, investors are Very Positive about the stock, as 15% of the top portfolios tracked by TipRanks increased their exposure to C stock in the last 30 days.

Conclusion

This seems to be an opportune time to accumulate quality stocks in the financial sector, as they have come down to reasonable valuations on the back of a correction in the market. Further, the prospects of these companies look bright because of the rising interest rate environment. Also, attractive dividend yields of the companies mentioned above make them wise investment choices, ensuring certainty of income.

Read full Disclosure